Key Points:

- Chainlink’s tokens witnessed a significant surge as investors exchanged ether for LINK following the release of the Cross-Chain Interoperability Protocol (CCIP).

- The CCIP launch allows seamless cross-chain application building and has garnered attention from major investors, contributing to a price increase of over 22%.

- Chainlink’s CCIP opens up new possibilities for traditional institutions to integrate with blockchain networks, further bridging the gap between the traditional financial world and the decentralized ecosystem.

Chainlink tokens surged Friday as wealthy investors swapped ether for LINK following the release of the company’s Cross-Chain Interoperability Protocol (CCIP) earlier this week.

On-chain data shows some whales – or large holders of an asset – added upward of $6 million to their link holdings during the morning, with the increased demand lifting prices as much as over 22%.

CCIP is designed to help build cross-chain applications and services. It was being tested by at least 25 partners that are now beginning to move to the mainnet and was pushed live for early access users on the Avalanche, Ethereum, Optimism, and Polygon blockchains.

The protocol will expand Chainlink’s use case by making it possible for companies like banks and insurance firms to join the blockchain. The announcement came a month after Chainlink announced that it was running a trial of linking banks to the blockchain through its partnership with Swift.

On Thursday, CCIP will become available to all developers across five testnets: Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli, and Polygon Mumbai.

Chainlink price rise led the crypto market gains on Friday as the altcoin found sudden optimism from its investors. The reason behind this was a speech from the project’s founder that highlighted the potential impact of their new service on the blockchain industry.

LINK shot up on Thursday following the comments from its co-founder, Sergey Nazarov, during an interview at the EthCC event. Nazarov was discussing the company’s newly launched cross-chain interoperability protocol, which would ease the transfer of funds between blockchains.

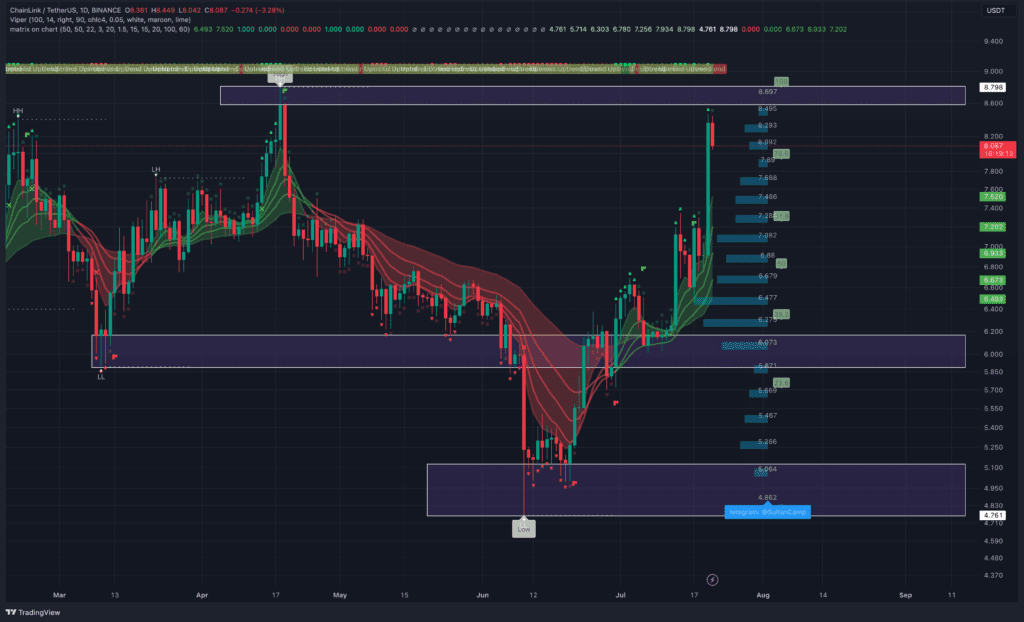

LINK could be seen trading at $8.46 after noting a near 20% rally in the span of 24 hours, up from $6.88. The green candlestick marked the largest single-day growth for the altcoin this year, bringing the cryptocurrency to a three-month high and near the year-to-date high.

There are signs that whales have started buying the coin. Data shows that two whales acquired 788,877 LINK tokens this week. They bought these tokens by swapping their stETH and ETH tokens for LINK. Historically, accumulation by whales is usually one of the best buy signals in the market.

Most of these transactions ended up generating profits for the LINK holders, which makes the market susceptible to potential profit-taking. If such selling was to take place, the cryptocurrency is bound to absorb some selling pressure.

However, up until the time of writing, the supply of exchanges has only observed a decline and not incline. This translates to optimism from investors of a further increase in price, which is why they have been mostly accumulating for the past month, ramping it up in the last week.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.