Key Points:

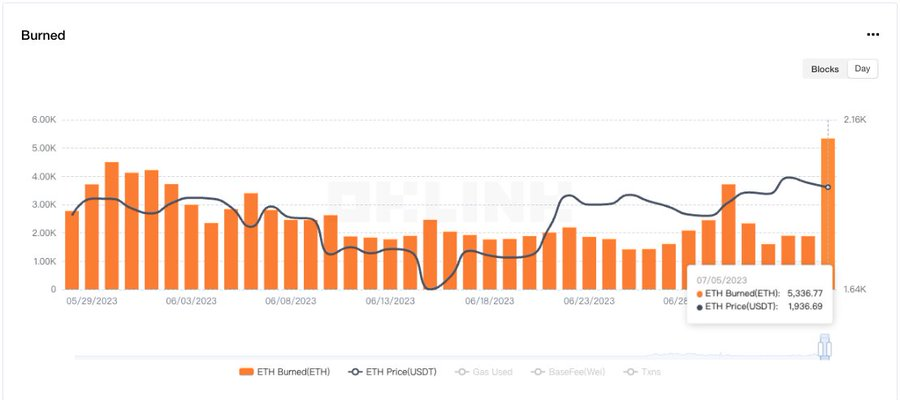

- 5336.77 ETH, equivalent to over $10 million was burned in yesterday’s transactions.

- As of now, the total amount of ETH burned has exceeded 3.4 million, worth more than $6.5 billion.

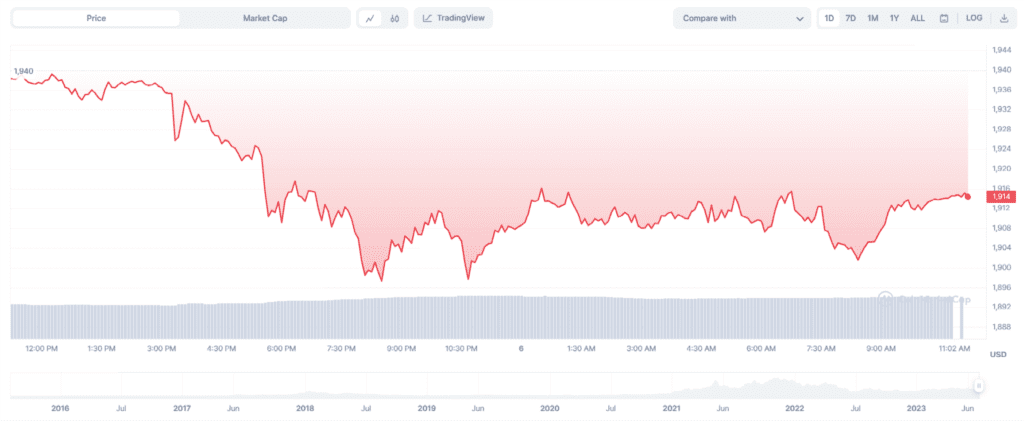

- However, the ETH price has yet to break through.

Yesterday ETH burned, reaching 5336.77 worth over $10 million, based on the current value of Ethereum at the time of publication ($1,936.69), was burned from Ethereum transactions. This is a record high in a month.

The annual net issuance rate for Ether yesterday was -3,352.67 ETH. The Ethereum network set a new milestone with 3.4 million ETH worth about $6.5 billion burned after nearly two years of implementing the EIP-1559 coin-burning mechanism.

Burning is when a coin or token is sent to an unusable wallet to remove it from circulation. On August 5, 2021, the Ethereum blockchain implemented a significant upgrade known as EIP-1159. This Ethereum improvement proposal has dramatically changed the fee model. Each transaction now includes a variable base fee adjusted to the current demand for block space. This base fee is either burned or permanently removed from circulation, reducing the Ether supply forever. Thereby increasing the token price.

Ethereum is issuing new Ether at a rate of 4% per year, although the rate is expected to drop to around 0.5 -1% as part of the Ethereum 2.0 upgrade. When this happens, many speculate that the burning rate of Ether will be greater than the rate of token issuance, making ETH a deflationary currency.

In May 2023, Ethereum saw a spike in burn rates due to the memecoin craze triggered by the introduction of PEPE. At its peak, about 14,600 ETH was burned on May 5, destroying millions of dollars worth of coins. But since then, the burn rate has dropped dramatically.

However, from May 5 to July 4, the amount of ETH burned daily decreased by more than 64%, from 14,967 to 5336.77. This could be a reason why ETH’s plan to tighten the supply has not been effective. ETH price has fluctuated between $1,930 and $1,960 after another unsuccessful attempt to break out of the $2,000 range this week.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.