Key Points:

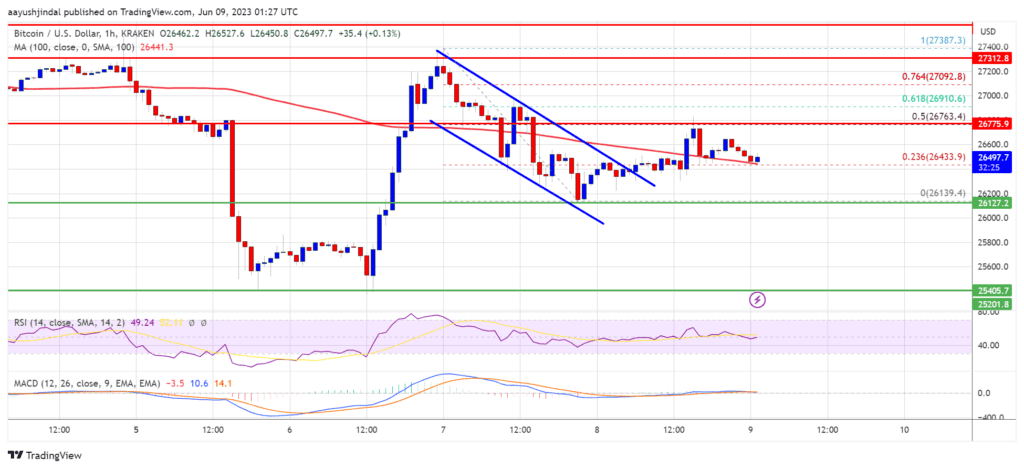

- Bitcoin’s price is stable above the $26,000 level, and it recently started an upside correction, climbing above the $26,250 level.

- Immediate support on the downside is near the $26,140 level, while the next major support is near the $25,850 level.

- Technical indicators such as the hourly MACD and RSI suggest a potential bearish trend.

Bitcoin price has remained relatively stable above the $26,000 level.

The cryptocurrency market saw a slight dip in BTC trading, as it traded as low as $26,139 before starting an upward correction. The price of Bitcoin was able to climb above the $26,250 level, indicating a possible bullish trend.

In fact, Bitcoin has shown significant upward momentum, as evidenced by a recent move above the 23.6% Fib retracement level of the downward move from the $27,387 swing high to the $26,139 low. This is a positive sign for investors, as it suggests that the market may be moving towards an upward trend.

Moreover, there was a break above a declining channel with resistance near $26,420 on the hourly chart of the BTC/USD pair. This also indicates a possible price increase in the near future.

At present, Bitcoin is trading near $26,500 and the 100 hourly Simple moving average. However, it seems to be facing resistance near the $26,750 level. It is close to the 50% Fib retracement level of the downward move from the $27,387 swing high to the $26,139 low.

Despite this, a clear move above the $26,750 resistance might start a decent increase, with the next major resistance being near the $27,000 level. A close above $27,000 might send the price further higher.

The next key resistance is near the $27,400 level. A clear move above the $27,400 resistance might call for a move toward the $27,500 resistance. Any more gains above the $27,500 resistance zone might send the price toward the $28,500 resistance zone.

On the other hand, if Bitcoin’s price fails to clear the $27,000 resistance, it could continue to move down and experience another decline. Immediate support on the downside is near the $26,140 level.

Investors should also take note of the next major support near the $25,850 level, below which the price might accelerate lower. In the stated case, the price could drop toward the $25,400 support in the near term.

Technical indicators such as the hourly MACD and the RSI for BTC/USD also suggest a possible bearish trend, with the MACD gaining pace in the bearish zone and the RSI nearing the 50 level.

While the price of Bitcoin is currently in a precarious position, with both bullish and bearish indicators, there is still a possibility for the market to move towards an upward trend. Investors should take note of the major resistance and support levels, as they may be crucial in determining Bitcoin’s future price movements.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News