Themis Protocol is the first protocol to introduce DeFi to the thriving Metaverse and GameFi economies. Leverage your NFT and GameFi liquidity by using it as collateral for loans. Let’s learn details about this project with Coincu through this Themis Protocol Review article.

What is Themis Protocol?

Themis Protocol is a layer-2 crypto trading platform that offers NFT mortgage loans based on past NFT transaction data.

The protocol is a set of DeFi protocols built using smart contracts. It enables users to take on various roles in the governance chain based on their degree of risk and receive corresponding rewards. Participants have the ability to lend, borrow, stack yield, auction, and leverage UNI-V3. This is something unique that past efforts have not been able to do.

Themis also provides liquidity providers with leverage: NFTs may be used to borrow stablecoins. Market makers, launchpads, and long-term holders benefit from the scaling protocol’s liquidity. Themis adds liquidity to a previously illiquid metaverse. Now, the Themis Protocol Review article will explore how the project works.

How does it work?

Themis Protocol is an Ethereum-based decentralized peer-to-peer lending mechanism. It is ERC-721/ERC-1155-compliant and enables users to make anonymous loans between fund pools and NFT mortgagors. Contains Uniswap-V3 LP locations.

Market Makers – Market Makers may also profit from market creation by establishing loan payment arrangements with a pool of money in order to borrow crypto assets for other uses.

Themis user object:

- Lender: Deposit assets into the platform. Themis will then create 1 quantity of tToken tokens in a 1:1 ratio to match the number of user assets. The value of this tToken will progressively rise over time, and the user may return the full tToken to the original asset at any moment. The remaining tTokens will thereafter be incinerated from the system.

- Borrower: Give collateral (token or LP token) in order to borrow an equivalent amount of money. Moreover, Themis mints 1 number of sToken or vToken tokens at a 1:1 ratio to symbolize the user’s obligation. The quantity of these s/vTokens grows over time, and when the loan + interest is paid off, the borrower receives the collateral back. The remaining s/vTokens are then burnt from the system.

Accepting various sorts of collateral. Themis’ assets are separated into two categories:

- M0: A large quantity of liquid collateral is represented by M0.

- M1: LP tokens serve as collateral.

Lenders may provide assets to one of the two groups. They gain a greater APY margin when they provide liquidity into M1.

When a borrower’s debt surpasses 80% of the collateral’s value, their property is liquidated. Themis is separated into two categories:

- For assets in group M0, the liquidator returns a portion or the whole amount owing and earns a liquidation incentive. The liquidator has the option of receiving the necessary amount of tToken rather than the underlying asset.

- There is no Liquidation Bonus in M1, thus, the liquidator repays the total amount owing for collateral at a reduced price.

Highlights of Themis Protocol

Collateral UNI-V3 NFT

When a user defaults, Themis Protocol readily accesses asset values in UNI-V3, utilizing that data as the foundation for offering mortgages of equivalent value. NFT is employed for withdrawals, which helps to secure the primary lender’s security. It is also the system that allows UNI-V3 market makers to use the Vault pool and leveraged instruments.

Risk management

Themis Protocol employs a straightforward risk management strategy. To counteract systemic risk, risk will be allocated to all parts of governance by concentrating on three factors: asset liquidity, profit, and safety.

Yielding Farming

Themis Protocol’s NFT Mortgage Plan now includes traditional mortgage lending in addition to inner ring collateral liquidity expectations and new output tokens. The return and risk of each post-mortgage phase are intended for risk diversification.

With several unique new incentives, such as token account cancellation and incentive rules, the price of assets for mortgage lending will be more stable on Themis.

Products of Themis Protocol

Lending To The Metaverse

Themis Protocol is hosted on Ethereum and will enable additional parallel chains in the future. Themis also delivers business nodes at various locations based on the attributes of the property. As a result, Themis’ basic structure is very significant. The ultimate objective of Themis Protocol is to become “Libra” in order to quantify the worth of native crypto assets.

Themis is built in accordance with the following principles:

- Compatible with all Ethereum assets: Ethereum was the first practical and extensively utilized smart contract platform. Each crypto community has its own mature native assets deployed on Ethereum, allowing other communities to access a decent environment.

Simultaneously, Ethereum compatibility implies that code may be cycled on the same sort of public chain as BSC, or in parallel across many public chains using cross-chain bridges, enabling numerous users to utilize the product. - Simple Risk Management Model: Themis’ risk management logic is based on the three-way assessment concept, which assigns risk to the asset’s safety, profitability, and liquidity attributes. Combats systemic risk by allocating various risks and reverting to different linkages.

- Market-Based Lending: The key to mortgage lending is to guarantee that the collateral is worth more than the loan money. As a result, borrowers must have unrestricted access to price and collateral via long-term decentralized agreements.

