Key Points:

- TUSD is in the midst of the most severe de-anchor against BUSD and USDC.

- Yesterday, TrueUSD announced it to stop providing mint service through Prime Trust amid rumors that this company is on the verge of bankruptcy.

- In addition, the deposit and withdrawal channels of TUSD are all US companies, and in theory, they will be affected by SEC prosecutions.

TUSD suffered a severe peg loss after the announcement of a mining halt through Prime Trust and the impact of SEC lawsuits against crypto companies.

The TrueUSD stablecoin issuance project announced yesterday on Twitter that it will suspend the service of issuing stablecoin through Prime Trust until the latest update.

They said minting and redemption TUSD operations are unaffected and can still be used normally. It also declares that the project’s partnership with banks remains intact, ensuring that transactions are seamless, reliable, and efficient.

TrueUSD did not explain why it stopped offering stablecoin minting through Prime Trust, which provides custodial services to crypto companies. However, the main reason likely stems from the fact that Prime Trust is involved in bankruptcy rumors and is said to have agreed to buy back by BitGo on June 9, 2023, despite raising more than $100 million in capital in June 2022.

It can be seen that USDC and BUSD are both in the process of de-anchoring, but TUSD is in the most serious de-anchoring process. All of this involved the SEC’s prosecution of two major cryptocurrency exchanges.

The Coinbase prosecution affects USDC. The prosecution of Binance and the restriction of the USD accounts of Binance and CZ may affect its stable minting. The Paxos behind BUSD and TrueUSD’s deposit and withdrawal channels are all US companies, and in theory, they would be affected.

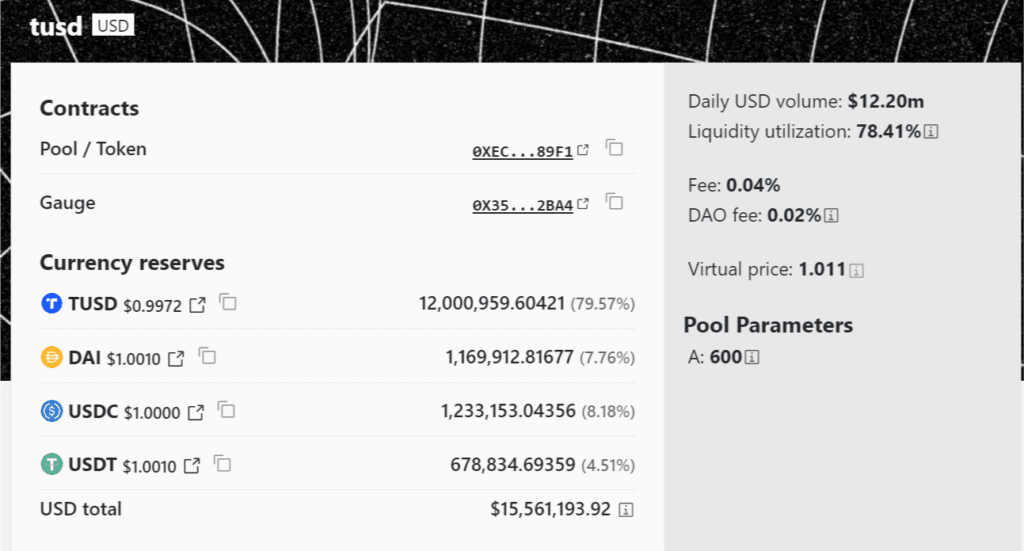

Currently, the TUSD pool with a TVL of over $12 million on Curve is tilted, with TUSD accounting for 79%. Users want to convert TUSD into a stablecoin based on USDT. The current price of TUSD/USD is $0.996, with a slight drop. On Binance, TUSD/USDT once dropped to $0.9906.

Previously, TrueUSD became Binance’s choice after the BUSD incident because it was sued by the SEC as a security and ordered Paxos to stop issuing BUSD from February 2023. Binance then promoted TUSD by offering only free Bitcoin trading for the stablecoin pairing. However, there were many concerns when TrueUSD was said to be linked to Justin Sun – a controversial businessman in the crypto industry.

The capitalization of TrueUSD is reaching $2 billion, up sharply from the $800 million mark at the beginning of 2023.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News