Korbit is a prominent South Korean cryptocurrency exchange that has significantly impacted the local digital asset trading landscape. In this Korbit Review, let’s learn about this project through the article below.

Established in 2014 with substantial financial support from venture capitalists, Korbit has been at the forefront of providing essential services for cryptocurrency enthusiasts in South Korea. With its headquarters situated in Gangnam-gu, Seoul, Korbit Inc. has emerged as a trusted platform within the country’s thriving crypto market.

Korbit Review: Introduction

As the first cryptocurrency exchange to offer fiat to cryptocurrency trading using the South Korean Won (KRW) as the primary fiat currency, Korbit has played a pivotal role in satisfying the needs of local traders and investors. In a market heavily populated by domestic players and those seeking refuge from China’s cryptocurrency trading ban, Korbit has stepped up to provide a secure and efficient platform for individuals to engage in digital asset transactions.

While regulations for cryptocurrency exchanges in South Korea are still under consideration by the government, Korbit has earned a reputation for reliability among its competitors. In a highly competitive landscape, where maintaining customer trust is paramount, Korbit has excelled in delivering a dependable and transparent trading environment.

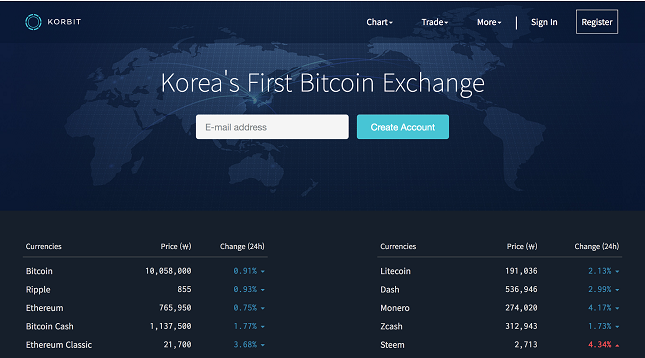

Korbit review offers a web-based trading interface that allows users to navigate seamlessly through the platform’s features. The separation of charting tools and the trade execution interface enables users to analyze market trends and execute trades efficiently. Additionally, users have access to an order book, which provides valuable insights into market sentiment, aiding traders in making informed decisions.

Traders on Korbit can engage in the exchange of various digital assets, including Bitcoin, Ethereum, Ripple, Litecoin, and more. Initially focused on Bitcoin-KRW trading, Korbit has expanded its asset base over time to cater to the growing demand for alternative cryptocurrencies. With the ability to trade both crypto-to-fiat and crypto-to-crypto, Korbit facilitates a diverse range of investment strategies and trading opportunities.

Korbit Review: Features

Korbit, as a leading South Korean cryptocurrency exchange, offers a range of features that cater to the needs of traders and investors in the local market. In this section, we will explore the key features of the Korbit platform, including its trading interface, available instruments, account types, and more.

Exchange Platforms:

Korbit review provides users with a web-based trading interface that is accessible through standard web browsers. The platform’s user-friendly design allows for seamless navigation and efficient trading activities. While Korbit does not offer a dedicated mobile app, its web platform is optimized for use on mobile devices, enabling users to trade on the go.

The web-based platform on Korbit features a clear separation between charting tools and the trade execution interface. This division allows users to analyze market trends and patterns on one window while executing trades on another. Traders can access the order book, which displays market entries and serves as a gauge of market sentiment, helping them make informed trading decisions.

The charting tools provided on Korbit’s platform are basic, offering essential analysis capabilities. However, for in-depth technical analysis, traders may need to utilize external charting software. Despite this limitation, the platform’s user-friendly interface and efficient trade execution contribute to a seamless trading experience.

Instruments/Trade Types:

Korbit review initially began as a Bitcoin-KRW exchange but has since expanded its asset offerings to include a variety of popular cryptocurrencies. Traders on Korbit can engage in the trading of the following digital assets:

- Bitcoin (BTC)

- Bitcoin Gold (BTG)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Dash (DASH)

- ZCash (ZCH)

- Monero (XMR)

- Augur

- Steem

- Ethereum Classic (ETC)

These digital assets can be purchased as tokens using the South Korean Won (KRW) or used for crypto-to-crypto trading. The available order types on the Korbit platform include limit orders (buy/sell), stop orders (buy/sell), OCO (Order Cancels the Other), and market buy/sell orders. This diverse range of instruments and trade types provides flexibility for traders to implement various strategies and capitalize on market opportunities.

Account Types:

Korbit offers a single account type for all users, regardless of their trading volume or frequency. This streamlined approach simplifies the account creation process, allowing users to start trading quickly without the complexities associated with multiple account tiers.

By providing a unified account type, Korbit ensures that all users have access to the same set of features and benefits, creating a level playing field for traders of all levels of experience.

Fees:

Korbit review employs a maker-taker fee structure, wherein fees are based on the trading volume generated by each trader over a 30-day period. The maker fee is applicable to traders who add new entries to the order book, while the taker fee is charged to traders who execute trades at the best available entry price.

