Bankless Report: Ethereum Q2 Revenue Plunges 33.3%, Addresses Drop 6%

Key Points:

- Ethereum experienced a significant decline in key metrics, including network revenue, burned ETH value, and daily active addresses.

- Network revenue fell by 33.3%, indicating a slowdown in transactional volume during the period.

- Burned ETH value dropped 35%, possibly due to factors affecting inflation control and asset scarcity.

In the recently published Q2 2023 report by Bankless, Ethereum experienced a notable decline in various key metrics, signaling potential shifts within the ecosystem.

The report revealed a concerning decrease in network revenue, burned ETH value, daily active addresses, and a surprising change in the inflation rate.

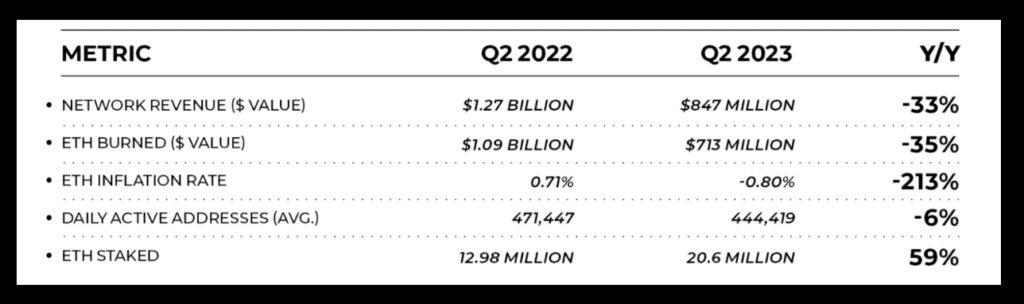

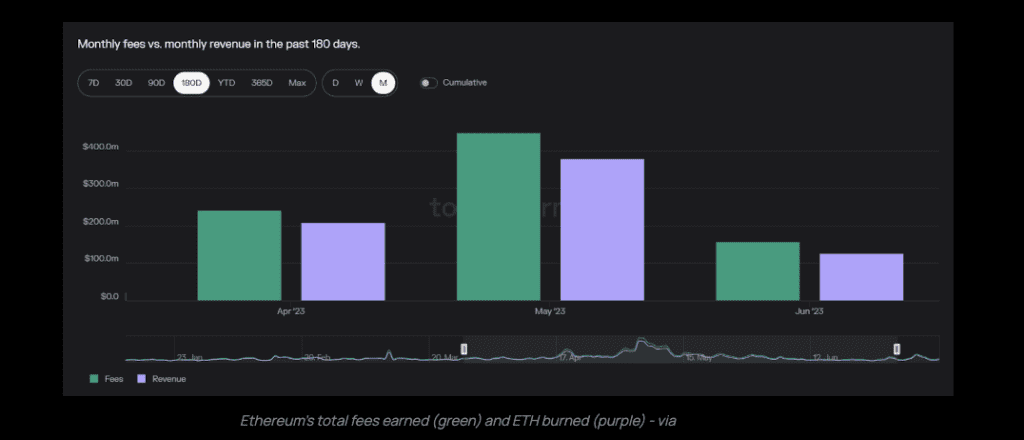

According to the report, Ethereum’s network revenue fell by a significant 33.3%, dropping from a substantial US$1.27 billion in the previous quarter to US$847 million. This decline in revenue may raise questions about the platform’s underlying economic activity and could be indicative of a slowdown in transactional volume during the given period.

