Key Points:

- The SEC alleges that Binance and its CEO mishandled customer funds and broke securities rules.

- The regulator accuses the exchange of flouting basic know-your-customer rules and misleading investors.

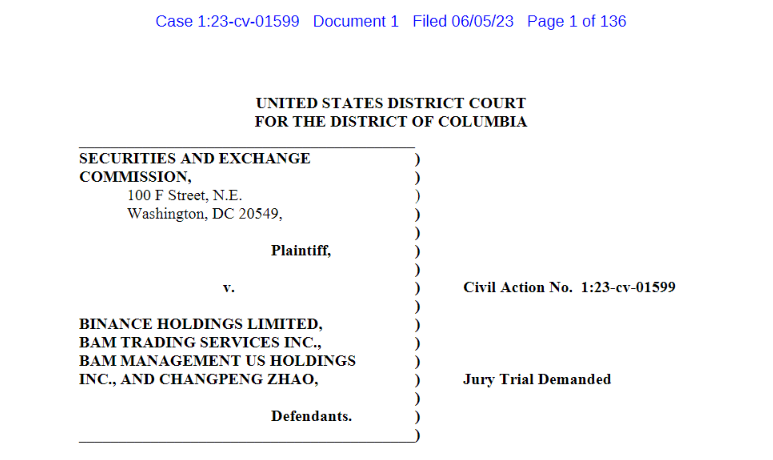

The Securities and Exchange Commission (SEC) has filed a lawsuit against Binance. The SEC alleges that the exchange mishandled customer funds and lied to regulators and investors about its operations.

The allegations are laid out in a 136-page complaint filed in US federal court in Washington. The complaint accuses Binance of flouting basic know-your-customer rules by letting Americans improperly open accounts and trade. The SEC alleges that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.

The regulator has asked the court to freeze Binance’s assets and appoint a receiver. Among other allegations, the SEC said that two Binance-linked tokens, BNB and BUSD, were securities that the firm improperly offered and sold. The regulator also claimed that Binance and its US affiliate weren’t actually independent from each other and improperly functioned as an exchange, broker-dealer, and clearing agency without registering with the agency.

The SEC has also alleged that the “purposeful efforts to evade US regulatory oversight while simultaneously providing securities-related services to US customers put the safety of billions of dollars of US investor capital at risk and at Binance’s and Zhao’s mercy.” In addition, the agency accused Binance of misleading investors about controls in place at the US entity to prevent manipulative trading. “The supposed controls were virtually non-existent,” the lawsuit said, alleging that from at least September 2019 until June 2022, Sigma Chain — a trading firm owned and controlled by Zhao — used wash trading to inflate Binance.US’s trading volume artificially.

According to the SEC, at least $145 million was transferred from Binance.US to a Sigma Chain account by 2021. Another $45 million was deposited into the account from a Nevada-based trust company connected to the US platform. Sigma Chain allegedly used $11 million from the account to purchase a yacht.

Binance called the complaint “disappointing,” saying it had engaged with the SEC in good-faith negotiations to settle the matter. The firm said, “While we take the SEC’s allegations seriously, they should not be the subject of an SEC enforcement action, let alone on an emergency basis. We intend to defend our platform vigorously.”

The derivatives regulator also alleged that Binance worked to evade US regulations, a claim that the SEC repeated in its Monday complaint. Since August 2021, the SEC said that the exchange didn’t require clients with account withdrawal limitations to submit any know-your-customer information when opening accounts, allowing them to bypass anti-money laundering restrictions.

After the case was announced, Bitcoin fell by 6.7%, the steepest decline in almost three months. The SEC is fearless in taking on the biggest players in this space. The agency has brought several high-profile cases against crypto firms this year, and SEC Chair Gary Gensler has often criticized firms for shirking the SEC’s rules.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News