Rodeo Finance Hit By $1.5 Million DeFi Attack: Latest In Series Of Exploits

Key Points:

- Rodeo Finance was recently hit by a TWAP oracle manipulation attack, resulting in the loss of around $1.5 million worth of ether.

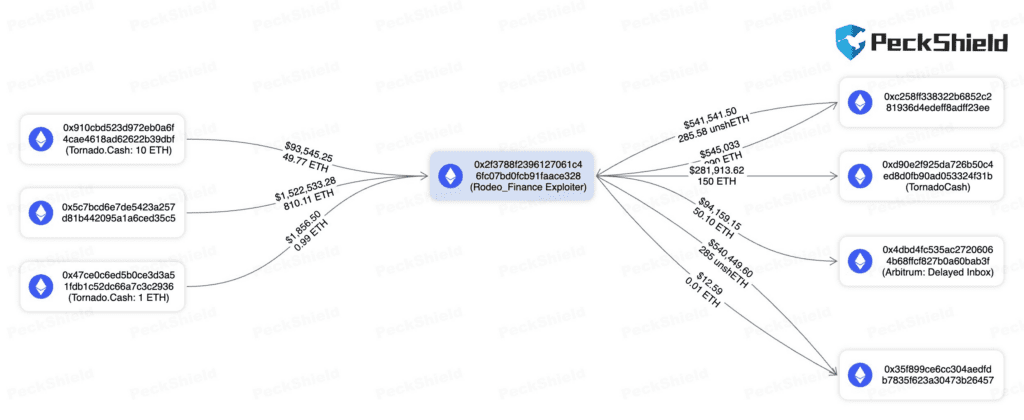

- The attacker transferred the stolen funds from the Arbitrum network to Ethereum and exchanged the tokens for other assets.

- The Rodeo Finance team has not yet issued a response or statement regarding the attack, which is part of a trend plaguing the Arbitrum ecosystem over the past few months.

Rodeo Finance lost $1.5M to a TWAP oracle manipulation attack. The attacker transferred stolen funds to Ethereum, exchanged tokens & used Tornado Cash to obfuscate trail—part of a trend in Arbitrum ecosystem.

Rodeo Finance, a decentralized finance (DeFi) protocol, was recently hit by a TWAP oracle manipulation attack, resulting in the loss of around $1.5 million worth of ether. The attacker was able to transfer the stolen funds from the Arbitrum network to Ethereum and exchanged the tokens for other assets.

The ether was then routed through Tornado Cash, a popular transaction mixer, which effectively obscured the trail of funds. Igor Igamberdiev, the head of research at Wintermute, described the attack as a form of DeFi manipulation that artificially skews the calculated average price of an asset, giving the attacker an undue advantage during a transaction.

This manipulation can lead to various forms of attacks, including flash loan exploits. Such complex maneuvers have become tools for hackers who manipulate oracle price data feeds to execute exploits. The Rodeo exploit is not an isolated occurrence but part of a trend that has been plaguing the Arbitrum ecosystem over the past few months.

Blockchain security firm PeckShield detected the incident and conducted further analysis of on-chain data. The Rodeo Finance team has not yet issued a response or statement regarding the attack.

These types of attacks highlight the importance of implementing robust security measures in DeFi protocols. Users should also exercise caution and thoroughly research protocols before investing in them. As the popularity of DeFi continues to grow, it is crucial to stay informed and remain vigilant against potential threats.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.