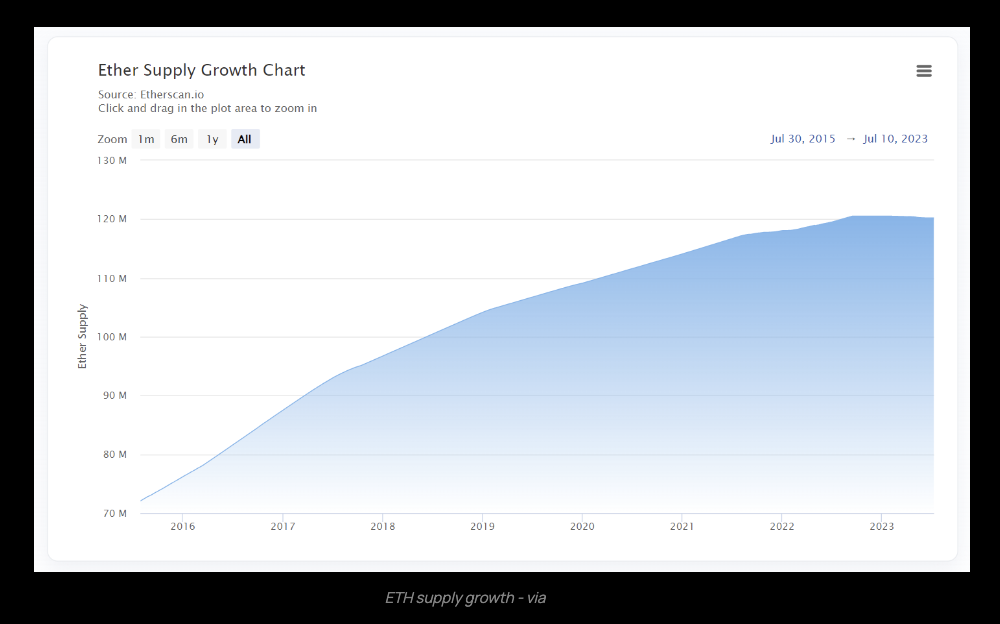

Furthermore, the dollar value of burned ETH also experienced a sharp decline, plummeting 35% from $1.09 billion to $713 million. The burning of Ethereum tokens is often viewed as a measure to control inflation and maintain the scarcity of the digital asset. Such a significant decrease in the value of burned ETH may warrant further investigation into the factors influencing this development.

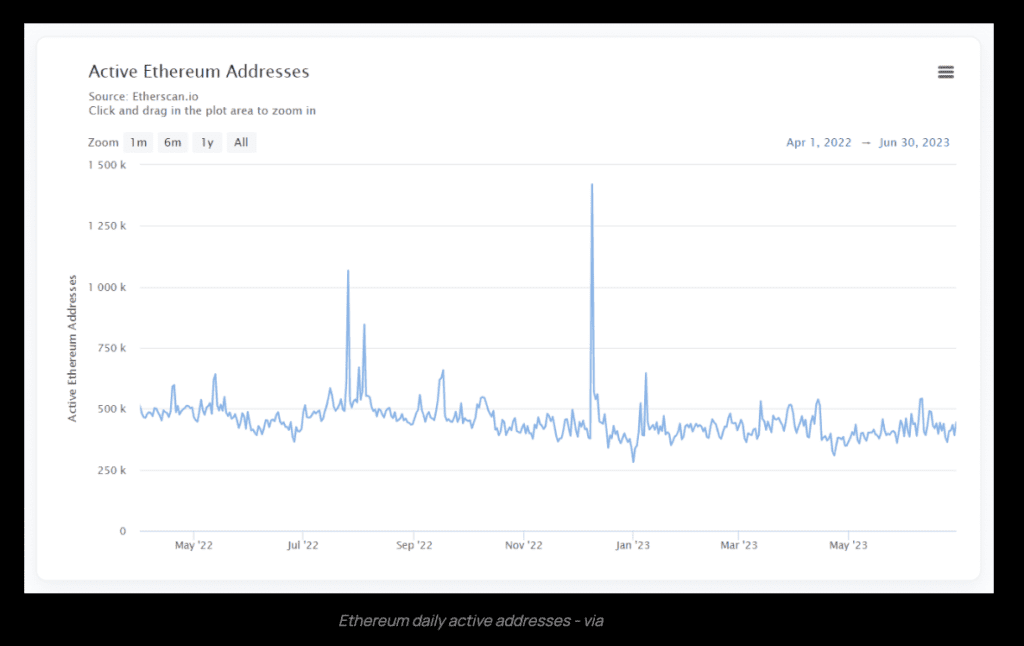

The report also revealed a 6% decrease in average daily active addresses, declining from 471,447 in the previous quarter to 444,419. The number of active addresses is considered a key indicator of network usage and adoption. This drop may signal reduced user engagement or potential challenges in onboarding new users during the stated period.

Additionally, the most surprising and noteworthy figure in the report was the change in the ETH inflation rate. The inflation rate decreased by an average of 213%, shifting from 0.71% to a remarkable -0.8%. This deflationary turn could have significant implications for the cryptocurrency’s value and its economic model.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.