The trading fees on Korbit are competitive and designed to reward higher volume traders with lower fees. The fee structure is as follows:

- For a 30-day trading volume less than 100 million KRW: Maker fee of 0.08% and taker fee of 0.2%.

- For a trading volume greater than 100 million KRW but less than 200 million KRW: Maker fee of 0.05% and taker fee of 0.2%.

- For a trading volume greater than 200 million KRW but less than 500 million KRW: Maker fee of 0.03% and taker fee of 0.2%.

- For a trading volume greater than 500 million KRW but less than 2 billion KRW: Maker fee of 0.02% and taker fee of 0.2%.

- For a trading volume greater than 2 billion KRW but less than 10 billion KRW: Maker fee of 0.01% and taker fee of 0.15%.

- For a trading volume greater than 10 billion KRW but less than 30 billion KRW: Maker fee of 0.00% and taker fee of 0.1%.

- For a trading volume greater than 30 billion KRW but less than 50 billion KRW: Maker fee of 0.00% and taker fee of 0.05%.

- For a trading volume greater than 50 billion KRW but less than 100 billion KRW: Maker fee of 0.00% and taker fee of 0.02%.

- For a trading volume equal to or greater than 100 billion KRW: Maker fee of 0.00% and taker fee of 0.01%.

These moderate fees make trading on Korbit cost-effective for both small-scale and large-scale traders, encouraging active participation within the platform.

Deposits and Withdrawals Options:

Korbit review offers multiple options for deposits and withdrawals, catering to the diverse needs of its users. Users can deposit funds using the South Korean Won (KRW) or various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and more. The available deposit and withdrawal methods include:

- Credit/Debit Card: While convenient, it is important to note that using credit or debit cards may incur higher transaction charges. Users should be mindful of these fees when selecting this method.

- Bank Transfers: Deposits and withdrawals can be made using KRW through bank transfers, providing a secure and widely accepted option for users.

By offering a range of deposit and withdrawal methods, Korbit ensures accessibility and convenience for users, allowing them to manage their funds effectively.

Korbit Review: Pros and Cons

Korbit review, as a leading cryptocurrency exchange in South Korea, offers several advantages and disadvantages that users should consider before deciding to trade on the platform. In this section, we will explore the pros and cons of using Korbit, providing you with a comprehensive overview to aid in your decision-making process.

Pros

- Established Reputation: Korbit review has built a strong reputation since its launch in 2014. With its years of experience and successful operations, the exchange has gained the trust and confidence of users in the South Korean cryptocurrency market. The platform has demonstrated reliability and security, contributing to its positive reputation.

- Fiat-to-Crypto Trading: One significant advantage of Korbit review is its support for fiat-to-crypto trading. This means users can easily convert their local currency, the South Korean Won (KRW), into various cryptocurrencies available on the platform. This feature simplifies the onboarding process for newcomers and enables a seamless transition from traditional finance to the world of cryptocurrencies.

- Broad Range of Cryptocurrencies: Korbit review offers a diverse selection of cryptocurrencies for trading. Users can access popular options such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and more. This wide range of options allows traders to explore different investment opportunities and diversify their portfolios according to their preferences and risk appetite.

- User-Friendly Interface: The platform’s interface is designed to be user-friendly, making it accessible to both novice and experienced traders. The intuitive layout and navigation enable easy account setup, depositing funds, executing trades, and monitoring portfolio performance. Korbit review strives to create a seamless trading experience for its users.

- Strong Security Measures: Korbit review prioritizes the security of user funds and personal information. The exchange implements stringent security measures, including two-factor authentication (2FA) for account access, encryption protocols, and cold storage for storing a significant portion of users’ digital assets offline. These measures help protect against unauthorized access and mitigate the risk of hacking incidents.

Cons

- Limited International Availability: Korbit review primarily caters to the South Korean market and has limited availability for international users. This may pose a challenge for traders outside of South Korea who wish to access the platform’s services. Geographic restrictions may limit the potential user base and limit opportunities for international traders.

- Limited Trading Features: While Korbit review offers essential trading features, it may lack some advanced tools and functionalities available on other international exchanges. Traders who require advanced charting tools, extensive order types, or specific trading options may find the platform’s offerings relatively limited.

- Customer Support Options: The availability of customer support options is an area where Korbit review could improve. Currently, customer support is primarily provided through email and phone, with limited options for real-time assistance. A more comprehensive and responsive customer support system, including live chat or ticket-based support, would enhance the overall user experience.

- Regulatory Uncertainty: South Korea’s cryptocurrency market operates in a regulatory gray area, and there is ongoing discussion and potential future regulation concerning cryptocurrency exchanges. While Korbit review has used successfully within this framework, regulatory changes or uncertainties could impact its operations and user experience in the future.

Conclusion

In conclusion, Korbit offers a reputable and user-friendly platform for cryptocurrency trading, particularly for the South Korean market. Its support for fiat-to-crypto trading, diverse range of cryptocurrencies, and robust security measures are notable advantages. However, the platform’s limited international availability, trading features, customer support options, and the regulatory landscape should be considered when evaluating whether Korbit aligns with individual trading needs and preferences.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Chubbi

Coincu News