Former SEC Chair Now Changes His View, Backing The Bitcoin ETF Approval

Key Points:

- Former SEC Chairman Jay Clayton observed a shift in market views on Bitcoin, from an offshore retail market with concerns to credible organizations entering the industry.

- Clayton noted the growth of companies willing to associate their reputation with Bitcoin trading and custody services.

- Conventional financial firms have filed applications for Spot Bitcoin ETFs, awaiting approval from the SEC.

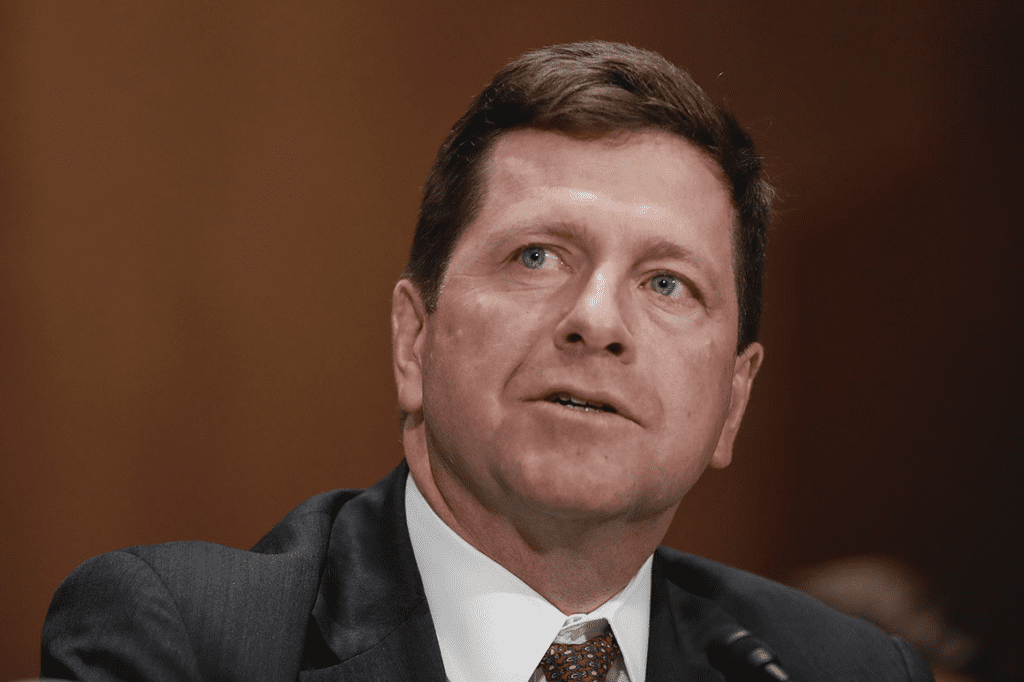

Former SEC Chairman Jay Clayton recently spoke with CNBC on the shifting legal landscape for Bitcoin ETFs, stressing the major shifts in market views about Bitcoin during his tenure.

Clayton, who served as SEC chairman from 2017 to 2020, raised worries about Bitcoin and detailed his developing views on cryptocurrency.

“This is an offshore, retail, nothing close to what I would say are the core of our financial markets,” Clayton said of Bitcoin’s early days.

When questioned about Bitcoin and its rising popularity, Clayton noticed a major change in market view during his term as SEC chair. Before, he saw the Bitcoin market as mostly offshore retail, with the possibility for manipulation and wash trading.

Clayton did, however, recognize the tremendous growth of credible organizations joining the sector, eager to put their name behind Bitcoin trading and custody services.

Clayton emphasized the evolution of the Bitcoin industry, noting that corporations now think the trading and custody safeguards are enough to sell goods with their reputations on the line. This shift in view startled Clayton, who had previously expressed reservations about trading in the Bitcoin market owing to worries about activities such as wash trading and market manipulation during his tenure as SEC chair.

“At that time if you look at trading of Bitcoin, the emergence of Bitcoin, it looked like stocks, but it was nothing like it. Now we’ve seen development all the way to the point where companies whose reputation in the market matters are saying, ‘you know what, we think that trading, that the custody, those protections around this market are sufficient that we’re willing to put our name on it and offer that product.‘”

A slew of conventional financial companies have filed Spot Bitcoin ETF applications in recent weeks. Asset management behemoths like BlackRock and Fidelity are among those that have filed proposals in the previous month. The sector is now waiting for the SEC’s judgment on what would be their first approval of the kind.

Thus far this year, the growth of Spot Bitcoin ETF proposals has been a pretty startling trend. Nevertheless, the interest from these businesses is now contingent on the US Securities and Exchange Commission (SEC) approving its formation.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.