unshETH Review: Outstanding LSDFi Project Promoting ETH Staking Development

One of the pioneering projects in the LSDfi field, gaining market attention and achieving impressive growth during the first launch, is unshETH. It is considered more profitable for smaller validators, stakingers get higher yields and ETH is more decentralized. Think of it as a decentralized preferred profit aggregator. In this unshETH Review, let’s find out through the article below.

What is unshETH?

unshETH is a protocol that aims to further decentralize validators by creating a marketplace for staking ETH liquidity in which LSD protocols can compete for ETH by the best yielding profits.

The project is a decentralized, on-chain movement to improve the decentralization of validators. The matrix prevents monopolies from growing so large that it stifles innovation and jeopardizes the economy by turning into a central point of failure through the creation and enforcement of antitrust laws.

Project’s mission is simple — decentralization through incentives. Through incentive engineering, UnshETH aims to distribute capital across the LSD ecosystem in a way that prioritizes the decentralization of validators.

This LSD project is trying to take this industry further with its unified ERC-20 token (unshETH). All liquidity-staking derivative tokens on the Ethereum network can be swapped for this one token, increasing accessibility. Furthermore, unshETH is taking a completely new approach to Liquid Betting Derivatives.

unshETH Review: Mechanism of Action

unshETH is a multi-liquid staking ETH basket that earns ETH staking and swap fees, all wrapped up in a single ERC-20 token. unshETH is also an Omnichain token on the ETH Mainnet and BNB Chain that can be transferred between chains for free.

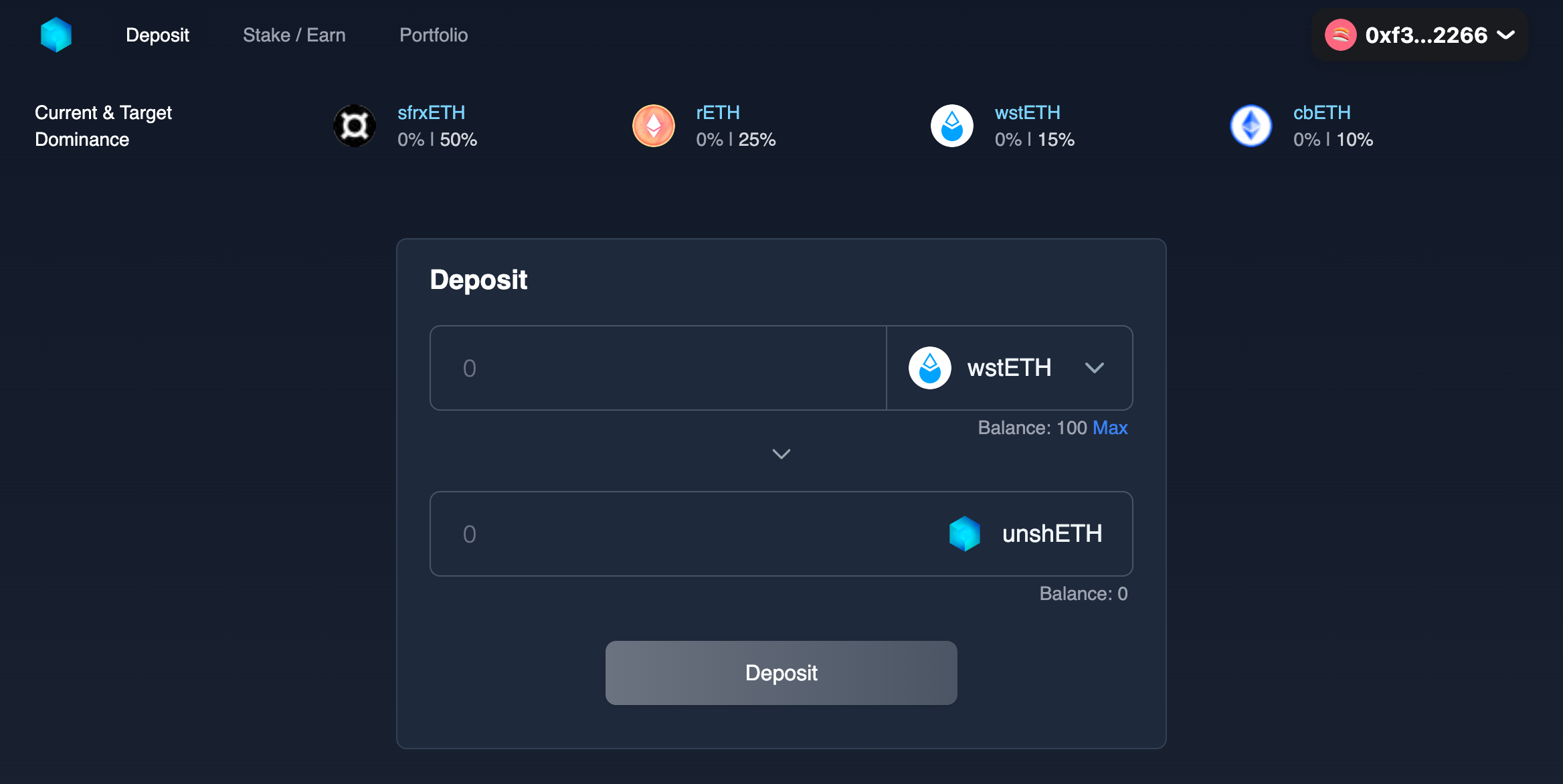

The project currently supports the four largest LSDs: wstETH, cbETH, rETH, and sfrxETH, with plans to support more. Through the protocol, users can deposit their ETH/ETH LSD in exchange for unshETH tokens. Users can stake more of their unshETH tokens to receive $USH tokens. Staking unshETH allows users to earn high profits from locked LSD if they were staking with certain conditions.

unshETH Review: Highlights

This LSD project enables owners of liquidity tokens to convert their derivative assets used for staking liquidity, such as stETH or cbETH (created by Lido and Coinbase, respectively), into an unshETH asset. This is distinct from other suppliers that provide several derivatives for various tokens, creating a confusing string of derivative pairs to manage. They are also concentrating on decentralizing the Ethereum LSD market.

The majority of the other LSD suppliers, if not all of them, are not concerned with supporting the validator hierarchy, and they are motivated to earn money via fees. With a simplified approach to its unified token, unshETH is unique to Ethereum. The ecosystem’s integrity will be restored as a result.

It seeks to bring validator decentralization back to the Liquid Staking Derivatives market through incentive engineering. Vitalik Buterin, the original Ethereum creator, has firmly embraced this goal. Just this distinguishes it from other suppliers. Additionally, unshETH review enables holders of liquidity to combine several derivatives into a single operational and tradeable unified token.

Upon completion of the March Ethereum Shanghai update, users will be able to withdraw tokens, and the entire version of unshETH will thereafter be made available. Then, by dividing staking income from the only LSD supplier through a new mechanism, unshETH review team will put into practice the Validator Domination Option, a brand-new DeFi derivative created to offer another layer of decentralized enforcement.

unshETH Review: Products

unshETH

This is an ERC-20 token that acts as the heart of the entire project as an index representing a basket of various LSDs tokens currently sfrxETH, rETH, stETH, and cbETH. The process of minting and redeeming unshETH is also depositing and withdrawing LSDs from the asset pool.

