GBTC Volume Skyrockets 79% in June as Traditional Finance Seeks Crypto Exposure

Key Points:

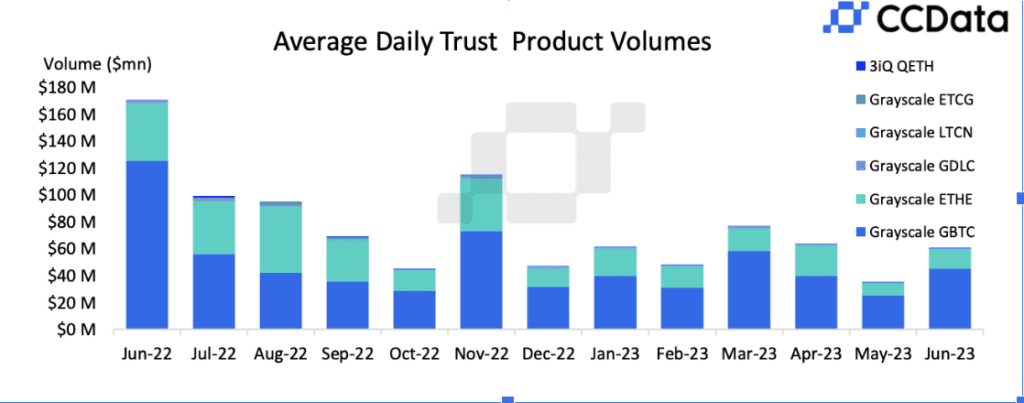

- Grayscale’s Bitcoin Trust (GBTC) trading volume increased by almost 80% in June, reaching $45 million, maintaining its position as the most traded trust product in the industry, accounting for 74% of the volumes. (Data from CCData).

- This surge in GBTC’s volumes coincides with the growing positive sentiment towards bitcoin and comes as multiple high-profile institutions, including BlackRock, Invesco, and WisdomTree, filed for bitcoin exchange-traded-funds (ETFs) in June.

- Compared to Grayscale’s ETHE trust, GBTC significantly outperformed in trading volume, capturing 74% of the total trading volume for trust products, while ETHE’s volumes declined.

Grayscale’s Bitcoin Trust product, GBTC, saw a significant increase of almost 80% in its trading volume.

This increase came as BlackRock, one of the largest financial services firms, applied to the U.S. Securities and Exchange Commission (SEC) for a spot bitcoin exchange-traded-fund (ETF), along with two other high-profile institutions, Invesco and WisdomTree, also filing for ETFs. The volume of GBTC increased to $45 million in June 2023, maintaining its position as the industry’s most traded trust product, accounting for 74% of the volumes, according to CCData.

This surge in GBTC’s volumes and market share aligns with the growing positive sentiment towards the underlying asset. CCData reported that the surge in BTC’s volumes and market share aligns with the growing positive sentiment towards the underlying asset. However, it’s worth noting that compared with Grayscale’s ETHE trust, GBTC’s volume significantly outperformed in trading volume. Since September, BTC’s trading volume rose from $35.6 million to $45 million in June 2023, capturing 74% of the total trading volume for trust products, compared to 50.9% in September. In contrast, ETHE’s volumes declined from $31 million in September to $14.4 million in June 2023, and from 44.4% to 23.6% market share.

GBTC also witnessed its share price surge to a one-year high after a report about investment asset manager Fidelity Investments preparing to follow BlackRock’s application for a spot bitcoin ETF with its own. This surge in GBTC’s share price may indicate a growing interest in bitcoin investment products in the market. It will be interesting to see how this trend develops over the next few months.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News