Former CFTC Chair Proposes Self-Regulatory Organization For Balanced Crypto Regulation

Key Points:

- Former CFTC Chair Timothy Massad proposes the establishment of a self-regulatory organization (SRO) for balanced crypto regulation.

- Massad emphasizes the need for investor protection measures to prevent potential calamities in the crypto industry.

- The SRO would operate under the supervision of both the SEC and CFTC, creating standardized investor protection standards for crypto intermediaries and digital assets.

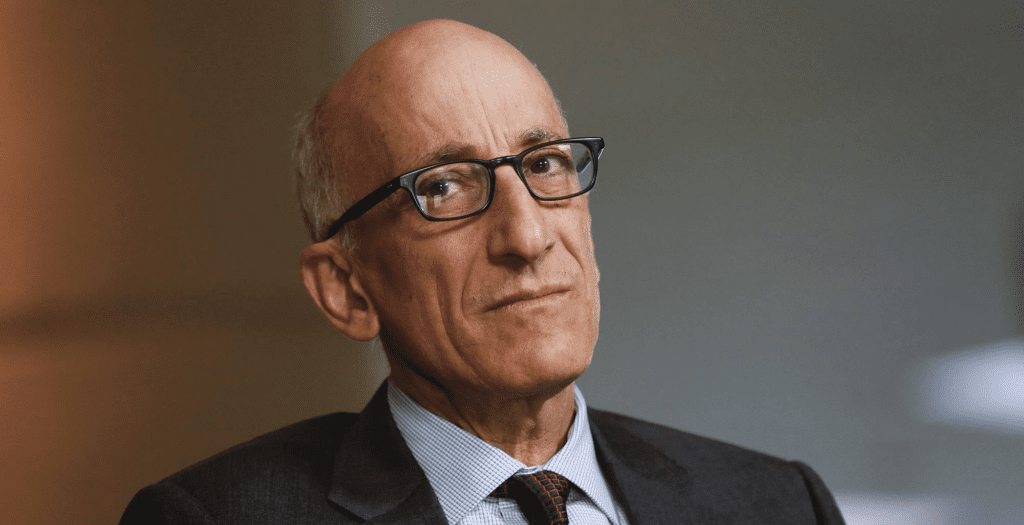

In a recent interview with Fortune, former Commodity Futures Trading Commission (CFTC) Chair Timothy Massad presented his perspective on crypto regulation, advocating for a balanced approach that addresses investor protection concerns.

Massad, who chaired the CFTC from 2014 to 2017, emphasized the need for responsible regulation in the crypto industry to prevent potential calamities.

Unlike some proponents of crypto legislation, Massad does not believe that regulation is solely necessary to keep technology within the United States. Instead, he highlights the importance of implementing proper investor protection measures to mitigate risks and enhance transparency in the sector.

While acknowledging the role of enforcement cases in upholding the law, Massad argued that existing regulations are insufficient. He stressed that many stakeholders struggle to comprehend the nuances surrounding securities and commodities laws. Massad was the first to classify Bitcoin as a commodity and emphasized that financial instruments subject to futures or swap contracts can be classified as commodities, securities, or both.

To circumvent the ongoing debate on whether specific crypto tokens are securities or commodities, Massad proposed the establishment of a self-regulatory organization (SRO). This SRO would operate under the supervision of both the Securities and Exchange Commission (SEC) and the CFTC, creating a standardized framework of investor protection standards for crypto intermediaries and the digital assets traded on their platforms.

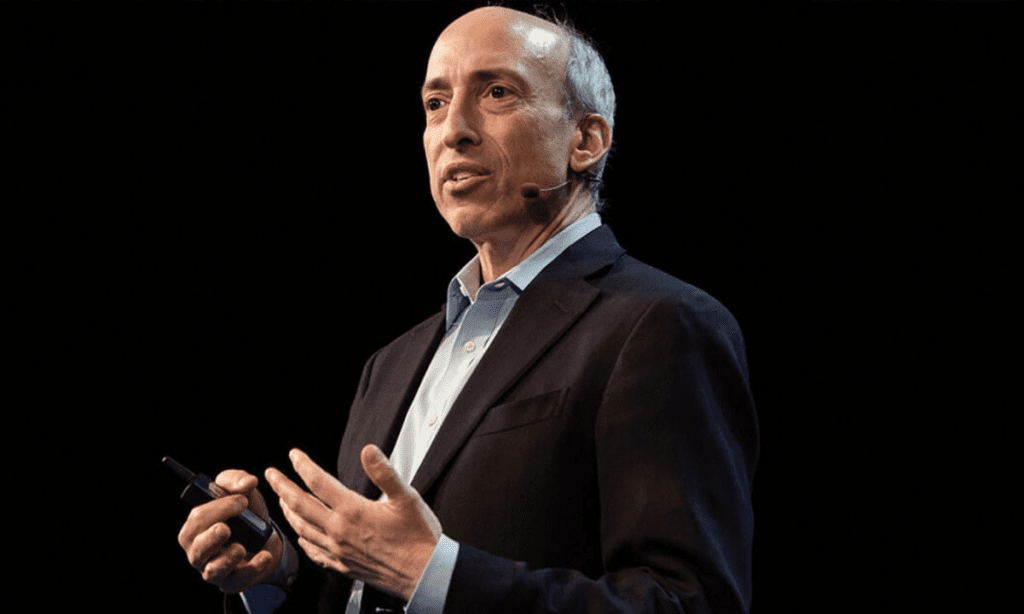

While gaining the support of SEC Chair Gary Gensler may pose a challenge, Massad remains optimistic that collaboration between the SEC and CFTC is possible. He drew parallels to the past cooperation between the agencies when implementing swaps regulation after the passage of the Dodd-Frank Act. Massad also dismissed concerns about other jurisdictions surpassing the United States in crypto regulation, asserting that the implementation of new laws, such as the European Union’s Markets in Crypto-Assets (MiCA) regime, would face similar complexities.

As the crypto industry continues to evolve, Massad’s proposal for a self-regulatory organization aims to strike a balance between safeguarding investors and fostering innovation. The conversation surrounding responsible digital asset regulation remains ongoing, with stakeholders seeking clarity and effective frameworks to navigate the rapidly expanding crypto landscape.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News