In addition, unshETH review is an Omnichain token currently available on both Ethereum & BNB chains and will soon be available on other EVM chains.

unshETH review is inspired by Curve’s 3pool model – creating a peer-to-peer LP with deep liquidity that reduces the cost of the need to exchange between 2 LSDs of tokens, something that currently needs to be done by liquidity pools on AMM through an intermediary asset, ETH. Tokens emphasize the term “Real-Yield” as the media attracts liquidity, indeed, by holding unshETH

In short, users, instead of just holding LSDs with ~5% interest on unshETH, can enjoy a higher yield through providing liquidity to unshETH. As for the protocol, they can create deep and direct liquidity between LSDs that attract many users and compatible dapps generate a lot of fees.

USH token

USH is the governance token and incentive class for unshETH. It is used to develop TVL and unshETH liquidity and to promote competition among liquidity staking protocols. Deposited USH (e.g., USH) governs the following:

- The protocol composition (LSD included/excluded, target weight, and maximum weight)

- How to guide USH offers and partner protocol offers

- Charge curve parameters and charge conversion

USH token holders can vote on proposals and make decisions about the protocol’s governance. They can also stake their USH to receive vdUSH, which can be used to participate in government and earn a share of the protocol’s revenue.

The validator decentralization Autonomous Market Maker (vdAMM)

This is the first product that mines project mentioned above with the idea of creating an AMM that optimizes fees and slips for the exchange of 2 LSDs.

Decentralized Autonomous Market Maker (vdAMM) is a new approach to providing liquidity that aims to deliver enhanced capital efficiency and improved price discovery for digital assets. With the new design of vdAMM, users and LSD protocols no longer have to choose between earning ETH staking, APR swap fees, and DeFi utility.

Validator Domination Option (VDO)

VDO is an LSDfi term that allows dominant LSD holders to write options on their validator. This allows non-dominant LSD holders to reap the benefits, while also providing dominant holders a way to earn additional income from their established dominance.

Dominant LSD holders write VDOs against their own LSD (no other collateral allowed). In this case, the strike price corresponds to the validator dominance rate (%) at expiration. The typical contract term for a VDO is a few days.

Representatives of the non-dominant LSDs purchase VDO through the unshETH DAO, prepaying the option cost. In return, this DAO has a liquidity preference over the yield when VDO pays out. If the option expires without value, the DAO will remove the cost.

unshETH Review: Roadmap

Currently, unshETH is available on BNB and Ethereum thanks to Layer Zero technology. In the near future, the project will continue to expand to Polygon and some other L2.

unshETH Review: Basic User Manual

Claiming USH Airdrop

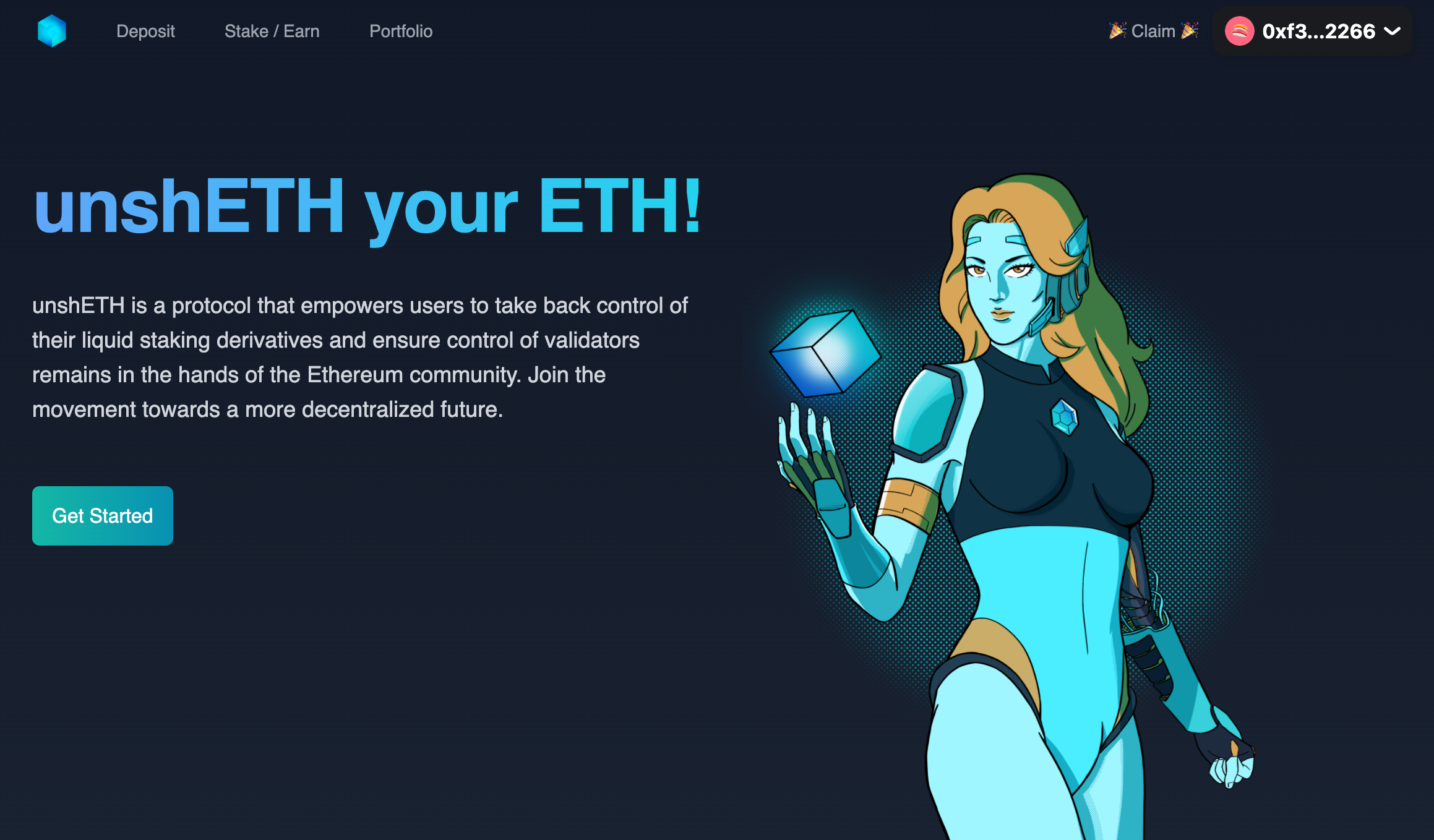

Step 1: Connect Your Wallet

Connect your wallet to the platform.

