Market Overview (July 3rd to July 9th): Could BTC Value Up To $100K This Year? Wall Street Is Coming!

Key points:

- BlackRock has amended and re-submitted its application for a Bitcoin spot ETF, with Coinbase as its partner exchange.

- Binance did experience some turnover last week.

- Last week, the cryptocurrency market was relatively stable, with few fluctuations. The BTC value did not get an impact from FUD!

- The DXY index is 102 and has experienced a definite downward trend. It is possible to see DXY fall to the 100 support level, which may contribute to an increase in the price of BTC.

The value of BTC might be on the rise due to Wall Street venture capitalists’ increasing interest in the cryptocurrency market. BlackRock, Fidelity, and Vanguard have also applied for BTC Spot ETF, indicating a growing desire to invest in digital assets. This trend suggests that traditional financial institutions are becoming more mainstream and accepting of BTC and other cryptocurrencies. As more institutions and investors enter the market, the BTC value will likely continue to rise.

Binance continued to get FUD, but the BTC value remained the same!

Last week, Binance, a cryptocurrency exchange, made headlines for several reasons. Binance’s office in Australia was searched as part of an investigation into its derivatives trading activities. Despite this setback, Binance Labs led a $4 million seed round investment in Web3Go, a blockchain company.

CZ, the CEO of Binance, remains optimistic about the future of the exchange. He predicts that trading volume on Binance will soar, an uptrend may occur within the next 6-12 months, and the BTC value can increase. To improve security, Binance will stop using deposit addresses on 38 networks and remind users to update their wallets when receiving a notification email.

However, Binance did experience some turnover last week. Three senior executives resigned, but CZ believes this is normal. Steven Christie, the high-level regulatory compliance manager who was among those who left, cited personal reasons for his departure and said he wants to rest after six years of dedication and work in the crypto market.

Pressure from Wall Street for BTC ETF Spot, many experts predict the BTC value could be up to $100K at the end of the year!

BlackRock has amended and re-submitted its application for a Bitcoin spot ETF, with Coinbase as its partner exchange. This move is similar to many Wall Street investment firms that have chosen Coinbase as their partner exchange to provide extensive trading data for Nasdaq’s management software. However, BlackRock has signed an official contract with Coinbase.

Larry Fink, BlackRock CEO, views the BTC value as “digital gold,” an alternative asset for other investment channels, and wants to work with the SEC to approve the spot ETF. Valkyrie has also resubmitted its application for a Bitcoin Spot ETF to the SEC, with Coinbase as its partner exchange. Additionally, the stock of the world’s largest Bitcoin ATM company, Bitcoin Depot, is officially listed on Nasdaq.

Macroeconomic – Political – Legal Factors could also impact the BTC value!

The Federal Reserve (FED) is expected to release the meeting minutes from June, with no changes anticipated. The FED’s stance on raising interest rates and combating inflation remains firm.

Hong Kong has proposed issuing a stablecoin to compete with USDT and USDC, possibly indicating that digital currencies are becoming more mainstream and accepted.

The UK Senate is promoting a bill allowing the government to seize illegal cryptocurrencies, reflecting growing concerns about using cryptocurrencies for illicit activities.

The city of Tena in China now accepts Central Bank Digital Currency (CBDC) payments for bus journeys, showing a practical use case for CBDCs. So many people could use crypto daily, which will increase the BTC value in the future!

Belarus, Singapore, and Thailand are tightening regulations on the cryptocurrency industry, likely in response to concerns about money laundering and other illegal activities.

Namibia has passed a crypto bill, joining the growing number of countries recognizing the importance of cryptocurrencies worldwide. This also increases the BTC value!

The International Monetary Fund (IMF) has suggested that governments consider taxing cryptocurrencies, indicating a potential shift towards increased industry regulation.

