Pendle Opens Up New Growth Potential With TVL Up Nearly $150M

Key Points:

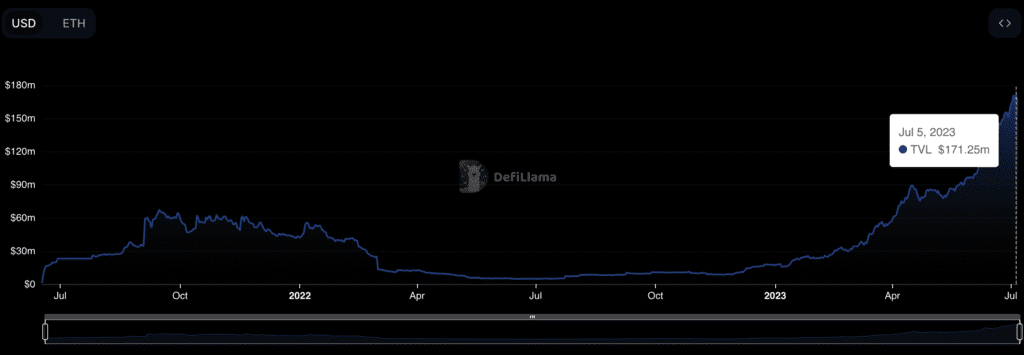

- Pendle has reached an all-time high of $171.25 million in TVL, driven by its unique approach to yield farming.

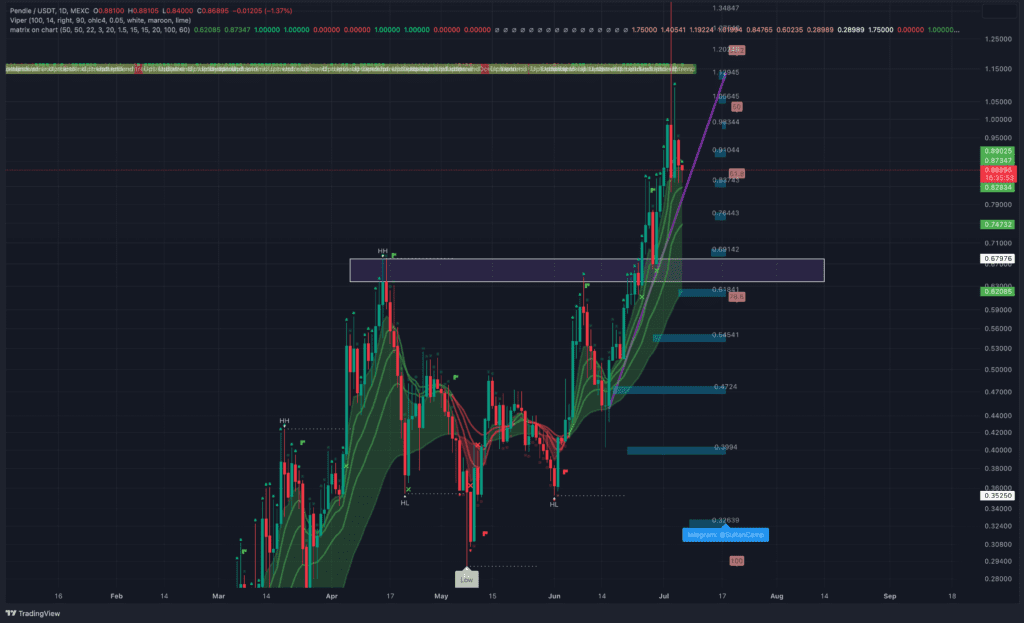

- The project’s native token has surged by approximately 4,000% this year, from $0.044 to $1.75, attracting significant attention from investors.

- The protocol’s success can be attributed to factors such as the Ethereum Shanghai upgrade, which enabled the withdrawal of staked ETH.

On July 5, total value locked (TVL) in Pendle, a DeFi protocol that divides yield-bearing tokens into principle and yield components, reached an all-time high of $171.25 million.

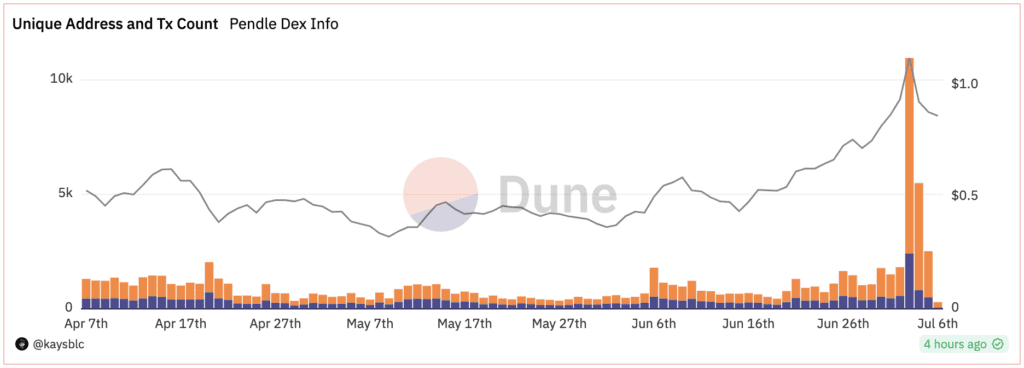

This year’s growth of PENDLE has been spectacular. The token has risen from $0.044 at the start of the year to $1.75. The project’s token, which collects protocol fees while locked, is up roughly 4,000% this year, trading at levels last seen at the bull market’s peak two years ago. A spike of this size cannot be explained only by a recent listing. A close look into the on-chain data uncovers some intriguing insights into the factors behind the protocol’s extraordinary success.

Moreover, whales’ accumulation of PENDLE might be seen as a significant vote of confidence in the protocol’s long-term potential. Pendle’s novel approach to yield farming, which allows users to tokenize and exchange future produce, has grabbed the curiosity of forward-thinking investors.

Inflows increased when Ethereum’s Shanghai upgrade went online in April, allowing for the first-time withdrawals of staked ETH. According to DeFiLlama data, approximately $40 million in stETH has been tokenized on the network since then.

Pendle, in addition to yield-splitting, has an automated market maker (AMM) where traders may buy and sell either the primary token or its related yield independently. On July 3, the AMM observed a significant increase in activity, with over 8,500 transactions.

Currently, the price of PENDLE is trading at $0.87, it broke the previous $0.66 resistance area and once reached the $1.75 mark. The current price is also close to the Fib %61.8 level. We need to wait for more signals to consider this price area.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.