Genesis Global’ $2 Billion Dispute With FTX Could Delay Creditor Payment Plan

Key Points:

- Bankruptcy crypto lender Genesis Global is in a $2 billion dispute with FTX Trading.

- A protracted dispute will likely delay a court review of a payment plan for Genesis’ creditors.

- FTX initially said Genesis owed them $3.9 billion, but in a letter to Lane this week, that amount was reduced to about $2 billion.

According to Bloomberg News, Manhattan District Bankruptcy Judge Sean Lane said at the bankruptcy hearing of crypto lender Genesis Global that the dispute is worth $2 billion with FTX Trading.

Responding to Genesis’ request to approve a creditor payment plan next month, Lane said the timeline “seems very optimistic” and “I understand that those deadlines could be pushed back”. This means that if the dispute drags on, it will affect Genesis’ repayment plans for creditors.

FTX claimed that Genesis owed them about $2 billion, and at the hearing, Genesis and FTX filed lawsuits to settle the claim. However, the Digital Currency Group subsidiary wants Judge Lane to hold a hearing to decide if the alleged debt is lawful and, if so, how much.

FTX wants Judge Lane to sue Genesis in Wilmington, Delaware, whose bankruptcy is being overseen by another federal judge. Judge Lane denied both requests and ordered the parties to exchange information about the dispute.

Ultimately, Judge Lane could schedule a “review” hearing to rule on FTX’s claim, as Genesis requested. He did not make a final judgment on whether FTX could sue.

FTX initially said Genesis owed them $3.9 billion, but in a letter to Judge Lane this week, that number has dropped to about $2 billion. However, Genesis denied that it owed FTX anything – they asked Lane to estimate FTX’s claim to be zero.

Since filing for bankruptcy last year, FTX has been trying to recover assets to pay off the millions of potential creditors it owes money to.

Genesis Global, a group of its largest creditors, and DCG are working with a court-appointed mediator to devise a revised payment proposal. Any settlement would form the basis of a Chapter 11 bankruptcy plan to pay out hundreds of thousands of Genesis creditors.

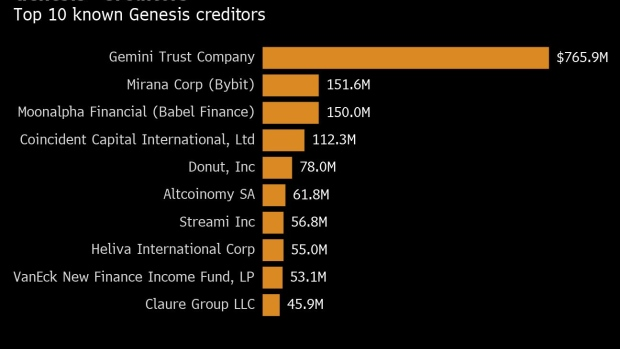

Its parent company DCG is also in trouble. Earlier this week, Cameron Winklevoss, co-founder of Gemini, accused the company of fraud and fostering a culture of lies and deceit in a scathing open letter to Barry Silbert, CEO of DCG. The letter, written on behalf of 232,000 Earn users with more than $1.2 billion in assets trapped in Genesis, a DCG-owned company, highlights these users’ dire situation.

Winklevoss raised concerns about abuses of the mediation process, which allowed DCG to indefinitely defer repayment of a $630 million debt owed to Genesis. The letter ends with an appeal to Silbert to do the right thing and to admit disappointment in his behavior.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.