Key Points:

- Litecoin’s price shows signs of a breakthrough as investors anticipate the upcoming halving, scheduled for early August.

- The halving event, which reduces miner rewards by 50%, aims to manage supply and inflation, driving enthusiasm among investors.

- While the market may have priced in the halving, LTCs recent uptrend and support levels suggest the potential for further gains, with resistance at $105 and potential targets at $115 and $130.

With the half of the Litecoin price approaching, could the recent breakthrough provide enough momentum for a fresh breakout?

LTC is presently down by about 4% in the last week but up by more than 40% in the previous 30 days, as investors are enthusiastic about the approaching Litecoin halving, which is scheduled for early August.

Litecoin, like Bitcoin, has four-year cycles that are highlighted by an event known as halving, which reduces the payout for mining a block of LTC by 50%.

The halving is intended to manage the supply and inflation of the currency, which has an 84 million maximum limit. The next LTC halving is scheduled on August 2, at block 2,520,000, when the miner reward will be reduced from 12.5 LTC to 6.25 LTC per block.

Yet, it is probable that the market has completed pricing in the halving and that LTC will not make any additional major gains from here on out, illustrating the’sell the news, buy the rumor’ axiom. Although the effect of the halving event on Litecoin pricing is unknown, they have been stockpiling in preparation for the August 2 event, which impacts supply and demand dynamics.

Unlike the majority of the top ten assets, such as Bitcoin and Ethereum, which are down 1% and 0.8%, respectively, to $30,406 and $1,872, Litecoin pricing is showing clear indications of a breakthrough.

Litecoin is now worth $100.57. It had a 24-hour trading volume of $674,999,780, an increase of more than 35% over the previous day. In the previous 24 hours, the price has dropped by 3.59%. The market capitalization of Litecoin is $7,375,242,872, with a circulating supply of 73,350,464 LTC coins. The maximum supply of LTC coins is 84,000,000.

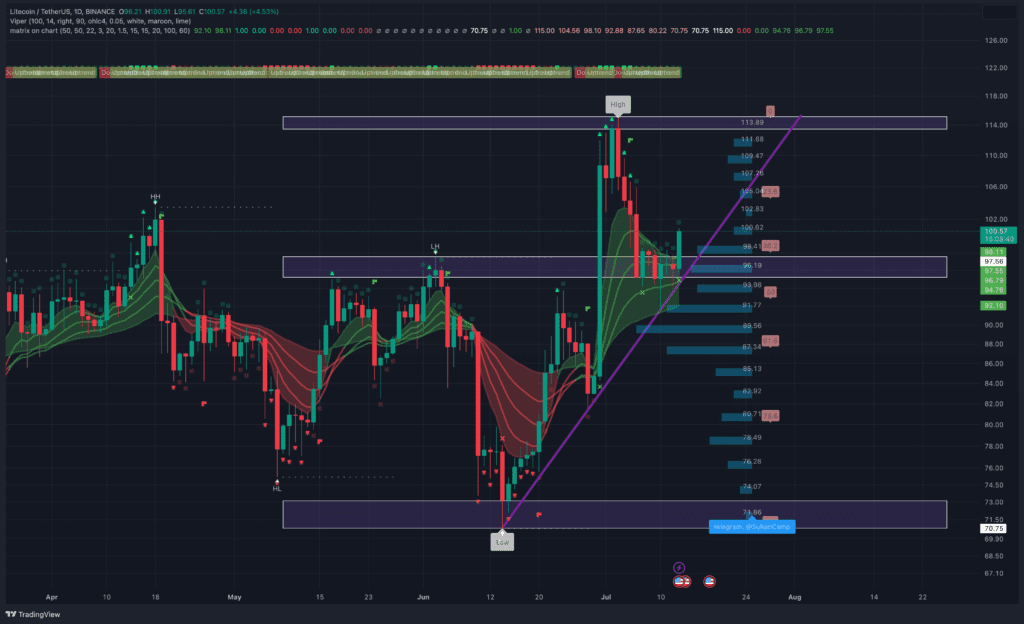

Based on the current chart, LTC is still in an uptrend, with the price just back to the $100 level after bouncing up from $92, which coincides with a bullish trend line.

Besides, the support confluence at $96.5 is still consolidating, so LTC is in a potential buy position for investors. Currently the closest resistance we should be interested in is the $105 price zone, as this is the price zone of the 23.6% Fib level. If the price continues to rise, the upcoming impetus could break the $115 resistance that LTC just created during the most recent bull run. The next potential could be the $130 price zone.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.