Solana Foundation Slams SEC’s “Security” Claim Amidst SOL Suffers 40% Loss

Key Points:

- The Solana Foundation is disputing the SEC’s classification of its SOL token as an unregistered security, leading to a drop in SOL’s value and regulatory uncertainty for investors.

- Despite the SEC’s actions, the Solana builder community remains committed to building exceptional blockchain projects and products.

Solana Foundation disputes SEC classification of SOL token as security, leading to plummeting prices and regulatory uncertainty for crypto investors.

The Solana Foundation, a nonprofit organization supporting the Solana blockchain development, is disputing the U.S. Security and Exchange Commission’s (SEC) classification of its SOL token as an unregistered security. This move came after the SEC filed lawsuits against two major cryptocurrency exchanges, Binance.US and Coinbase, charging them with trading crypto asset securities, including SOL.

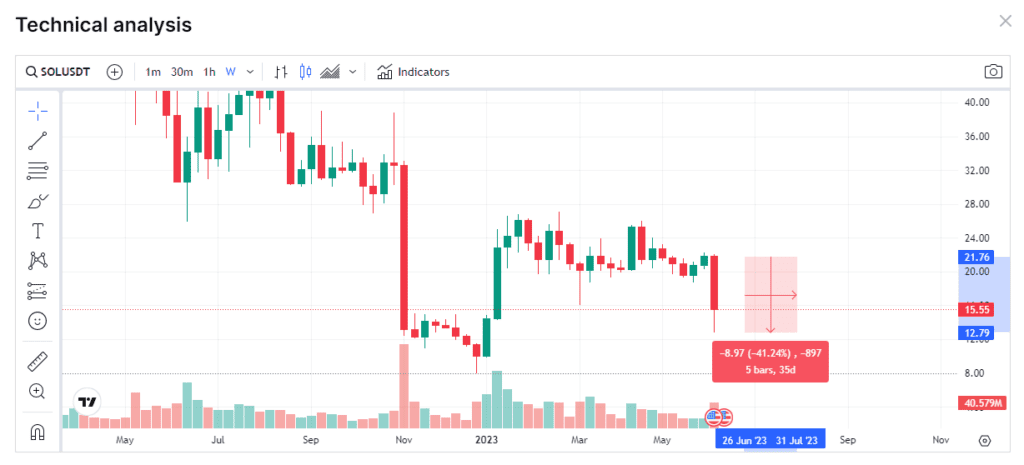

After the SEC announcement, Robinhood reportedly decided to end support for Solana (SOL) on June 27th, 2023. As a result, SOL has been hit seriously. At the time of writing, SOL is trading at around $15.5 after it is down over 40% in the past 7 days.

In response, the Solana Foundation stated that it strongly disagrees with the characterization of SOL as a security. They welcomed continued engagement with policymakers as constructive partners on regulation to achieve legal clarity on these issues for the thousands of entrepreneurs across the U.S. building in the digital assets space.

Despite the SEC’s actions, the Solana builder community remains committed to building exceptional projects and products, making it the strongest in the industry. The Solana Foundation is determined to create the best blockchain for a decentralized future and will continue supporting those building for the long haul. They believe blockchain technology can fundamentally change how we interact with each other and the world around us.

In addition to SOL, the SEC also identified tokens issued by companies and foundations or tied to protocols such as Cardano (ADA), Polygon (MATIC), Sandbox (SAND), Filecoin (FIL), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), Near (NEAR), Voyager (VGX), Dash (DASH), and Nexo (NEXO) as securities. The SEC’s action against Binance.US and Coinbase has raised concerns among cryptocurrency investors and entrepreneurs, who worry that regulatory uncertainty could hamper innovation in the digital asset space.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News