Key Points:

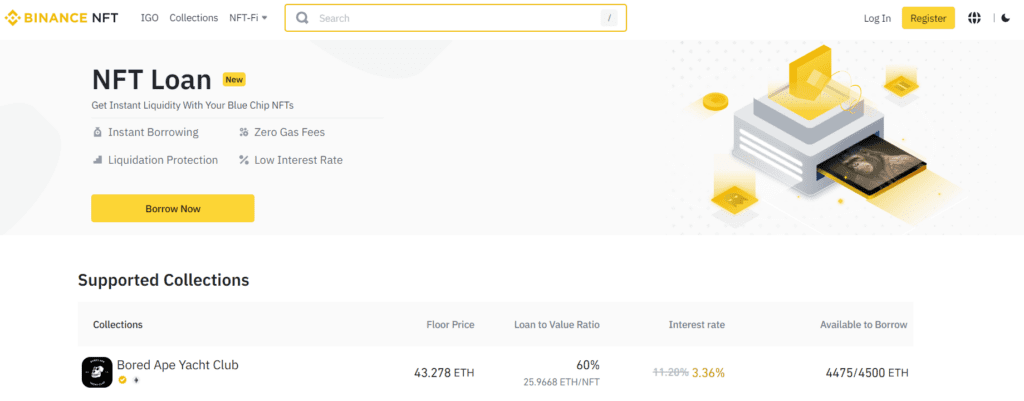

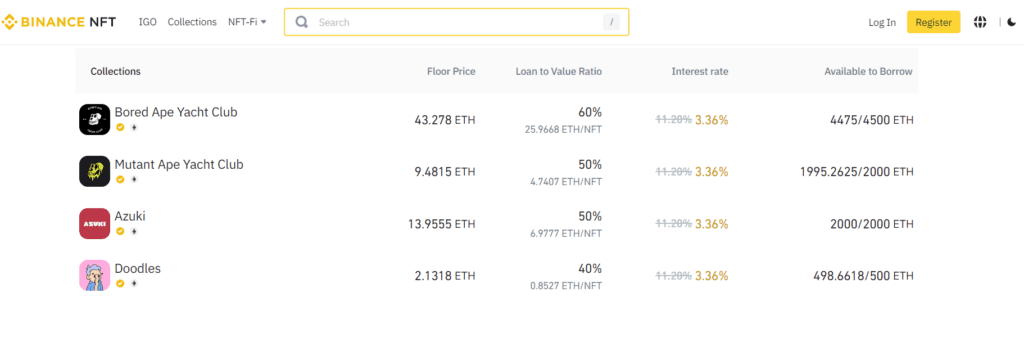

- Binance enters NFT lending space with ETH loans, offering 7.91% p.a. interest rate and 40-60% loan-to-value ratio.

- Binance NFT marketplace supports borrowing against “blue-chip” NFTs like BAYC, MAYC, Azuki, and Doodles.

- NFT lending is growing rapidly, with Binance and Blur’s Blend leading the way.

Binance, a popular NFT marketplace, has unveiled a new feature that allows users to borrow cryptocurrencies using NFTs as collateral.

This follows the recent trend of NFT lending, and marks Binance’s entry into the space. With this feature, users will be able to borrow ether (ETH), against “blue-chip” NFTs such as Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Azuki, and Doodles. This is a great opportunity for people who own NFTs to leverage their assets and access funds when they need them.

According to an announcement on Thursday, the current interest rate on NFT loans stands at 7.91% per annum. Additionally, the loan-to-value ratio ranges from 40% to 60%, depending on the NFT used as collateral. The Binance NFT website does not charge any gas fee or Ethereum transaction fee.

BNB launched its NFT marketplace in June 2021, after announcing it in April that year. Since then, the platform has been growing steadily and has added support for Ordinals, or Bitcoin NFTs, earlier this month. In addition to Ethereum and Polygon, Binance NFT now supports its native BNB Chain.

BNB’s entry into the NFT lending space comes just a few weeks after Blur, a major NFT marketplace, launched its NFT lending protocol called Blend. With Blend, lenders can set their own interest rates and loan-to-value ratios, making it an attractive option for many people. As per Kay, “Blend’s meteoric rise in the NFT lending market is undeniable. As it continues to break new ground, the protocol is proving that a market-driven approach can successfully revolutionize the lending landscape.” It will be interesting to see how Binance’s NFT loan feature fares in the face of competition from Blend and other similar platforms.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News