Key Points:

- Cathie Wood remains bullish on Coinbase following the court ruling favoring Ripple Labs against the SEC.

- ARK Invest continues to sell off Coinbase stock, attributing the activity to profit-taking and reallocating capital to other opportunities.

- Industry experts see the Ripple ruling as a potential positive precedent for Coinbase and other exchanges facing regulatory challenges, although concerns about unresolved regulatory aspects remain.

Cathie Wood, the founder, and CEO of ARK Investment Management, expressed her optimistic view on cryptocurrency exchange Coinbase following a court ruling in favor of Ripple Labs against the Securities and Exchange Commission (SEC) on July 13.

Despite ARK Invest’s recent sales of Coinbase stock, Wood remains positive about the exchange, citing the court ruling as a positive development for the industry, she said on Bloomberg TV.

ARK Invest recently sold off an additional $50 million worth of Coinbase stock on July 15 as the stock rallied. Wood attributed the selling activity to profit-taking and reallocating capital to other investment opportunities.

Ripple Labs secured a huge victory in its court lawsuit against the Securities and Exchange Commission on Thursday, sending cryptocurrency prices and associated equities up toward the close of the week.

In December 2020, the SEC filed a lawsuit against Ripple, alleging the crypto and blockchain solutions provider of marketing its XRP coin as unregistered securities. A court in the Southern District of New York determined on Thursday that XRP is a security when sold to institutions but not when sold to the general public. After the judgment, XRP surged almost 90% to $0.82.

Wood’s sentiments align with other industry experts who believe that the Ripple ruling could set a positive precedent for Coinbase and other exchanges currently facing regulatory challenges. The ruling potentially influenced the ongoing legal battles of Coinbase and Binance with the SEC.

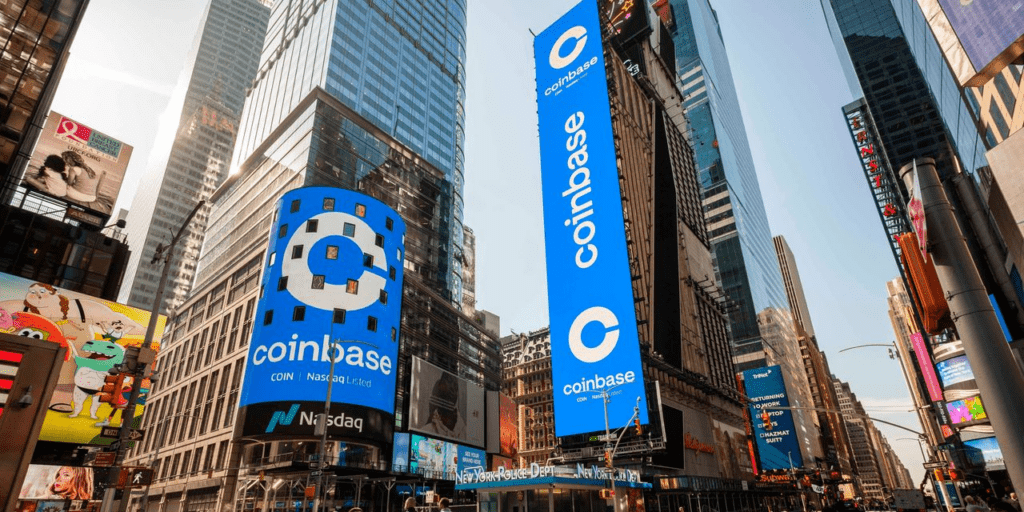

Despite receiving a Wells Notice in March and facing a lawsuit from the SEC in June, Coinbase’s share price has shown resilience, remaining relatively stable. Wood emphasized the robustness of Coinbase’s stock value.

While many are optimistic about Coinbase’s future, analysts from Berenberg Capital Markets cautioned that regulatory aspects for crypto exchanges are still unresolved. They specifically mentioned Coinbase Earn, a product offering crypto staking yield, as potentially vulnerable to being defined as a security.

Coinbase’s stock has performed well this year, rallying 189.3% so far. On Monday, it closed at $105.55, slightly below its one-year high of $107.

Overall, Wood’s positive outlook on Coinbase is driven by the recent court ruling and the resilience demonstrated by the exchange, despite regulatory challenges.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.