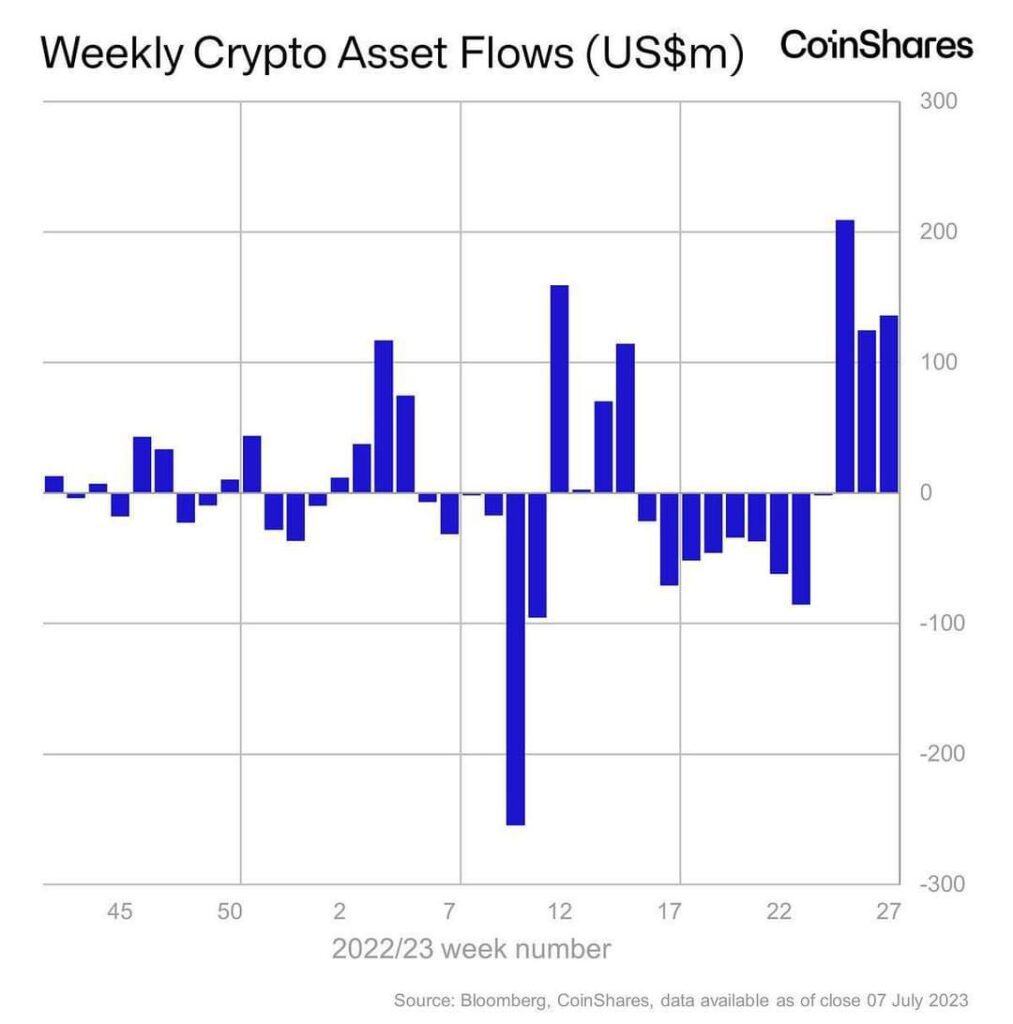

Market review of last week

Last week, the cryptocurrency market was relatively stable, with few fluctuations. The BTC value remained steady, from $30K to $31.5K. Although the price dropped to $29.5K at times, it quickly recovered to the $30.5K level. Currently, the price of BTC is almost the same as last week’s price at $30.5K.

New coins such as HOOK, SUI, ID, and EDU did not show much fluctuation, with weakening momentum. Even SUI, ID, and HOOK prices are lower than at the beginning of the week. Additionally, POW coins such as BCH, LTC, and ETC all saw a price decline last week, despite impressive increases in stocks of BTC mining companies like Core Scientific Inc, Bitfarms Ltd, and CleanSpark Inc.

Old and new Layer 1 coins like NEAR, DOT, CELO, ROSE, APT, and Layer 2 coins such as ARB and OP did not have any outstanding features last week, with prices following the general sideways trend. The NFT market decreased significantly due to the turmoil from Azuki NFT.

This week’s highlights big news – The BTC value could change by the CPI news!

Monday:

- Barr, Vice Chairman of the Fed, speaks.

- Daly, Chairman of the San Francisco Fed, speaks.

- Mester, Chairman of the Cleveland Fed, speaks.

Wednesday:

- Release of CPI inflation index.

- CPI is estimated at 3.1%, down from last month’s 4.0%.

- Core CPI is estimated at 5%, down from the previous month’s 5.3%.

Thursday:

- Release of PPI inflation index.

- The US Treasury will sell an additional $301 billion in bonds.

This week’s prediction – the BTC value can be up to $32K!

The DXY index is 102 and has experienced a definite downward trend. It is possible to see DXY fall to the 100 support level, which may contribute to an increase in the price of BTC and the BTC value in the short term.

The job market remains resilient: recruitment has slowed, salaries have increased, and unemployment rates remain low. Furthermore, there are expectations that interest rates may grow 1 to 2 more times, which the market has prepared for. Along with the PPI and CPI indices, as expected, we may witness slight growth in the market as well as the price of BTC this week!

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.

Join us to keep track of news: https://linktr.ee/coincu

Kevin

Coincu News