Regulatory Pressures Plague Coinbase, Causing Uncertainty And Revenue Challenges

Key Points:

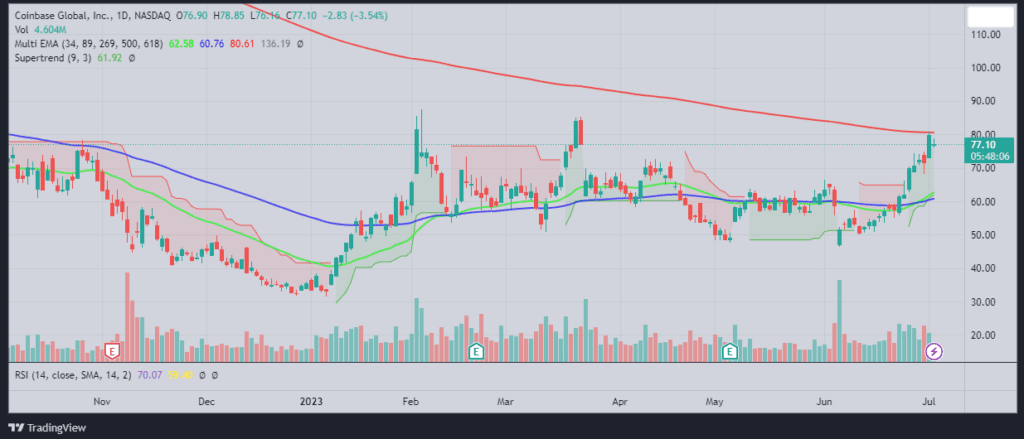

- Coinbase shares have fallen 69% since its initiation, and regulatory pressures from the SEC have led to a lack of clarity around cryptocurrency regulation in the US.

- Top expert has warned that the stock’s rally in June could be short-lived due to the lack of regulatory clarity around cryptocurrency, making it difficult for the exchange to meet its revenue projections.

Coinbase’s stock fell 69% since initiation, 11 analysts recommend buying while 13 rate a hold. Regulatory pressures and lack of clarity pose revenue challenges.

Coinbase has been facing regulatory pressures that have resulted in its shares dropping. The Securities and Exchange Commission has accused the company of illegally operating an unregistered securities exchange, and this has created a lot of uncertainty around the company’s future.

According to Bloomberg, Piper Sandler analyst Patrick Moley has downgraded his recommendation on the company to neutral from overweight. He believes that it is too difficult to forecast how much revenue the company could earn given the impending courtroom tussle with the SEC and the continued lack of clarity around cryptocurrency regulation in the US.

Berenberg, a German investment bank, has also warned that the stock’s rally in June could be short-lived. Investors followed BlackRock Inc.’s application for a spot-Bitcoin exchange-traded fund, naming Coinbase as a custodian. The lack of regulatory clarity around cryptocurrency could make it difficult for Coinbase to meet its revenue projections. Moley expects second-quarter trading volumes and monthly transacting user totals to be the lowest in over two years.

Despite the regulatory pressures, Coinbase’s shares have soared 55% since June 6, when the SEC accused the company of illegally operating an unregistered securities exchange. Piper Sandler has held an overweight rating on the exchange since May 2021, a month after the company went public. Moley sees Coinbase as positioned to be a “major player” in the crypto space once regulatory clarity is achieved, but he would “like to see more progress on the regulatory front and a convincing turnaround in the underlying fundamentals” before turning more positive.

Coinbase’s stock had fallen 69% since the initiation as of the close on Monday. Bloomberg reported that 11 recommend buying Coinbase stock while 13 rate it a hold and eight say sell. The lack of regulatory clarity around cryptocurrency could make it difficult for Coinbase to meet its revenue projections.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News