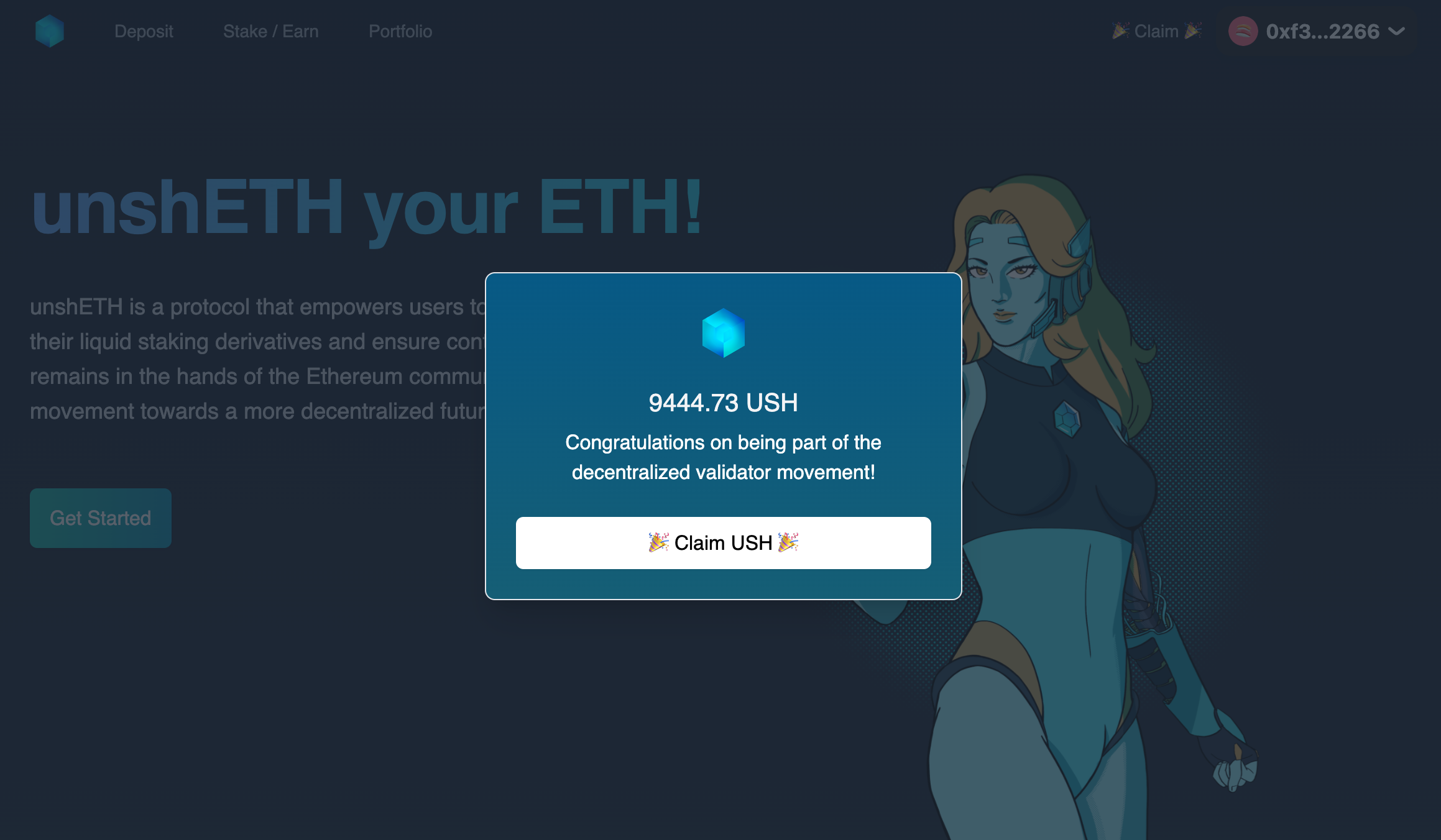

Step 2: Click on Claim Button

If you are eligable, you will be able to “Claim” button in the navigation tab.

Step 3: Confirm Claim

Once the Modal is open, you will be able to view the amount to be claimed and be able to click on Claim to recieve your USH. Once this tx is confirmed, it will show up in your balance.

Depositing LSDs

Deposit your LSDs and earn rewards by converting them to unshETH through a four-step process with the help of our platform.

Step 1: Visit the Deposit Page

Go to the Deposit page on the platform.

