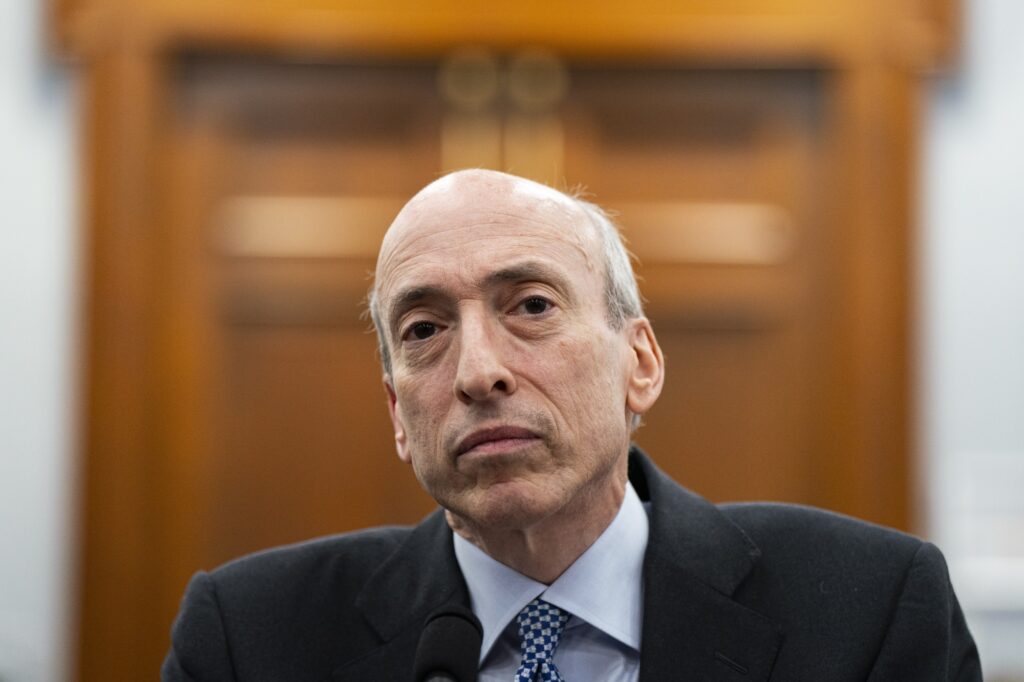

Gary Gensler Feeling Disappointed About The Court’s Judgment In Ripple Lawsuit

Key Points:

- SEC Chair Gary Gensler comments on the recent court ruling in the SEC’s lawsuit against Ripple, expressing both satisfaction and disappointment with the outcome.

- The court ruling determined that institutional sales of Ripple’s tokens violated federal securities laws, while sales on exchanges and programmatic sales were not considered securities.

- The ruling’s implications for retail investors and the potential for an appeal raise uncertainty about the future regulatory landscape for cryptocurrencies.

US Securities and Exchange Commission (SEC) Chair Gary Gensler has publicly addressed the recent court ruling in the SEC’s lawsuit against Ripple, stated that while he was disappointed with a district court’s decision in the Ripple case regarding retail investors, he was pleased with the portion of the order that found institutional sales of the tokens did violate federal securities laws.

Last week, Ripple achieved a partial victory as the court ruled that institutional sales of the XRP tokens violated federal securities laws, while sales on exchanges and programmatic sales did not qualify as the sale of securities. The ruling was based on the SEC’s inability to establish that speculative investors had a reasonable expectation of profits from the efforts of others.

During a talk on artificial intelligence at the National Press Club, Gensler was asked about the ruling’s impact on his stance on cryptocurrency and whether it necessitates federal legislation for regulatory oversight. He expressed satisfaction with the court’s decision to recognize the importance of investor protection for institutional investors. However, he voiced disappointment regarding the ruling’s implications for retail investors and stated that the SEC is still assessing the opinion.

Gensler reiterated similar sentiments in an interview with Yahoo Finance later in the day. He acknowledged the court’s recognition of XRP as a security for institutional investors and its consideration of fair notice. He mentioned that the SEC is continuing to evaluate the ruling and its implications.

The SEC chair declined to provide further details on the SEC’s requirements for being confident about spot Bitcoin exchange-traded funds (ETFs), citing ongoing litigation and the need to avoid prejudging the applications before the regulatory body.

When questioned about the SEC’s regulatory approach, Gensler highlighted that the SEC has engaged in rulemaking, including notice and comment rulemaking and special purpose broker-dealer licensing. He also acknowledged the existence of the European Union’s Markets in Crypto Assets (MiCA) regulatory framework, which emphasizes rulemaking.

This public response from Gensler marks the first time he has addressed the Ripple case since the court ruling. His expressed disappointment with the verdict’s impact on retail investors coincided with a drop in the price of Ripple’s XRP, following a brief nearly 100% rally in response to the mixed verdict.

The ruling’s nuanced differentiation between private sales to accredited investors and programmatic sales to exchanges has raised concerns among experts, including former SEC official John Reed Stark. Stark believes the ruling is on “shaky ground” and anticipates an appeal. He criticized the ruling’s potential creation of a new category of “quasi-securities” dependent on investor sophistication, deeming it counter-intuitive and inconsistent with SEC case law.

The possibility of an appeal introduces uncertainty regarding the final outcome of the case and the future regulatory landscape for cryptocurrencies.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.