Key Points:

- In 2021, MoonPay raised $555 million in an all-equity Series A financing.

- The funds will be used to recruit more employees, increase geographical coverage, and introduce new payment options.

- Yet, the CEO of the company apparently used part of his wealth to buy a $38 million house in Florida.

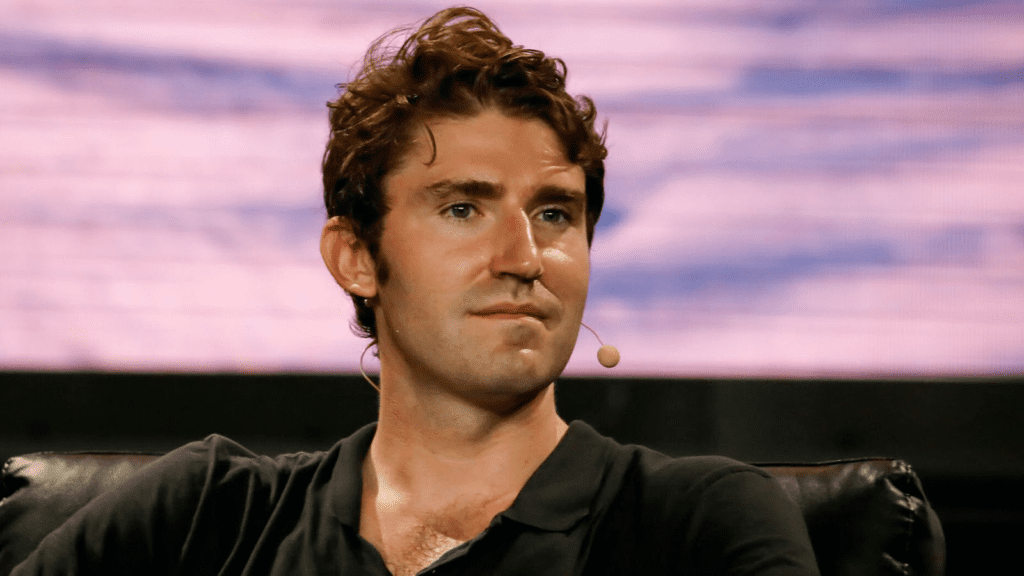

According to an unidentified source, MoonPay insiders, including co-founder and CEO Ivan Soto-Wright, got $150 million at the crypto payment startup’s Series A financing in late November 2021.

MoonPay, a cryptocurrency payments company, announced a major $555 million financing round in November 2021, with investors like Tiger Global Management and Coatue Management taking part during the Bitcoin craze, which reached a record high of over $69,000.

Insiders paid out $150 million in shares, according to The Information, with CEO Ivan Soto-Wright among the main sellers.

MoonPay is a crypto infrastructure company that provides a payment gateway for crypto companies. The platform supports digital asset transfers, allowing users to easily acquire cryptocurrencies such as Bitcoin. In 2021, the company received widespread notice for its non-fungible token (NFT) “concierge” service, which was lauded by celebrities like Jimmy Fallon and Paris Hilton.

The company was valued at $3.4 billion in the financing round, which was spearheaded by high-profile investors. Ivan Soto-Wright revealed in an interview with CoinDesk that the company intended to use the cash to expand its personnel and geographical reach, among other things. Nevertheless, rather than going to the firm, part of the funds was utilized to purchase shares from existing stockholders such as Soto-Wright.

According to The Information, $405 million of the total funds came from selling shares to investors, while the remaining $150 million came from insiders cashing out their shares in a secondary transaction. This suggests that a significant portion of the cash generated was not reinvested in the firm. Soto-Wright acquired a $38 million estate in Miami a few weeks after the Series A fundraising round, a property he’s accustomed to throwing expensive parties like the one hosted during last year’s Art Basel art festival.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News