Key Points:

- The Crypto Fear and Greed Index drops to fear levels not seen since March 11.

- The SEC files a lawsuit against Binance, its U.S. arm, and its CEO.

- Traders with open “long” positions suffer the most, accounting for 92% of the over $280 million in liquidations since the announcement of the lawsuit.

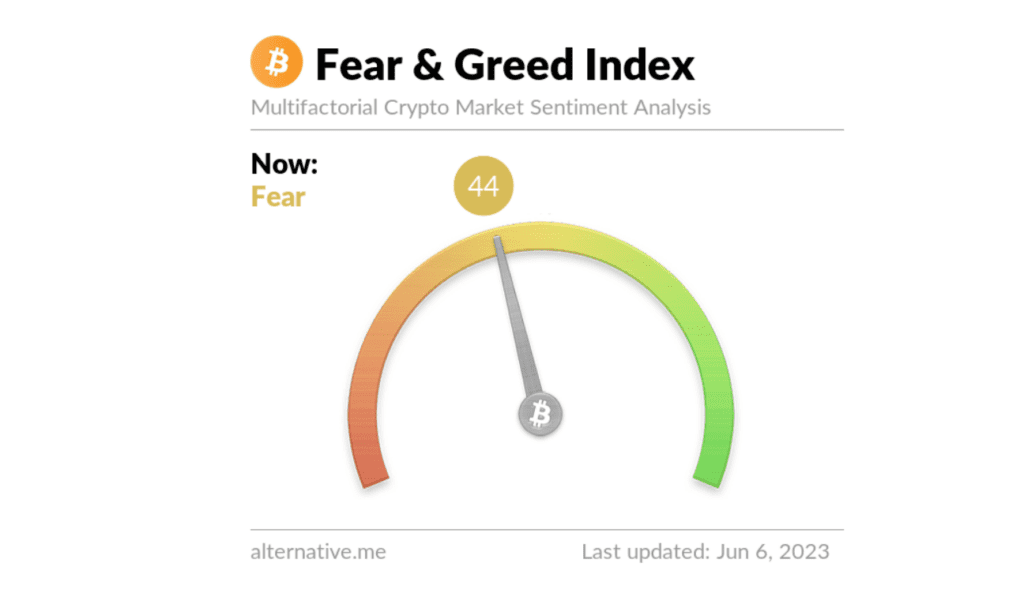

The Crypto Fear and Greed Index, a popular tool used to measure market sentiment towards Bitcoin and the broader crypto market, has recently plummeted to a level of “fear” not seen since March 11, 2021.

This was the day when Circle’s USD coin temporarily lost its dollar-peg, causing widespread panic among crypto investors.

The current dip in market sentiment follows a recent lawsuit filed by the United States Securities and Exchange Commission (SEC) against Binance, its US-based operations, and its CEO Changpeng Zhao. The SEC has pressed a total of 13 charges against the exchange and its affiliates for operating illegally in the United States and failing to register as a securities exchange.

The Crypto Fear and Greed Index works by aggregating a mixture of indicators, including price volatility, momentum, trading volume, as well as social media and Google trends data. These metrics are combined to form an overall picture of investor emotions towards Bitcoin and the wider crypto market.

The recent negative sentiment can be attributed to the immediate plunge in the value of cryptocurrencies following the SEC’s latest move against Binance. Major crypto assets like Bitcoin and Ethereum have lost 4.1% and 3.1% respectively in the last 24 hours.

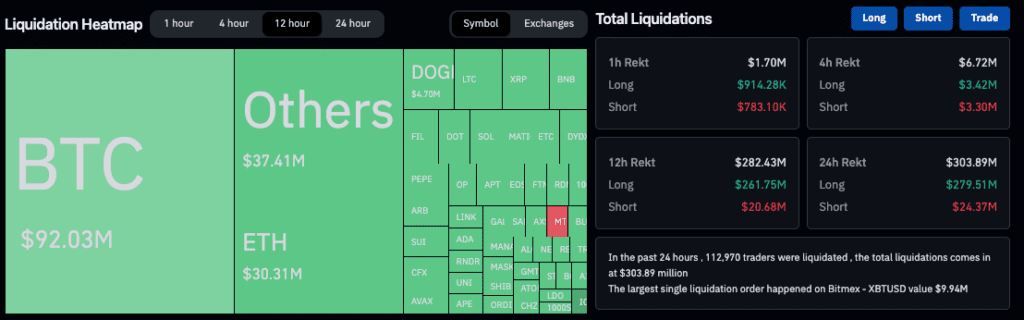

The impact of the lawsuit has not been limited to spot trading. Traders with open positions on crypto derivatives markets also suffered significant losses, with more than $280 million worth of liquidations occurring since the announcement of the lawsuit.

Unsurprisingly, traders with open “long” positions, who had leveraged bets on the price of crypto assets increasing, were the hardest hit, accounting for $261.75 million (92%) of the overall liquidations. Meanwhile, short traders experienced $20.7 million in liquidations. The top two digital assets were responsible for around 43% of these losses.

Despite the current negative sentiment, it is important to note that the crypto market has proven to be highly resilient in the past. It remains to be seen how this latest development will affect the market in the long run, although it is clear that investors will need to exercise caution and closely monitor the situation.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News