MakerDAO Backed DAI By Purchasing $700 Million In US Treasury Bonds, MKR Up 5%

Key Points:

- MakerDAO has just completed the purchase of an additional $700 million in US Treasury bonds.

- After buying $500 million of bonds in October 2022, the total current holding of the project is up to $1.2 billion.

- The DAO investing in bonds is a way to gain exposure to many low-risk financial instruments.

The issuer of stablecoins and decentralized finance protocol MakerDAO purchased another $700 million in US Treasury bonds, bringing the platform’s DAI stablecoin reserve to $1.2 billion, according to a press statement.

The acquisition was the next stage in Maker’s approach, defined by creator Rune Christensen’s “Endgame Plan,” to diversify the assets underpinning the $4.5 billion dollar-pegged stablecoin by boosting the role of conventional financial assets in reserve, such as government bonds.

With the acquisition of a $500 million bond in October 2022, the organization’s total bond holdings currently stand at $1.2 billion. MakerDAO purchased the bonds to expand its exposure to low-risk, liquid conventional assets.

According to a statement, the acquisition was executed on behalf of MakerDAO by the digital asset management Monetalis Clydesdale Vault, which was formed from the DeFi lender Monetalis Group. Monetalis Group CEO Allan Pedersen stated:

“MakerDAO is a pioneer and leader in the DeFi space and has built up a large volume of funds in its peg-stability-module, which ensures the stability of the DAI stablecoin.”

The platform is being restructured, which involves dividing its structure into smaller, autonomous parts known as SubDAOs and investing in yield-generating, real-world assets to improve protocol income at a time when demand for crypto financing is low.

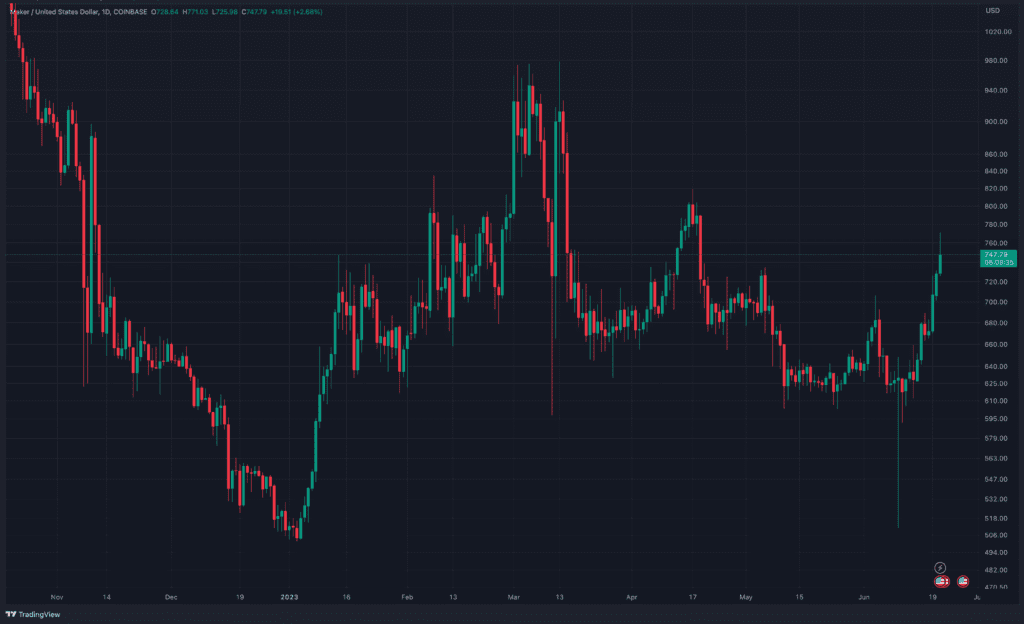

MKR, following the news, spiked more than 5% at $770 but quickly fell back to the $747 price zone.

In March, MakerDAO increased its debt limit from $500 million to $1.25 billion. Moreover, MakerDAO suggested raising the DAI Savings Rate (DSR) to 3.33% on May 26, which, if approved, may increase the stablecoin’s market capitalization by boosting demand for DAI holdings.

MakerDAO voting members also supported withdrawing $500 million in Paxos Dollar (USDP) and $390 million in Gemini Dollar (GUSD) from the reserve to pursue higher-yielding assets.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News