Key Points:

- Chibi Finance has been accused of staging a “rug pull,” allegedly absconding with roughly $1 million in user deposits.

- 555 ether (ETH), equivalent to $1 million, was drained from the platform’s liquidity pools.

- The price of the project-issued chibi tokens, which hovered at around $1 yesterday, took a sharp nosedive, plummeting to just $0.017.

Chibi Finance is a relatively new DeFi project that operates on the Arbitrum’s Layer 2 network. Recently, the project has been accused of a “rug pull” scam, which involves the withdrawal of user deposits.

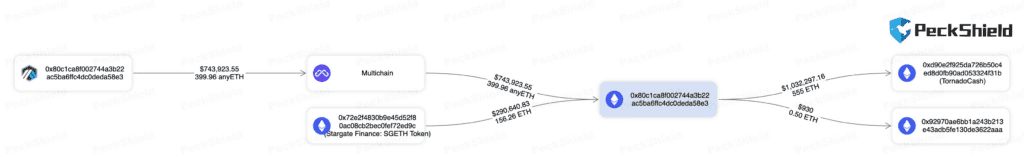

According to on-chain analysis carried out by security analysts at PeckShield, the platform’s liquidity pools were drained of 555 ether (ETH), which is equivalent to $1 million.

Chibi Finance team withdrew tokens staked by users on the platform, then converted them to ether. The funds were then moved from the Arbitrum network to Ethereum and passed through Tornado Cash, a popular Ethereum mixing service that is used to obscure transaction trails. All of this was done without the knowledge or consent of users.

Chibi Finance team’s social media accounts on Twitter and Telegram, as well as the project’s website, chibi.finance, are no longer accessible. It is unclear whether the project team has any intention of returning the funds to affected users. The Block has reached out to the project for comment but has yet to receive a response.

This incident is just one of many exit scams that have emerged in recent months on the Arbitrum and broader Ethereum Layer 2 ecosystem. Last month, the developers behind Swaprum, another Arbitrum-based project, disappeared with nearly $3 million in a similar case. Earlier in April, a decentralized exchange called Merlin, operating on zkSync, exited after siphoning off user funds worth $2 million.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News