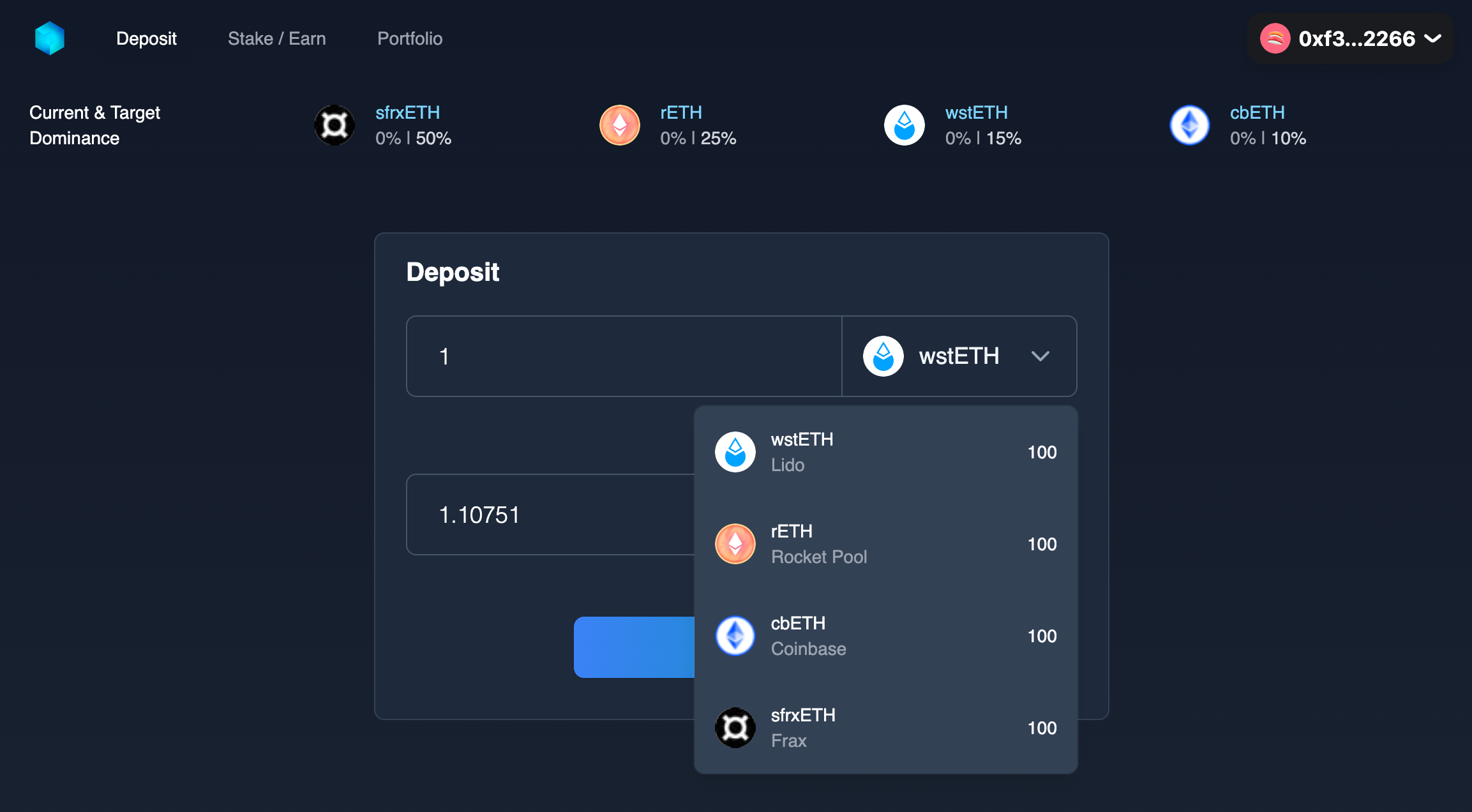

Step 2: Set the Deposit Parameters

Choose the LSD you want to deposit and the amount

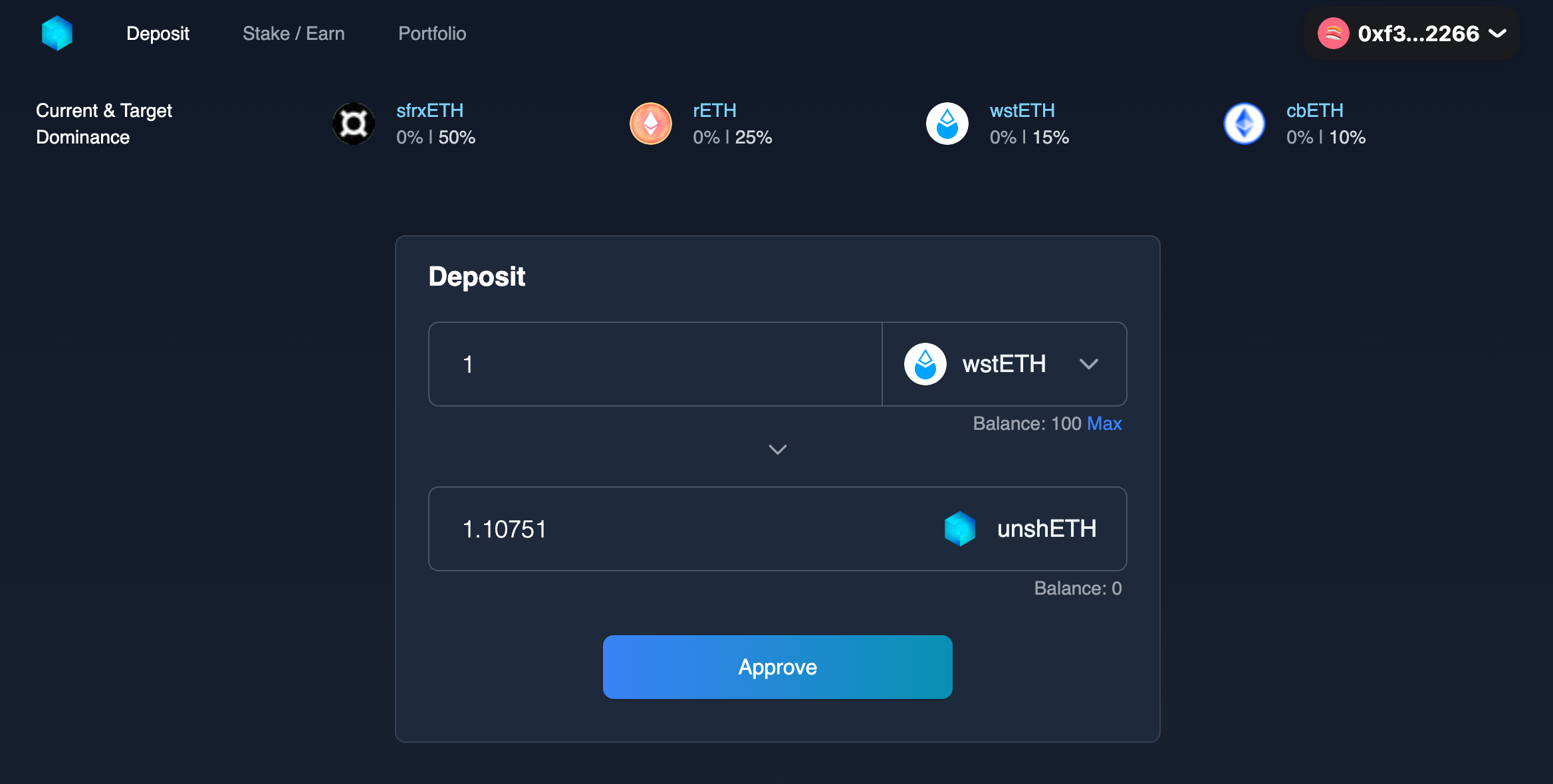

Step 3: Approve the Deposit

Click on Approve to allow the contract to access your LSD.

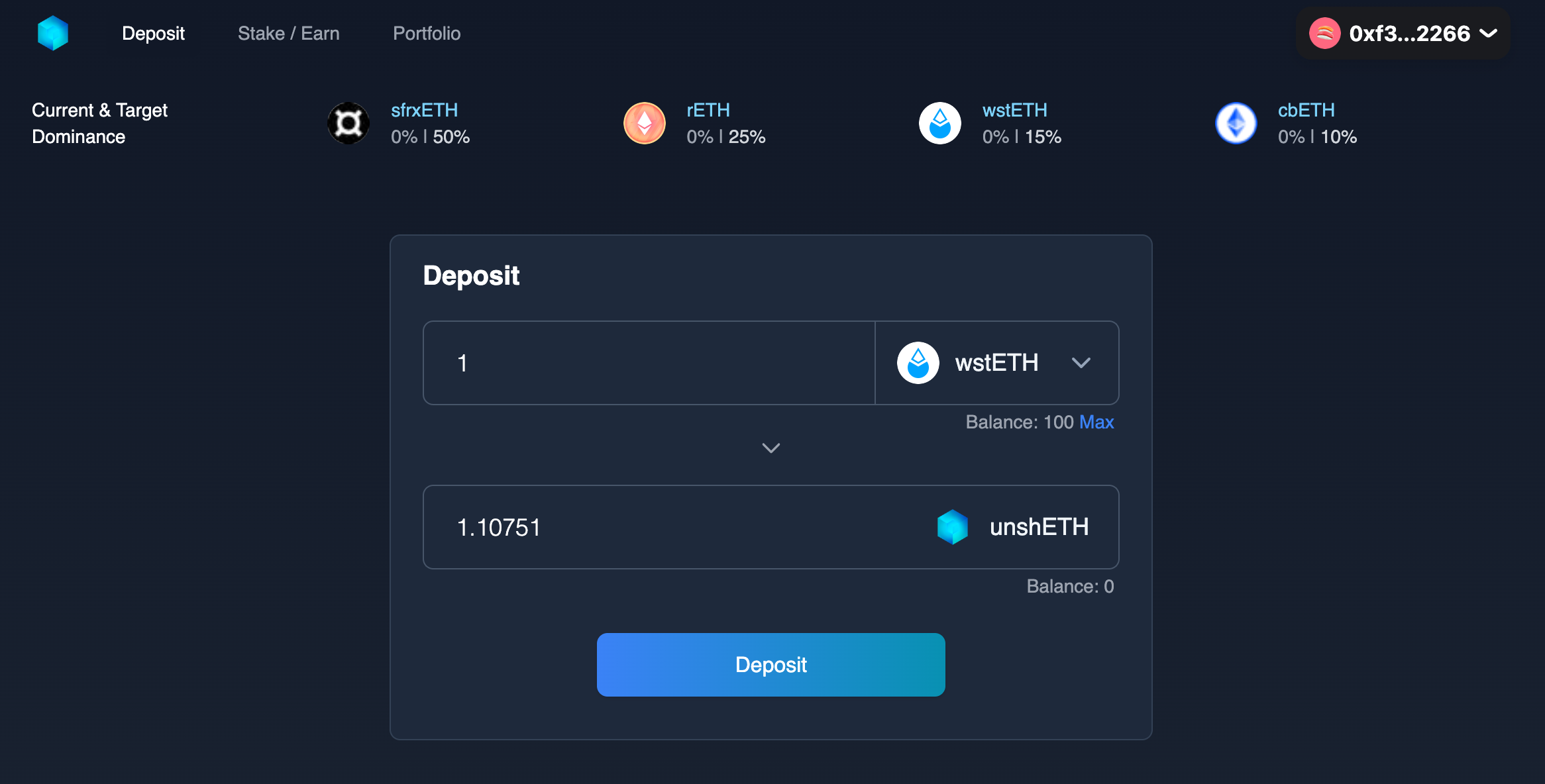

Step 4: Confirm the Deposit

Click on Deposit to transfer your LSD and receive unshETH. Your LSDs will be converted to unshETH and a proportional amount will be transferred to your address.

