Key Points:

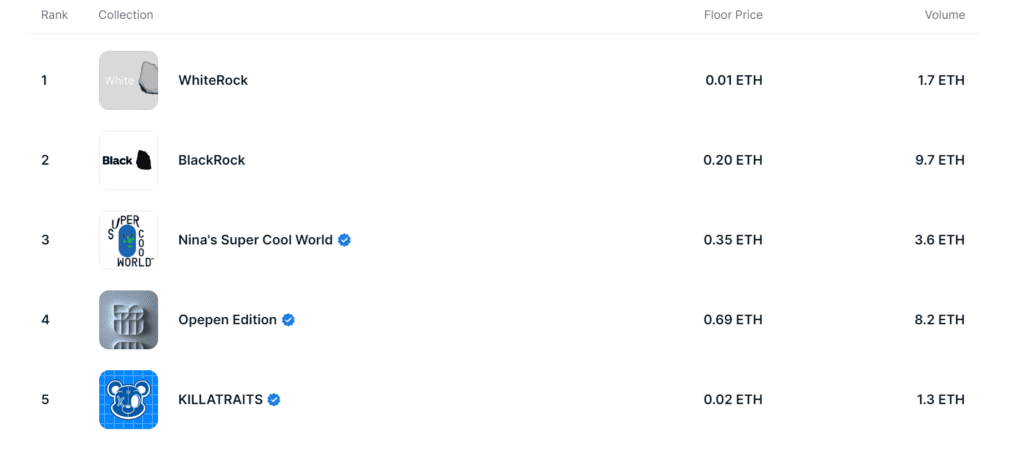

- BlackRock is currently the 2nd most popular collection on the chart of the largest NFT platform in the Opensea market.

- Its floor price of 0.2 ETH is 10 times higher than the floor price of the first ranked collection, WhiteRock.

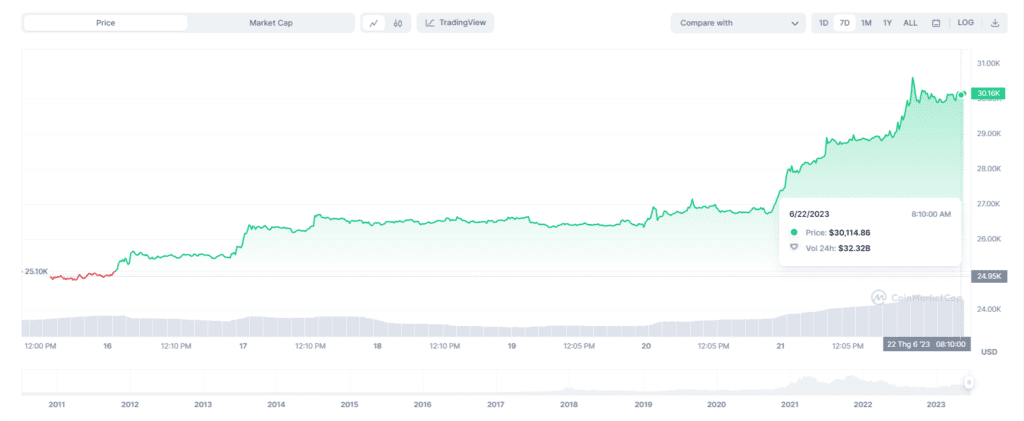

- The expectation of being approved for Blackrock’s request to open a Bitcoin ETH spot fund has partly dispelled the gloom for the whole market.

BlackRock is becoming the flagship collection of the largest NFT trading platform Opensea with floor prices reaching over $380.

According to data on Opensea, WhiteRock is the number 1 collection, leading BlackRock, but BlackRock currently has a floor price 10 times higher (0.2 ETH compared to 0.01 ETH) and almost 6 times the volume. (9.7 ETH vs. 1.7 ETH).

This boom is largely attributed to financial services giant BlackRock’s filing for a spot Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC) on June 15.

The Securities and Exchange Commission (SEC) has rejected any application to establish a spot Bitcoin ETF. However, in the case of Blackrock, this time, the SEC approval rate for a Bitcoin ETF application is relatively high because of its careful preparation. Blackrock’s ETF application could serve as a key event in crypto 2023 and possibly beyond.

This event not only helps to keep the “rock” themes trending on NFT collections, but it also provides a great deal of optimism for companies that also offer wealth management services in the traditionally dynamic market to enter the promising Bitcoin market.

In less than a week, a series of large funds such as Fidelity, Citadel, Charles Schwab, Deutsche Bank, MasterCard, WisdomTree,… have all applied to open a spot Bitcoin ETF with the SEC and have caused BTC price to increase continuously since $26,000 to $30,200 in just 2 days, BTC price is up more than 20% this week.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News