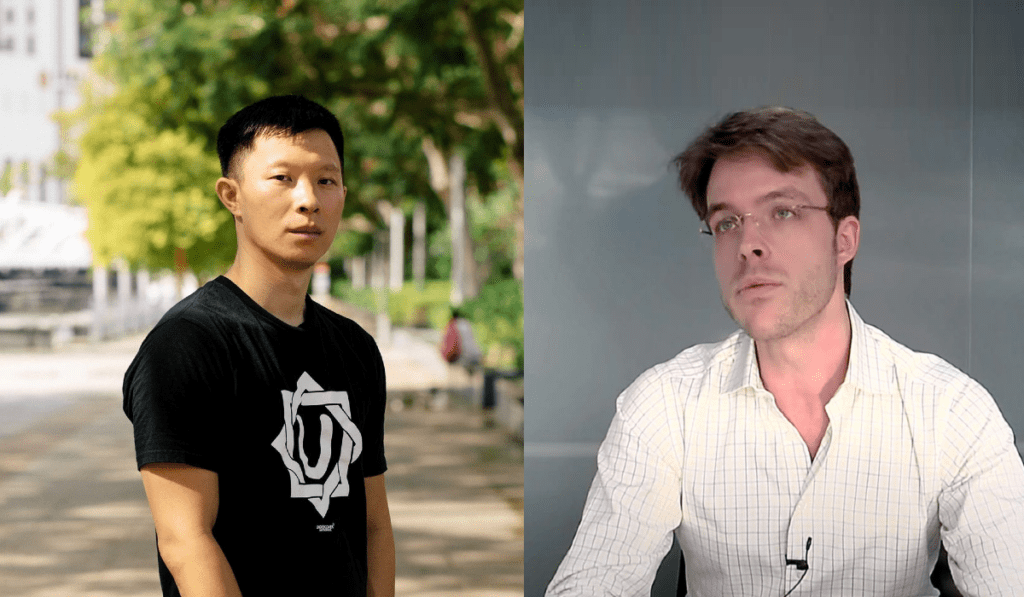

3AC Liquidators Are Chasing $1.3 Billion From Su Zhu And Kyle Davies

Key Points:

- 3AC liquidators are seeking to recoup $1.3 billion from its co-founders, Su Zhu and Kyle Davies.

- The liquidators claim that Zhu and Davies allowed Three Arrows to amass large amounts of debt after suffering significant losses on investments in Luna coins and other assets.

According to Bloomberg, Three Arrows Capital (3AC) liquidators are chasing $1.3 billion from the crypto hedge fund’s co-founders, Su Zhu and Kyle Davies.

A source familiar with the liquidators’ claims said that the liquidators raised the charges against Three Arrows co-founders Su Zhu and Kyle Davies in a Tuesday meeting with the hedge fund’s claimants.

Zhu and Davies are accused of allowing Three Arrows to take on enormous debt between May and June 2022 after the hedge fund incurred large losses on ill-fated Luna coins and other investments. The company was already bankrupt, and liquidators are now suing Zhu and Davies in a British Virgin Islands court to recoup those losses for the firm’s debt.

Due to a series of leveraged bets gone bad during a cryptocurrency bear market and its exposure to the $40 billion Terra Luna ecosystem, 3AC filed for bankruptcy in the British Virgin Islands in June 2022. Davies and Zhu could not be traced after the bankruptcy filing, despite media reports indicating they spent their time in Dubai and Indonesia.

In June, Zhu wrote on Twitter that his and Davies’ good faith attempts to work with liquidators were met with baiting.

The demise of Three Arrows happened during a slump in digital currencies, and its effects were seen by platforms with exposure to the hedge fund, notably BlockFi, and Voyager Digital Ltd., who filed for bankruptcy weeks after the hedge fund went into liquidation.

The liquidators’ charges against the co-founders increase moves taken against Zhu and Davies, whom they accuse of being uninvolved in their probe. The liquidators, Teneo partners, were appointed by a BVI court last year and are seeking to collect cash for Three Arrows, which is owed around $3.3 billion.

Recently, Open Exchange (OPNX), a platform for exchanging claims against failing crypto companies, has announced the addition of a new ecosystem partner, “3AC Ventures.” OPNX was established by Su Zhu and Kyle Davies.

3AC claimed to have managed $10 billion in assets at its height. On June 15, 3AC liquidators filed a petition in the United States to place Davies in contempt of court. The move, however, does not apply to Zhu, whose Singaporean citizenship precludes him from being subject to US jurisdiction.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News