Key Points:

- Themis Protocol was hacked, and its lending function was disabled.

- The attacker drained around $368,000 by exploiting a faulty oracle and using Stargate Finance for fund conversion.

- Recovery efforts and a compensation scheme are underway.

Themis Protocol reported that it had been hacked and that its lending function had been disabled.

Themis Protocol is a lending platform that has had an agonizing deployment, with consumers having to wait even longer for the platform to become operational after enduring multiphased airdrops but no useable product. On June 16, the project officially went into beta on Arbitrum, an Ethereum layer 2 platform.

On June 27, just eleven days later, the team announced that the project had expanded to over $1 million TVL in two working days. They declared an hour later that they would pause the procedure and launch an emergency investigation into a suspected flashloan attack. In its literature, Themis states that “security is the highest priority” of the project and references many PeckShield audits.

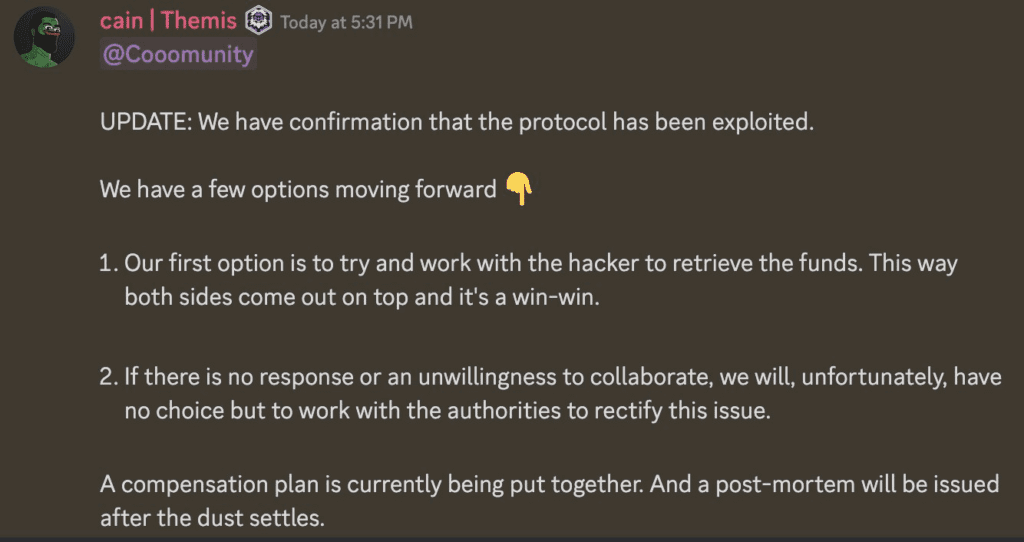

The protocol will initially attempt to work with the hacker to recover the monies. If the hacker refuses to comply, it will work with authorities to fix the situation. A compensation scheme is being prepared at the moment.

According to PeckShield monitoring, an attacker seems to have been able to compromise the project, draining around 220 Themis-wrapped ETH (approximately $417,000). Due to liquidity concerns, they were only able to exchange these for around 94 ETH ($178,000) and over $190,000 in stablecoins, for a total haul of approximately $368,000. According to PeckShield, the flashloan attack was caused by a faulty oracle, and the stolen monies were channeled via Stargate Finance.

Themis Protocol is a layer-2 crypto trading platform that offers NFT mortgage loans based on past NFT transaction data.

Themis is a set of DeFi protocols built using smart contracts. It enables users to take on various roles in the governance chain based on their degree of risk and receive corresponding rewards.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News