Presidential Candidate Robert F. Kennedy Jr. Owns Up To $250K In Bitcoin: Report

Key Points:

- Robert F. Kennedy Jr. has substantial BTC holdings, despite claiming not to be an investor at a Bitcoin conference in May.

- Kennedy’s support for Bitcoin and his financial interest in the digital asset industry has raised questions about his objectivity in policymaking.

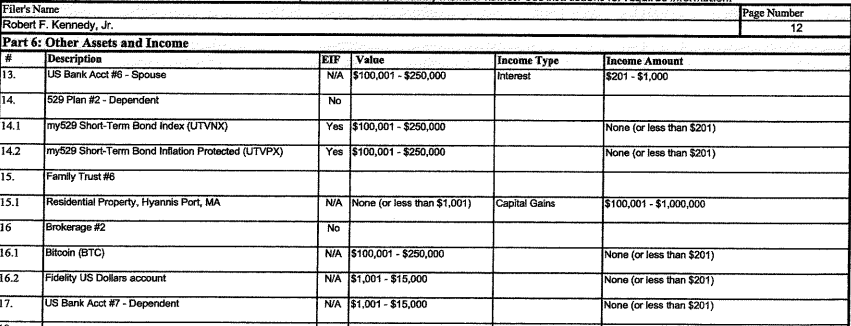

Presidential candidate Robert F. Kennedy Jr. holds between $100,001 and $250,000 in Bitcoin, raising concerns about potential conflict of interest for the candidate.

Presidential candidate Robert F. Kennedy Jr.’s recent BTC holdings have raised concerns about a potential conflict of interest for the candidate. Despite his statements at a Bitcoin conference in May that he was “not an investor,” CNBC uncovered financial records showing that Kennedy holds between $100,001 and $250,000 in BTC.

The revelation comes at a time when the digital asset industry is at the forefront of the political sector and has become a key talking point as the 2024 presidential election approaches.

Kennedy’s support for the king of crypto has been notable throughout his campaign, and he has gone as far as accepting the digital asset for campaign donations. However, the news of his substantial BTC holdings has led to questions about his objectivity in policymaking, particularly related to the regulation of the cryptocurrency industry. Kennedy has expressed concerns about government-issued digital assets, but his personal financial interest in Bitcoin could be seen as a potential conflict of interest.

It is unclear when Kennedy acquired the Bitcoin holdings, and the filing does not specify whether the investment was made by Kennedy himself or a member of his family. The lack of transparency has only added to the concerns raised by this news, highlighting the importance of transparency in political campaigns and policymaking. As the digital asset industry continues to gain mainstream attention and influence, it is crucial that policymakers approach it with an informed and objective perspective.

The news also emphasizes the need for a clear and concise regulatory framework for the cryptocurrency industry, ensuring that candidates and policymakers alike can operate with clarity and transparency. As the industry becomes more prevalent in the political sphere, policymakers must take a proactive approach to regulation, working to create a fair and level playing field for all participants.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.