Key Points:

- VanEck predicts Ethereum will reach $11,800 by 2030, using cash flow forecast and FDV calculation.

- ETH will become a competitor of U.S. Treasury bonds.

VanEck, an investment management firm, predicts that the price of Ethereum (ETH) will reach $11,800 by 2030. According to their report, the specific valuation methods used to determine these prices are cash flow forecast and FDV calculation. The report also notes that ETH will become a competitor of U.S. Treasury bonds.

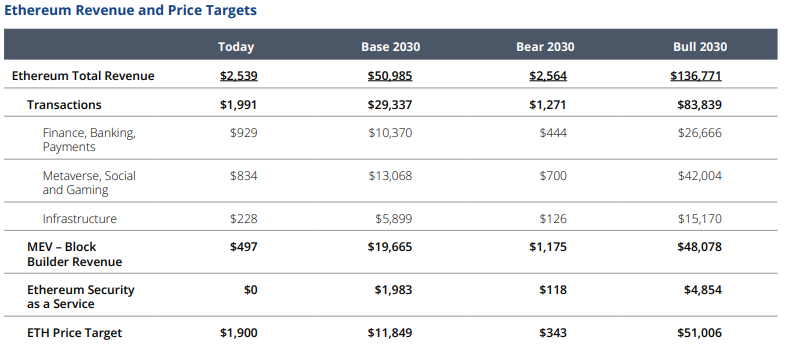

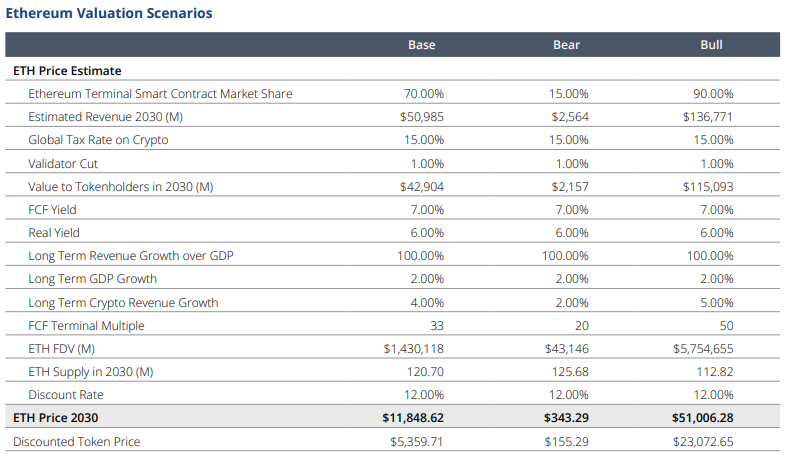

The report predicts that ETH network revenues will increase from an annual rate of $2.6 billion to $51 billion in 2030. Assuming that ETH takes a 70% market share among smart contract protocols, this implies a token price of $11.8k in 2030, discounted to $5.3k today at a 12% cost of capital derived from ETH’s recent beta.

The report offers a clear valuation methodology for Ethereum, considering transaction fees, MEV, and “Security as a Service.” It assesses market capture across key sectors and explores Ethereum’s potential as a store-of-value asset in the evolving crypto landscape. The report values Ethereum by estimating cash flows for the year that ended on 4/30/2030. They project Ethereum revenues, deduct a global tax rate and a validator revenue cut, and arrive at a cash flow figure.

Assuming a long-term estimated cash flow yield of 7% minus the long-term crypto growth rate of 4%, the report arrives at the fully diluted valuation (“FDV”) in 2030. They then divide the total by the expected number of tokens in circulation and discount the result by 12% to 4/20/2023. In the Base Case, the report assumes that Ethereum will achieve $51B in annual revenue in the year ending 4/30/2030.

They deduct a validator fee from this total, 1%, and a global tax rate of 15%, and arrive at cash flows of $42.90B to Ethereum. Assuming an FCF multiple of 33x, 120.7M tokens, the report shows a Base Case 2030 Price Target of $11,848 per token. The report discounts Ethereum at 12% to determine a valuation in today’s dollars, despite finding, through CAPM, an 8.74%. They use this elevated figure to reflect increased uncertainty around the future of Ethereum. Therefore, the report finds the discounted price of $5,359.71 in the Base Case.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News