- Scalability of the business: The basic framework includes mortgage lending, liquidation, asset auction, LP token mining pool, hedging pool, and quote collector, with future business expansion capabilities including full mortgage lending, NFT issuance, decentralized exchange, insurance, Oracle, and Vault.

- Native Crypto Asset Management: To maintain corporate compliance, Themis Protocol exclusively offers services for native crypto assets. The freshly produced token is a utility token or crypto login that the admin session generates. These credentials may be valuable, but they do not guarantee security token attributes such as corporate income, equity, and so on.

Lending Pool

Direct peer-to-peer agreements, which are unsecured between market participants, allow lending. When this format is used for NFT lending, there is no information equivalency between the borrower and the lender, resulting in considerable expenses for both sides. In decentralized networks, peer-to-peer lending proved unsuccessful.

Decentralized lending protocols like AAVE and Compound are now being utilized to establish funds with interest rates that are computed algorithmically based on changes in asset supply and demand. To earn or pay variable interest, asset borrowers and suppliers engage directly with the protocol, which becomes more efficient.

When it is decided that the user would be unable to repay the loan, a liquidation procedure will be carried out to reclaim the lender’s principle and interest by a rigorous payment to a third party.

When reading a user-authorized NFT, the Themis protocol will scan at least three blocks (to prevent a fast loan attack) to obtain the ApproveBind asset price in a third-party protocol platform, and if successful, TokenHub will tick the price relationship of that NFT to the tied asset in order to obtain the offer. The following loan procedure is completed based on this quotation.

NFT Auction

Themis Protocol differs from other NFT auction systems in that its NFT is conducted in a Dutch auction manner. This was created with the goal of dealing with challenging assets in mind. It will subsequently be made available to all users that want to trade using NFT swiftly.

Each new bid causes the preceding bid to fail, and if no additional bids are received during the countdown, the NFT will be awarded to the highest bidder. If no offers are received, the price will be decreased by 5%.

Farming with LP tokens

Themis offers high-yielding agricultural services like sushi, pancakes, and many other DEXs, but for different reasons. Users could only farm using TMS pairs until the DEX became stable.

Themis’ team investigated the logic and security of the NFT lending protocol. Themis protocol is built on the principle of governance by objective, differentiating responsibilities in the chain and dispersing risks, which primarily carry the following risks:

- Lenders: are mostly exposed to interest rate risk.

- Borrowers and lenders: Lenders face the majority of interest rate risk. Since Themis is a decentralized protocol and borrowers use excessive collateral, lenders may collect principle and interest by liquidating the borrower’s assets, although the interest is only slightly greater than that.

- Suppliers of liquidity: Particularly vulnerable to security issues as a result of temporary losses. The gains from liquidity mining, on the other hand, might be quite substantial.

- The liquidator is primarily responsible for profit risk.

- Dividend holders: face mostly liquidity risk and may participate in all Themis Protocol utility allocations by pledging TMS; nevertheless, price swings in TMS may occur while trading.

NFT Avatar

The NFT Avatar symbolizes the user’s VIP status. User addresses with NFT signature limitations are permitted to borrow at higher mortgage interest rates. The contract validates the balance of the NFT included in the borrower’s address when the user uses this power.