Staking unshETH

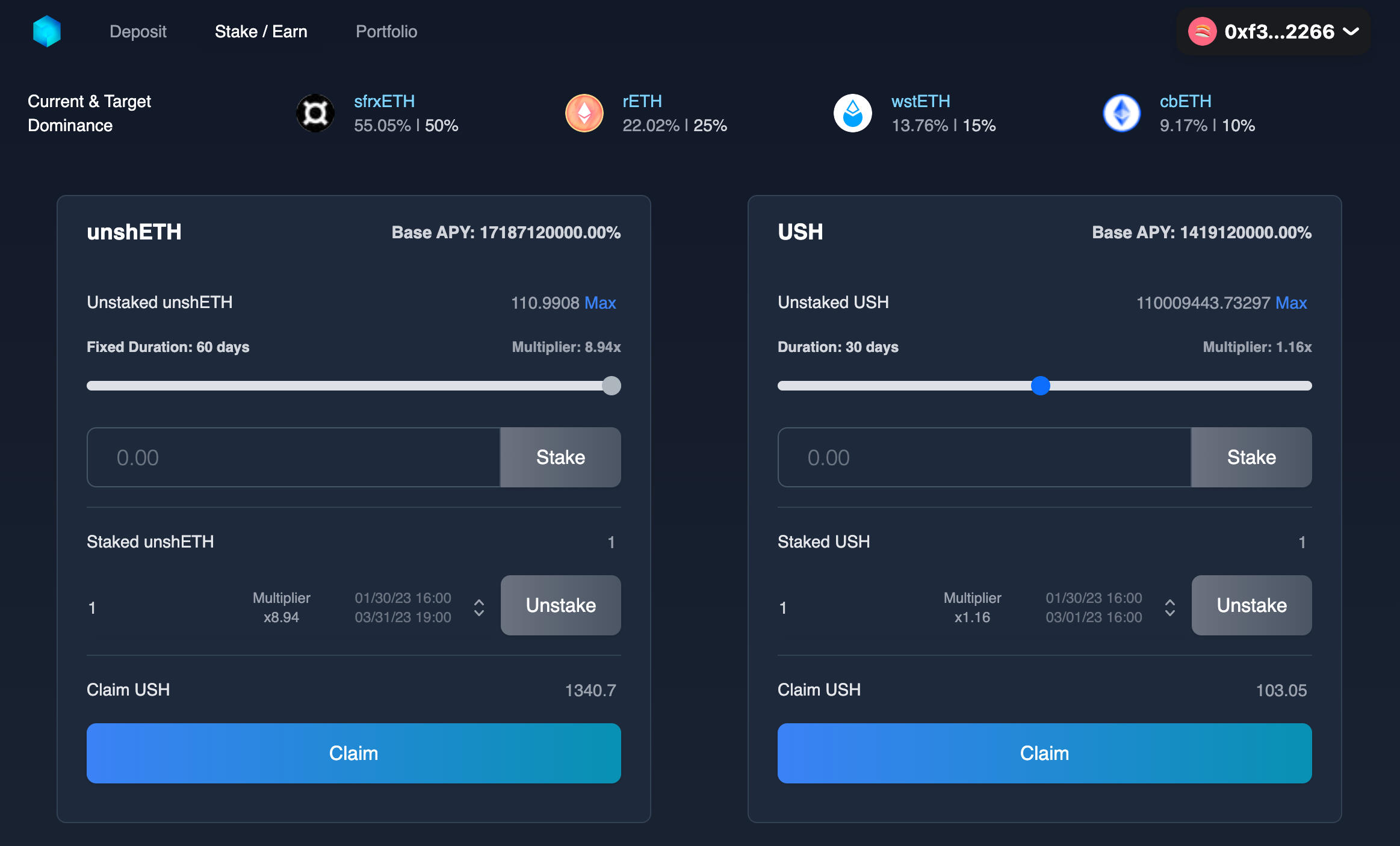

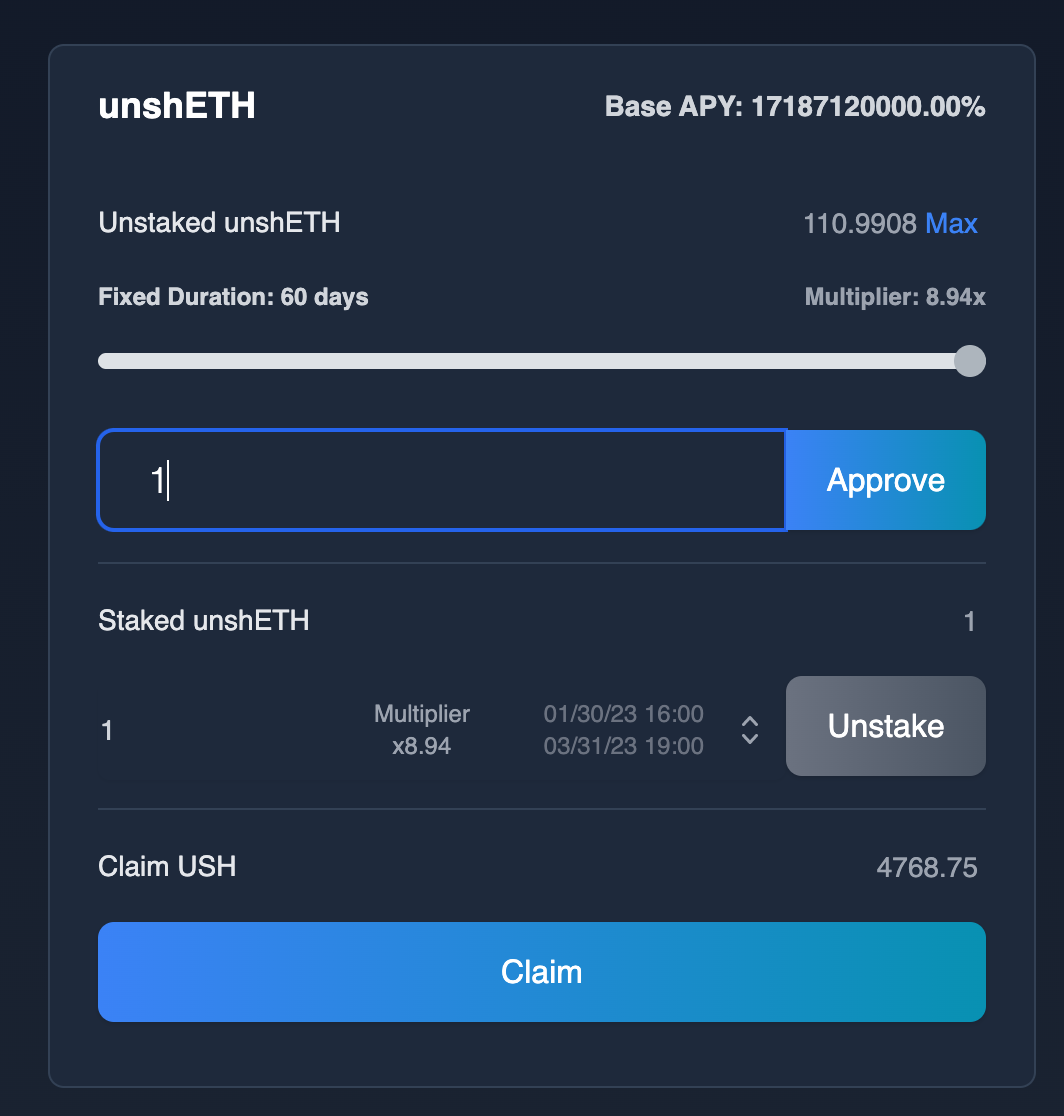

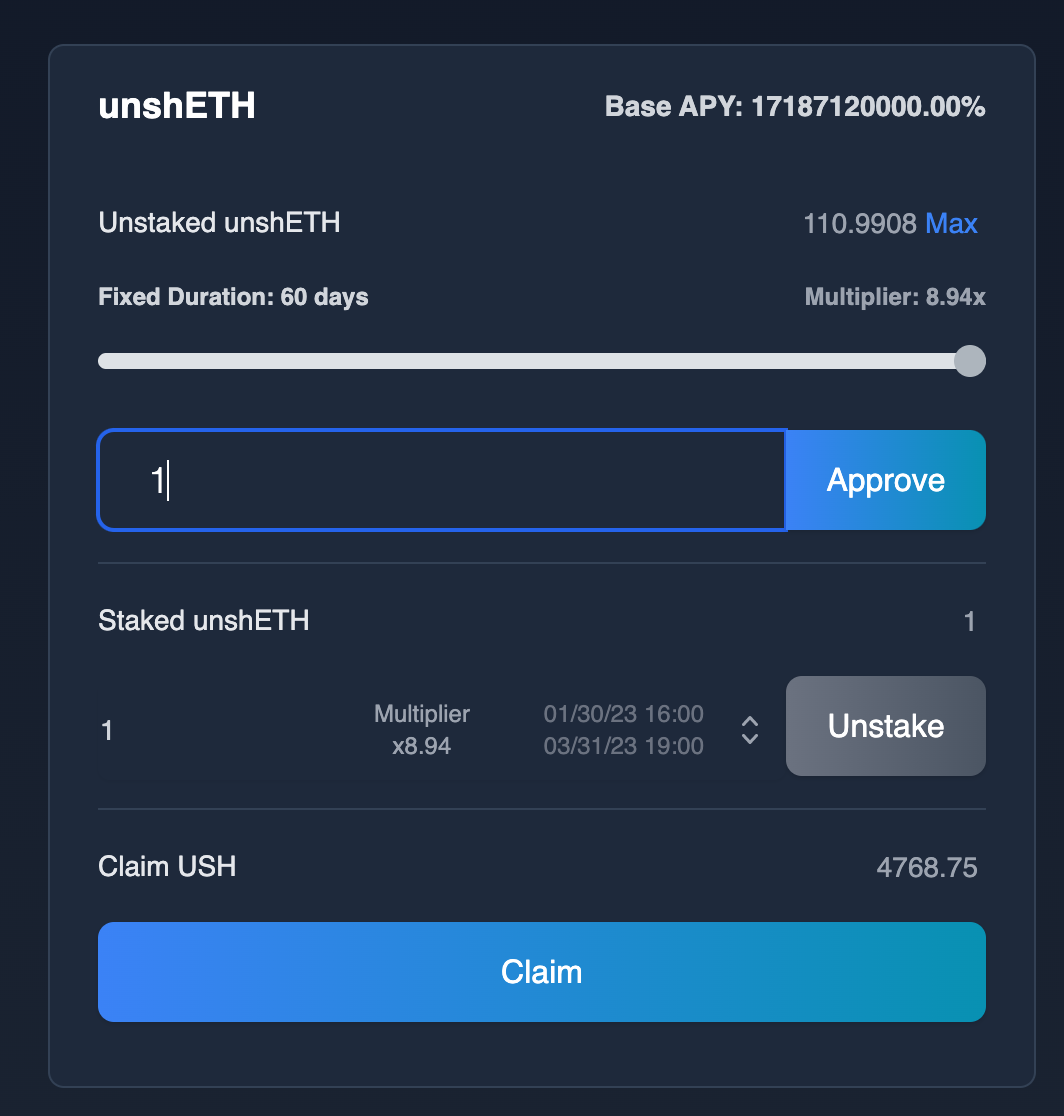

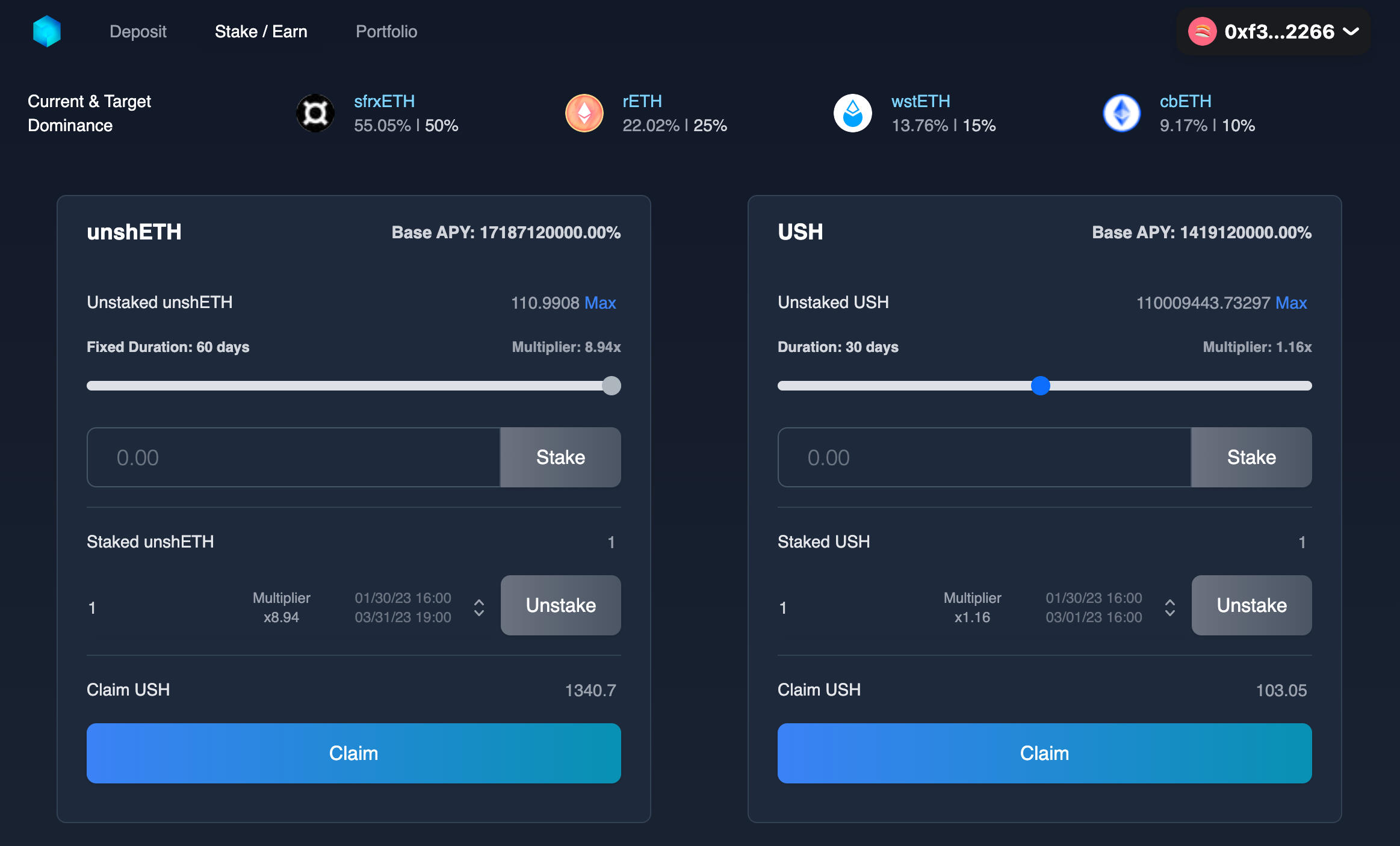

