Key Points:

- Tether’s USDT is currently struggling with market volatility.

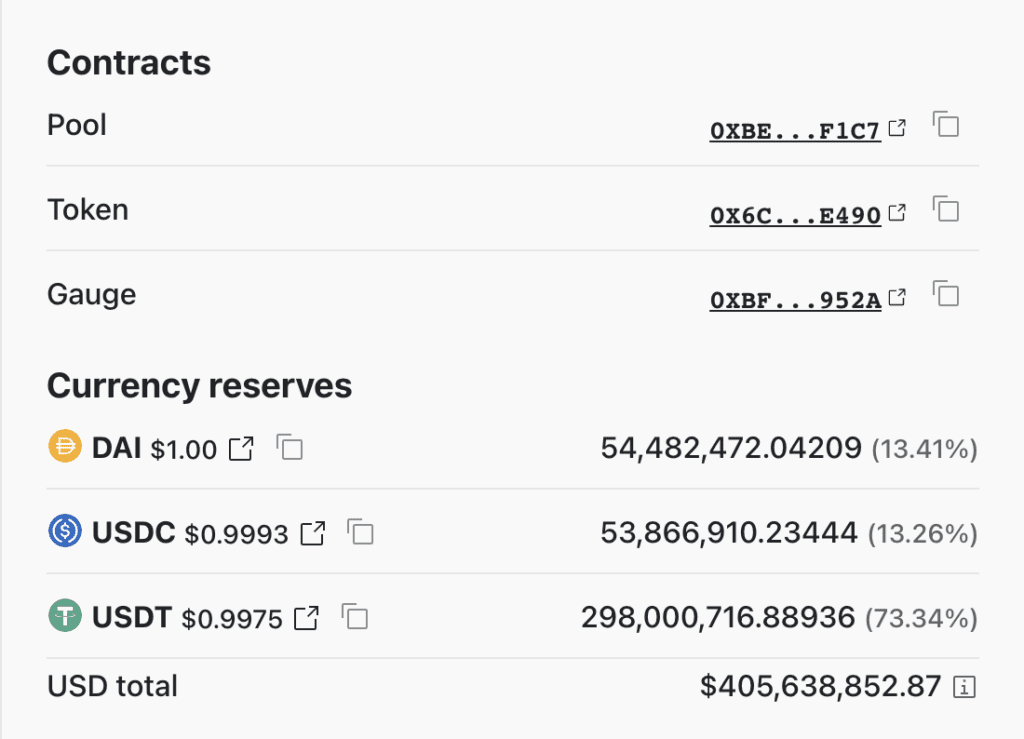

- The Curve 3Pool’s balance should be 33.33% for each of its three stablecoins, however, Tether’s balance has risen to well almost 70%.

- This suggests that traders are selling a lot of USDT for DAI or USDC, causing the stablecoin to de-peg to $0.9975.

Tether’s USDT, the biggest stablecoin by market capitalization, is under pressure, according to speculation.

There is presently no hint of a USDT depreciation, and the stablecoin is trading around one dollar. Yet, a stablecoin that is theoretically tied to a stable asset (the US dollar) might lose parity with that currency.

The deepest pools in the DeFi ecosystem, the Uniswap and Curve protocols, seem to be filled with USDT sellers at present.

When sellers rush the market, it might result in a fast depeg, as seen after the Silicon Valley Bank collapse, when the well-regarded USDC stablecoin (issued by Circle and Coinbase) lost its peg and plummeted as low as $0.93 before quickly recovering its dollar parity.

On June 15, the data showed that the Curve platform’s stable currency 3pool ratio has tilted, of which USDT accounted for 70.29%. In addition, the market shows that the stablecoin has slightly unanchored and fell to around $0.9975.

Tether Chief Technology Officer Paolo Ardoino stated:

“Markets are edgy in these days, so it’s easy for attackers to capitalize on this general sentiment.

But at Tether we’re ready as always. Let them come.

We’re ready to redeem any amount.”

Tether announced a chain swap with a third-party exchange to transfer 750 million USDT from Tron to Ethereum ERC-20.

Another reason for market players migrating to USDT, the world’s biggest stablecoin, is dwindling investor trust in fellow Circle-issued USDC stablecoin.

Nonetheless, the USDC/USDT trading pair on Binance has continued to surge, reaching $1.0034, a high since June 13, 2022. In reality, the USDT declined by 0.3%.

Tether is by far the most valuable stablecoin in existence, with a current market price of $83,5 billion. Stablecoin use has skyrocketed in recent years, and Tether has been working hard to diversify its reserve holdings in response to the rising requirement for network confidence.

Tether stated last month that it was extending its presence in Georgia by investing in CityPay.io, a payment processing firm. The business has announced ambitions to establish long-term Bitcoin mining operations in Uruguay.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News