Key Points:

- The price of MATIC, Polygon’s native token, has been performing well compared to the market due to factors like network growth and limited profit-taking.

- Polygon has seen an increase in new MATIC addresses, indicating growing interest and adoption of the network.

- Despite regulatory pressures, Polygon’s ecosystem remains resilient with various collaborations and achievements, positioning it as a leader in Ethereum’s layer-2 ecosystem.

By market capitalization Polygon, the price of MATIC, the native token of Ethereum’s greatest layer-2 scaling technology, is beating the rest of the market.

Rebounding network growth, falling supply on exchanges, and limited profit-taking are driving the small bull run in the top 12 cryptocurrency values. Another apparent pattern supporting growth is the increase in new MATIC addresses every day over the previous 30 days.

Notwithstanding the crypto winter and the dissemination of fear, uncertainty, and doubt (FUD) news, the Polygon Labs team, led by CEO Marc Boiron, continues to push the network forward. The impending release of Polygon 2.0 by the end of July is a huge milestone.

Polygon’s ecosystem is durable, even in the face of the current Securities and Exchange Commission onslaught, because of different network linkages (SEC).

Polygon has been one of the busiest top cryptocurrencies in terms of collaborations with mainstream firms in recent years. The layer 2 scaling platform has partnered with telecommunications behemoth Deutsche Telekom, which will be one of the 100 validators on the Polygon Proof-of-Stake (PoS) network.

The Polygon market is demonstrating its crypto expertise by exerting its supremacy in Ethereum’s layer two (L2) ecosystem. The Polygon network continues to make significant achievements, with a total value locked (TVL) of over $977 million and a stablecoins market worth $1,432 billion.

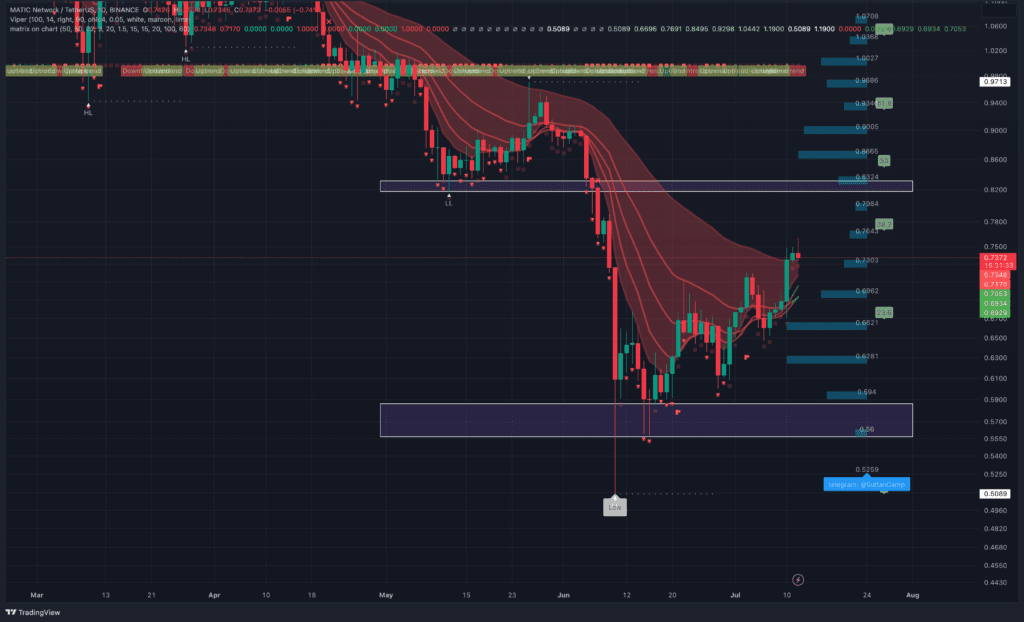

On July 12, MATIC’s price increased 3.8% to $0.759, its highest level this month, outpacing the cryptocurrency market, which remained essentially constant from the previous day at roughly $1.19 trillion.

Looking at the daily chart, MATIC seems to be fading away from the strong bullish momentum of the previous 2 days, with a gain of more than 10% since July 10 but now waning.

It should be noted that the retracement point is close to the 38.2% Fib level, or $0.76. If the price drops back to the 23.6% Fib level, this could be due to the strong selling in early June remaining.

If the MATIC price drops further, it is likely that a sell signal will appear, but this is not the time for us to consider quickly because, compared to the previous breakout level, the token seems to be slowing down for a beat. Investors need to observe to have a reasonable buy level with lower risk.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.