TMS token

Key Mectrics

- Token name: Themis

- Ticker: TMS

- Token type: ERC-20

- Contract: Updating

- Blockchain: Ethereum

- Total supply: 800.000.000 TMS

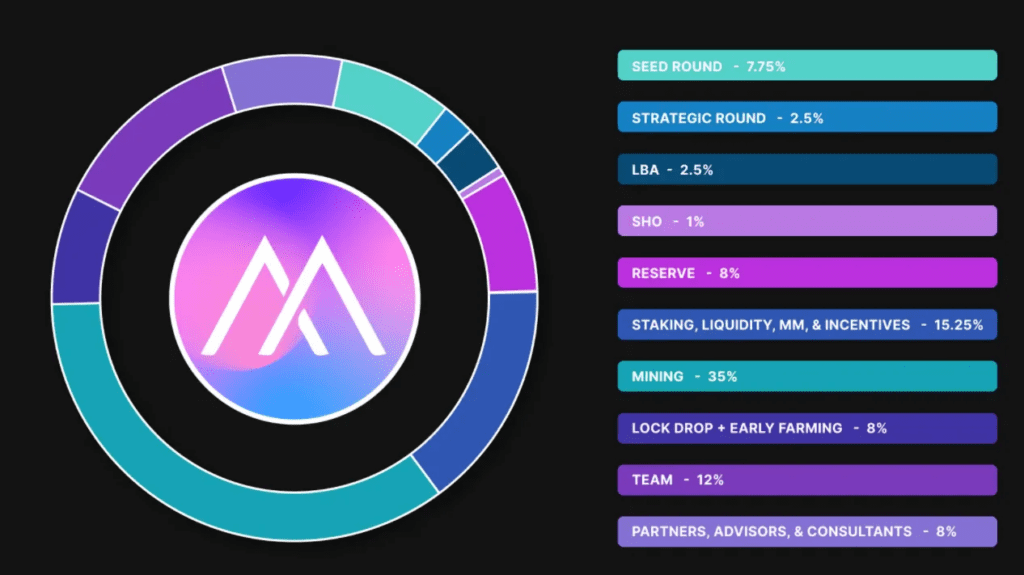

Token Allocation

- Seed round: 7.75%.

- Strategic round: 2.5%

- LBA: 2.5%.

- SHO: 1%.

- Reserve: 8%.

- Staking, liquidity, MM, Incentives: 15.25%.

- Mining: 35%.

- Lock drop + early farming: 8%.

- Team: 12%.

- Partners, advisors: 8%.

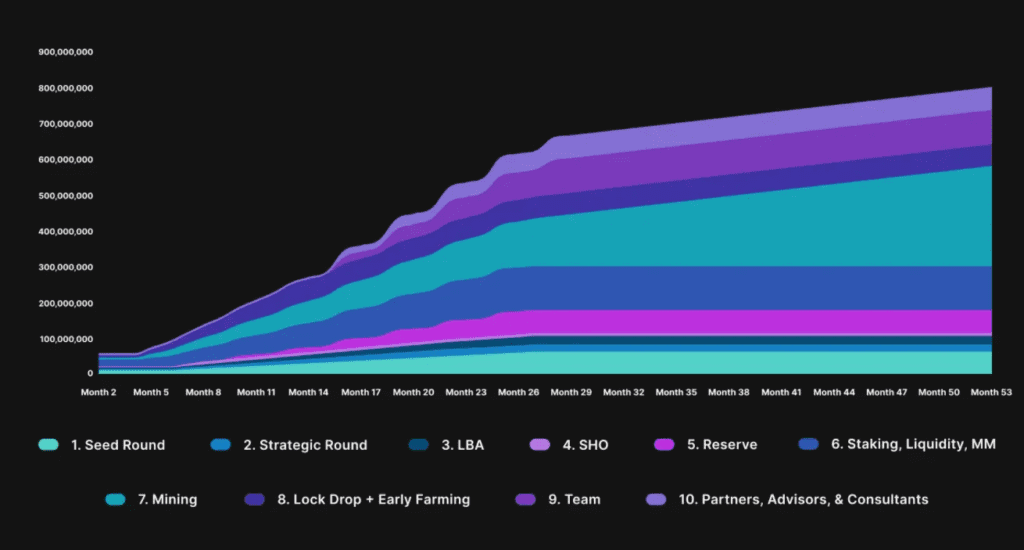

Token Release Schedule

Use Cases

Incentive

- The first Vault user receives a Lockdrop benefit.

- Mining incentives are received by LendingPool depositors.

- Borrowers receive mining incentives.

- Mining rewards will be used to fund gas fee liquidators.

- Promote the flow of money.

- Shareholder incentives to participate in governance.

Governance

- To vote on recommendations for renewal/upgrade/pause/restart.

- Increase your stake for additional voting/weighting.

- In lieu of risk, it is used to cover certain losses.

Treasury

- Decide how treasury money will be used.

- Contribute.

- Burn.

DApp authorization

- Set up Whitelisting & staking for fast lending.

- To acquire access to flash lending, create a whitelist for the /DAO protocol.

Roadmap

Themis Pro – 2022

- Themis Beta

- NFT Innovation Workshop

- Diversify crypto lending

- Convert LP to DEX

- Optimized Oracle

- Optimized Receiving Pool

- Eco-Partner to Pools API

- NFT Market-Making Mechanism

Themis Libra – 2023

- Themis Beta

- Themis Pro

- Cryptocurrency vault

- Cryptocurrency Derivatives

- Data Service

- Digital Copyright Protection

Investors and partners

Themis Protocol has secured over $2 million in funding from key investors, including Chain Finance, Nft, DAO Maker, and LD Capital, as well as a number of additional funds.

Conclusion of Themis Protocol Review

Themis Protocol is an unique approach to helping consumers increase the efficiency of capital utilization while also improving the constraints of earlier lending solutions. In comparison to existing pooled P2P lending protocols, the protocol has ERC-721/ERC1155 asset compatibility, enabling users to construct pools of cash to lend based on NFTs of value for lending. Hopefully the Themis Protocol Review article has helped you understand more about the project.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News