Step 1: Visit the Stake/Earn Page

Go to the Stake/Earn page on the platform.

Step 2: Set the Stake Parameters

Choose the amount of unshETH you want to stake.

Step 3: Approve the Staking

Click on Approve to allow the contract to access your unshETH.

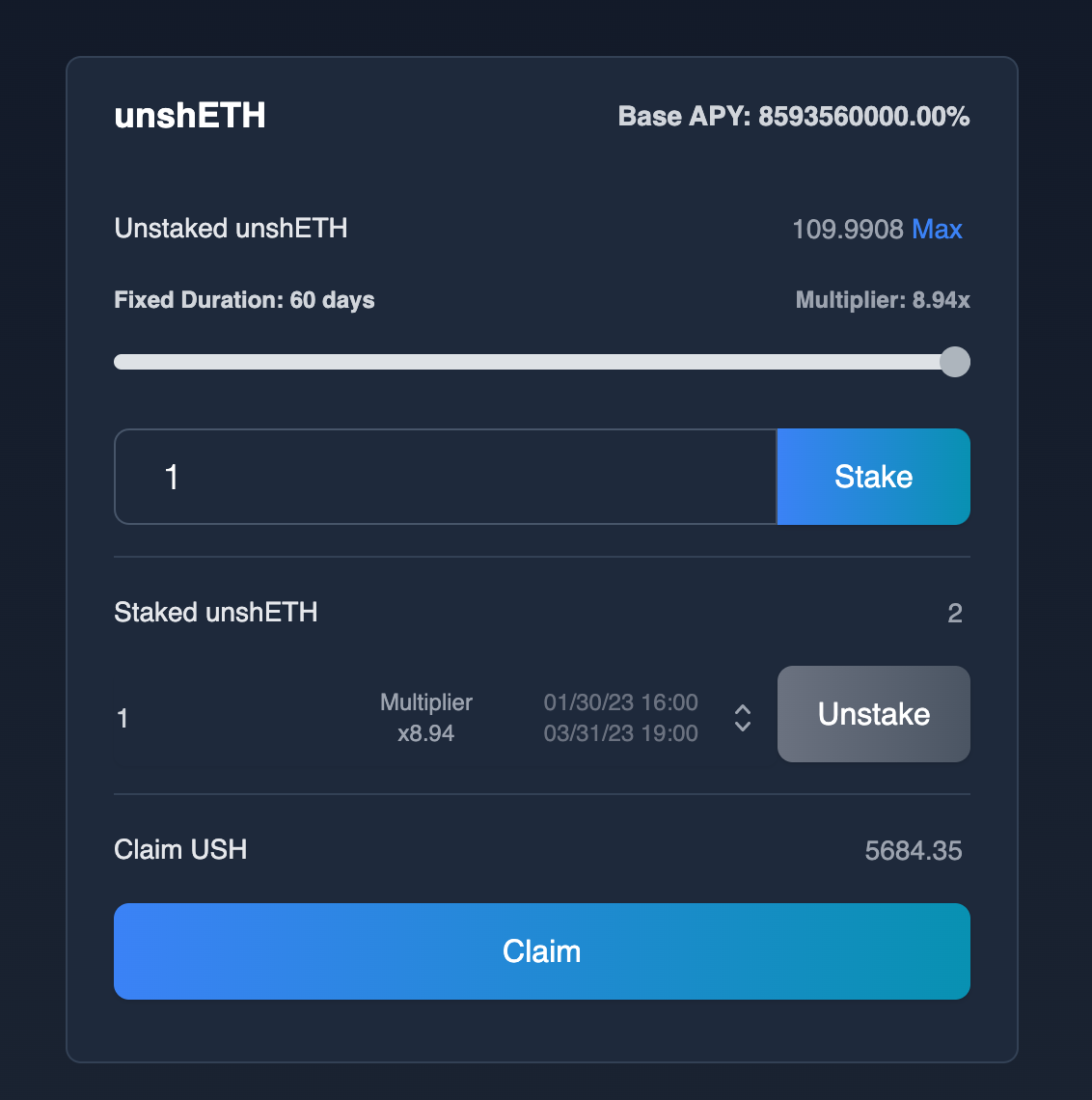

Step 4: Confirm the Staking

Click on Stake to transfer your unshETH and beging earning rewards.

