Key Points:

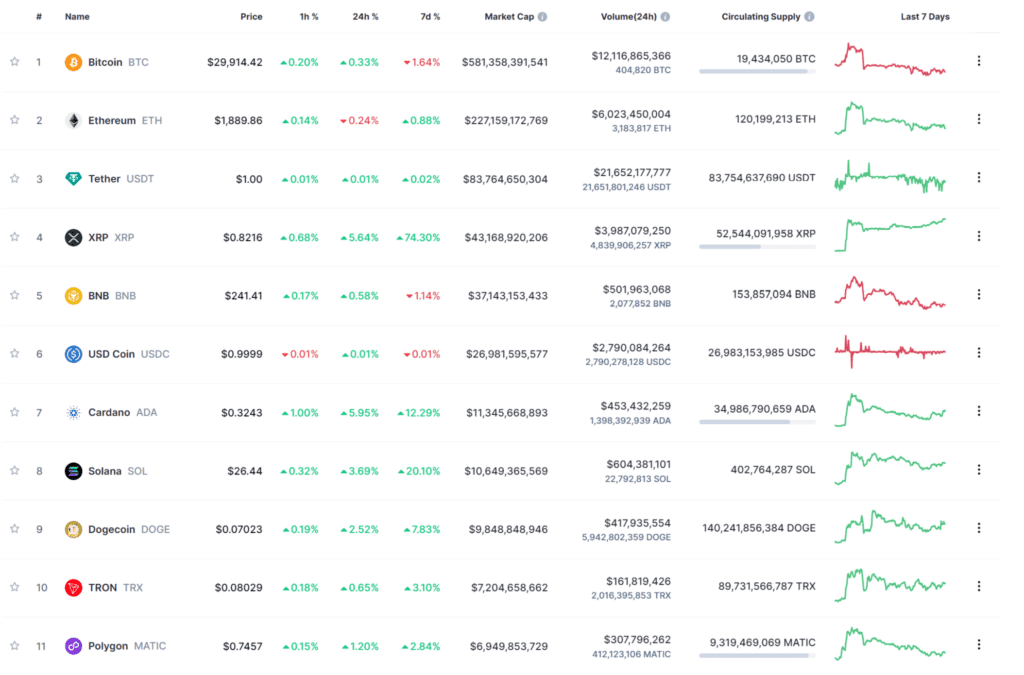

- XRP is up 73% consistently over the past 7 days after winning a dispute with the SEC that lasted nearly years.

- Altcoins are also enjoying the win with bullish momentum.

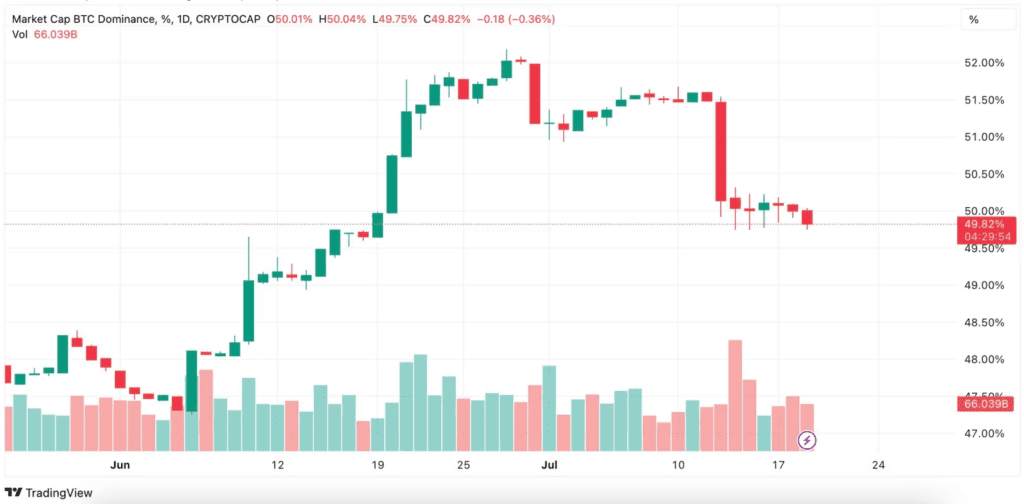

- BTC dominance has dropped to 49.8% from a high of 52% at the end of June.

Inheriting the victory from the Court’s ruling in the dispute with the SEC, Ripple (XRP) is still recording an impressive increase to become the most popular token, surpassing even Bitcoin.

The native token of the Ripple payment system has recently increased by around 6% in the last 24 hours and continuously increased by more than 73% in the past 7 days, reaching the highest level among the top 20 cryptocurrencies by market capitalization.

Ripple’s win with the SEC prompted several exchanges, such as Coinbase, Kraken, and Bitstamp, to re-list XRP, leading to an increase in investment, trading volume, and open interest for futures contracts.

In a recent report, smart data portal Kaiko revealed that open interest for altcoins is outpacing Bitcoin (BTC). When measuring the change in open interest since last week, XRP has outperformed Bitcoin by an impressive 50%.

Smaller cryptocurrencies are also up on the day. XLM, the token of the Stellar network adjacent to Ripple, is up 24%. Previous tokens that have been hit hard by the SEC’s battle with the electronics industry are Cardano’s ADA, up 12%, and Solana’s SOL, up around 20%, while the popular dogecoin memecoin (DOGE) is up 8% in the last 7 days.

In an unexpected turn, XRP now accounts for a significant 21% of the total global crypto trading volume, thus outstripping BTC and ETH. As a natural consequence, other altcoins have also experienced increases in their trading volumes. Currently, XRP is reaching new heights in trading, reaching levels not seen in the past 15 months.

Meanwhile, BTC is mostly trading steadily around $30,000. Ether (ETH), the second-largest digital asset by market value, is also down on the day at $1,900. Cryptocurrency investors have shifted their focus to smaller, riskier tokens due to the strong performance of so-called altcoins as BTC stalled.

Notably, BTC dominance, which measures bitcoin’s share of the total market capitalization of crypto assets, has dropped to 49.8% from a high of 52% at the end of June, according to TradingView. This is near a one-month low.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.