Federal Reserve Officially Launches ‘FedNow’ Instant Payment System For 9000 Banks

Key Points:

- The FedNow Service is a new instant payment system launched by the Federal Reserve that allows banks and credit unions to offer their customers instant transfers 24/7.

- The service enables customers to receive their paychecks instantly and access funds immediately when invoices are paid, leading to more efficient cash flow management for individuals and small businesses.

- The Federal Reserve is committed to working with over 9,000 banks and credit unions to ensure the widespread availability of the service, which is expected to lead to significant improvements in the payment system.

The Federal Reserve launched the FedNow Service, offering banks and credit unions the ability to offer their customers instant 24/7 transfers. Customers can receive their paychecks instantly and access funds immediately when invoices are paid, leading to significant improvements in the payment system.

The Federal Reserve has taken a significant leap towards improving the payment system in the United States with the launch of its new instant payment system, the FedNow Service. This system, which is now live, is designed to provide banks and credit unions of all sizes with the ability to offer their customers instant transfers 24/7.

Federal Reserve Chair Jerome H. Powell noted that the FedNow Service was built to make everyday payments more convenient and faster. According to Powell, as more banks sign up for the service, the benefits for individuals and businesses will be substantial. For instance, customers will be able to receive their paychecks instantly and access funds immediately when invoices are paid. Additionally, the U.S. Department of the Treasury’s Bureau of the Fiscal Service and 16 service providers are ready to support payment processing, in addition to the 35 early-adopting banks and credit unions.

The FedNow Service will provide significant benefits to consumers and businesses by enabling them to access funds rapidly and make just-in-time payments to manage cash flows more efficiently. Individuals will be able to receive their paychecks instantly and use them the same day, while small businesses will be able to manage their cash flows more efficiently without experiencing processing delays. Over time, customers of banks and credit unions that sign up for the service should be able to use their financial institution’s mobile app, website, and other interfaces to send instant payments quickly and securely.

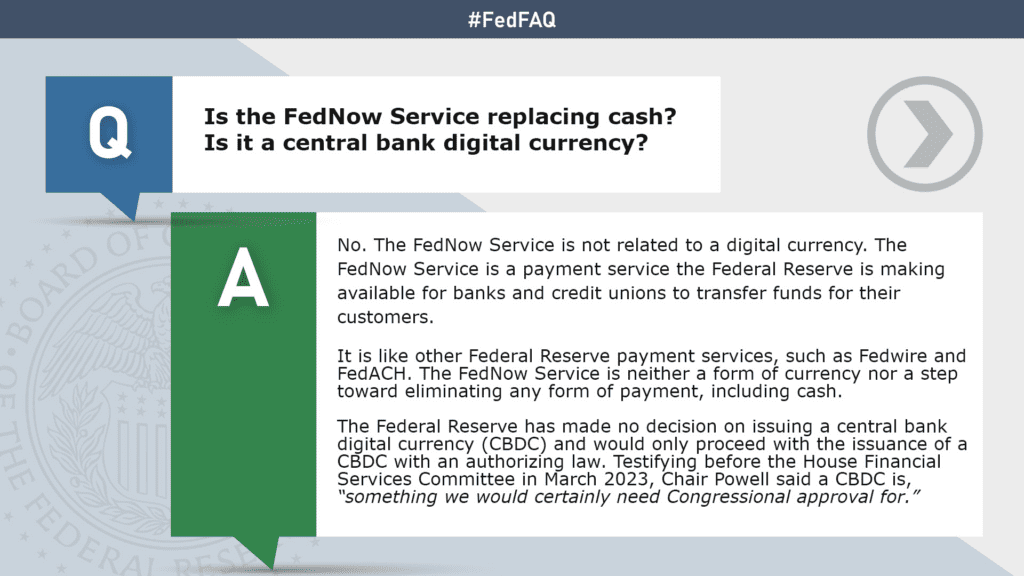

As an interbank payment system, the FedNow Service will operate alongside other Federal Reserve payment services such as Fedwire and FedACH. The Federal Reserve is committed to working with over 9,000 banks and credit unions across the country to ensure the widespread availability of this service for their customers over time.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.