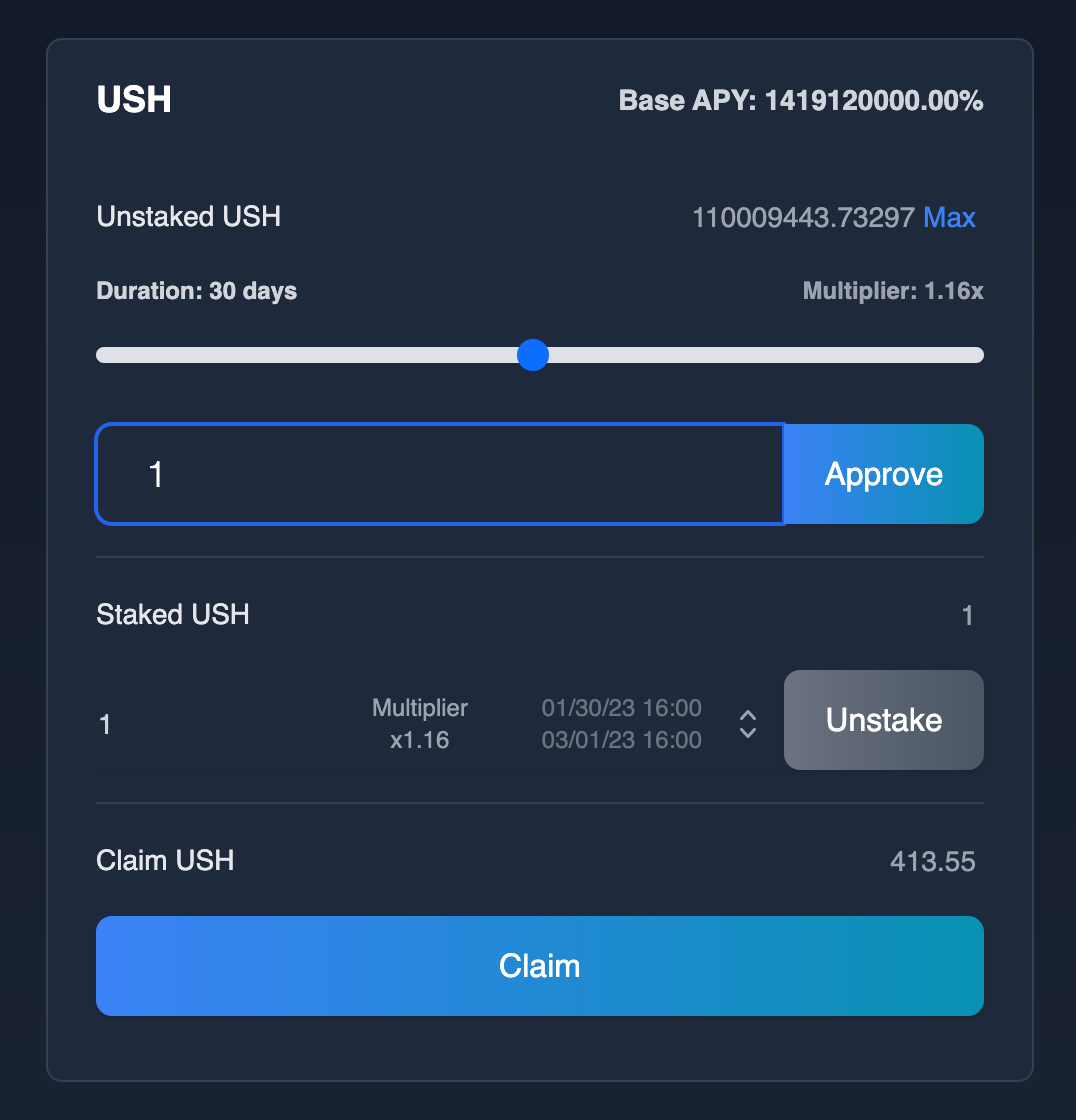

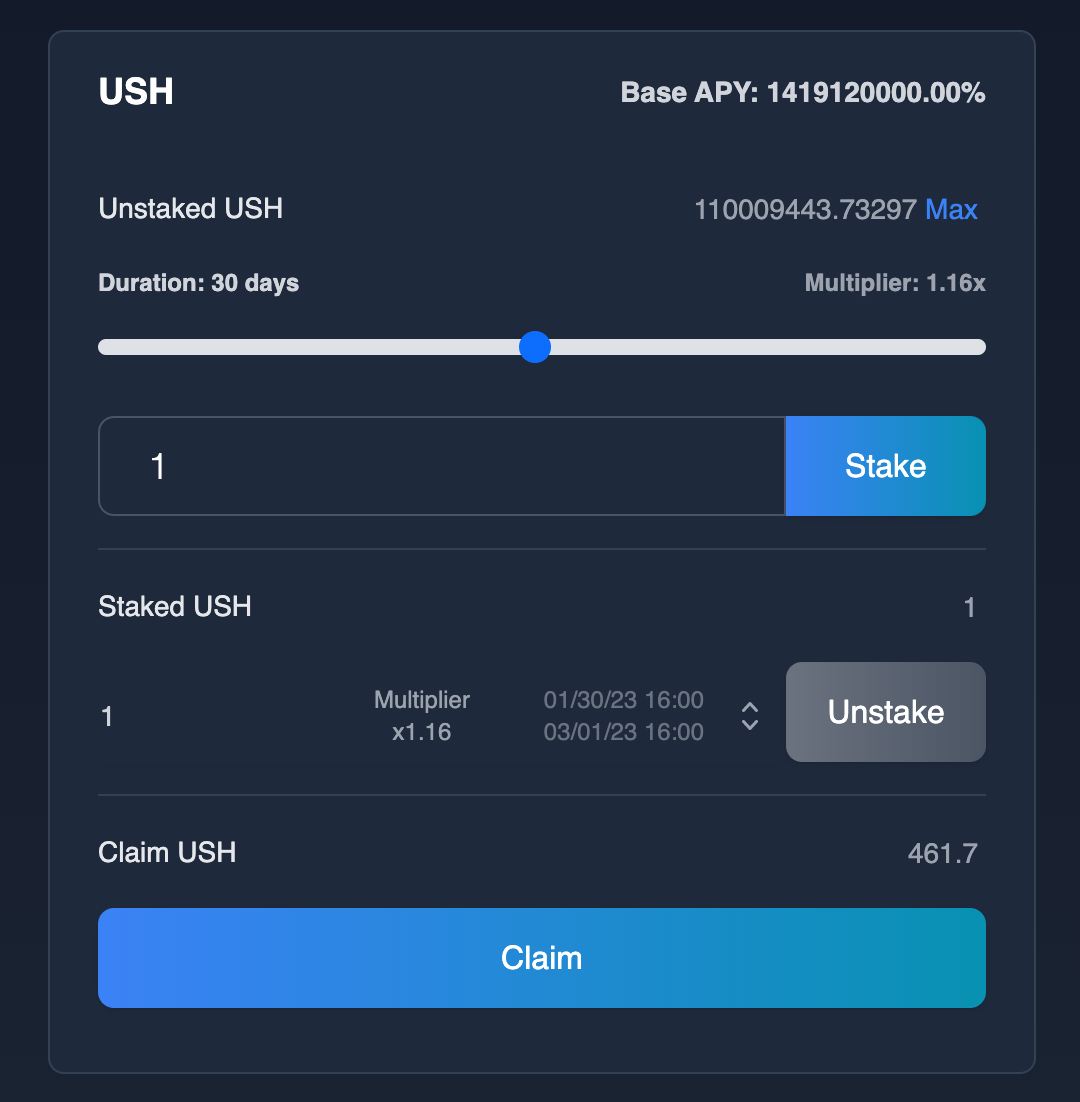

Staking USH

Step 1: Visit the Stake/Earn Page

Go to the Stake/Earn page on the platform.

Step 2: Set the Stake Parameters

Choose the duration and the amount you want to stake your USH.

Step 3: Approve the Staking

Click on Approve to allow the contract to access your USH.

Step 4: Confirm the Staking

Click on Stake to transfer your USH and beging earning rewards. Your USH will be locked into the contract and withdrawals will be allowed once the staking period set in the parameters ends.

Withdrawing LSDs

Shanghai Upgrade

The Shanghai upgrade is expected to be completed on March 31st, after which users will be able to access their underlying LSDs. In the case of delays, users can burn their unshETH for the underlying LSDs.

Options for Withdrawing LSDs

- Exit: Burn unshETH and receive a proportional amount of each LSD backing unshETH.

- Migrate to VDO Pools: Move to the new VDO pools and keep a portion of the multiplier.

Conclusion

LSD has become the standard in the PoS ecosystem and has become one of the main trends in DeFi. LSD can generate a stable, low-risk passive income and help maintain the stability of the blockchain. LSDfi is a logical extension of LSD that generates a whole economy that can generate substantial income on the one hand and simplifies interaction with LSD projects on the other.

LSDfi will continue to grow and gradually see an increase in the complexity and uniqueness of the project, let’s wait for its development in the future. As such, unshETH implements some intriguing incentivized innovations that address issues of great importance to the ETH community.

Join us to keep track of news: https://linktr.ee/coincu

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.