Multichain Announces To Stop All Services, No Confirmed Resume Time

Key Points:

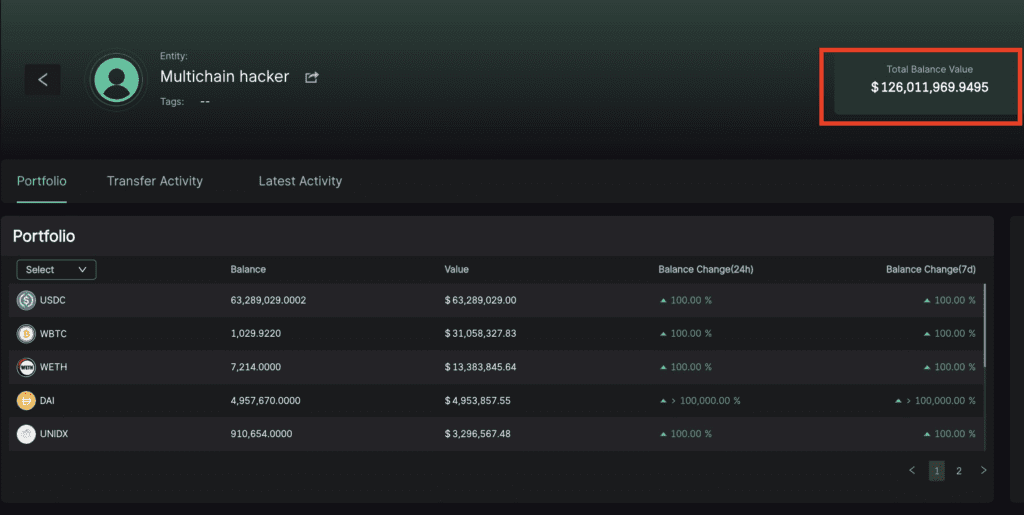

- Multichain protocol exploited, leading to over $126 million in losses.

- The team announced the discontinuation of all on-chain services with no confirmed resume time.

- Technical issues and network problems add to its challenges.

In a devastating turn of events, the cross-chain router protocol Multichain has fallen victim to an exploit, resulting in losses exceeding $126 million.

The exploitation was carried out through the withdrawal of more than $102 million worth of cryptocurrencies from Multichain’s Fantom bridge contract on the Ethereum network. Notably, this includes $31 million in Wrapped Bitcoin (WBTC), $13.6 million in Wrapped Ether (WETH), and $58 million in USDC. At the time of writing, the exploiter’s wallet address holds over $126 million.

The alarming incident unfolded with the first suspicious transaction occurring at 4:21 pm UTC when a mere $2 in USDC was withdrawn from the Multichain Fantom bridge. Within hours, the hacker proceeded to drain a staggering $31 million in WBTC, followed by the depletion of assets from the Multichain Moonriver bridge and the Multichain Dogechain bridge.

While the exact nature of the exploit remains unclear, some users suspect a possible rugpull event. The project has acknowledged that assets on the MPC bridge were moved to an unknown address but expressed uncertainty about the circumstances surrounding the incident.

As Coincu previously reported, the project advises users not to continue using the service in conjunction with revoking approvals. However, according to the latest announcement, Multichain has discontinued all on-chain services and has no confirmed continued uptime.

Multichain has been grappling with undisclosed technical issues in recent weeks. Earlier, on May 31, the team disclosed that their CEO had gone missing, and they were facing multiple issues due to unforeseeable circumstances, leading to transaction delays. The network’s struggle to process transactions in a timely manner prompted Binance to temporarily halt withdrawals of certain Multichain derivative tokens on July 5.

This exploit serves as a stark reminder of the risks associated with decentralized finance (DeFi) protocols and the need for heightened security measures. Users are advised to cease using the service and revoke approvals, while the protocol has taken the unprecedented step of discontinuing all on-chain services, leaving its future uncertain. The incident is likely to fuel further discussions on the importance of robust security measures in the ever-evolving DeFi landscape.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.