Key Points:

- Paradigm, an institutional liquidity platform for crypto, launches Paradex, a decentralized perpetual platform on Starknet’s Layer 2 appchain.

- Paradex combines CeFi liquidity with DeFi transparency and self-custody, addressing trust issues and fragmented risk engines in traditional finance.

- Collaboration between Paradigm and StarkWare brings scalability and customization, ushering in a new era of hybrid derivatives exchanges in DeFi.

Paradigm, a prominent institutional liquidity platform for cryptocurrency, is making its entry into the decentralized finance (DeFi) arena with the unveiling of Paradex, an innovative decentralized perpetual platform.

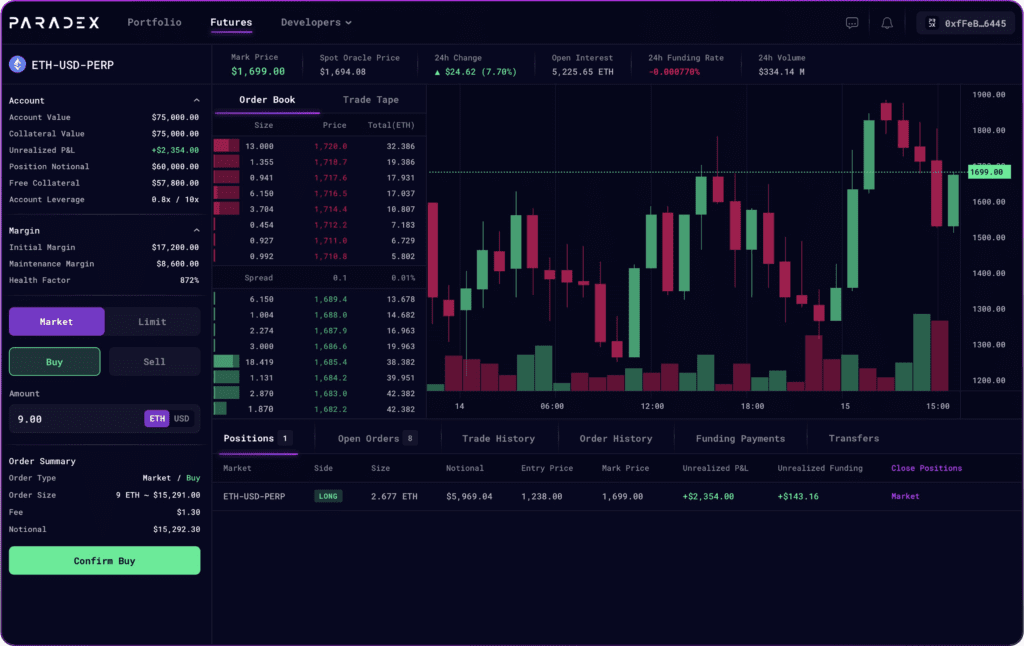

Blending the best of both worlds, Paradex aims to offer a seamless trading experience by combining the liquidity prowess of centralized finance (CeFi) with the transparency and self-custody features of DeFi.

The birth of Paradex is the result of a productive six-month collaboration between Paradigm and StarkWare, the visionary company behind Ethereum’s layer 2 network, Starknet. As a testament to its versatility, Paradex will operate as an independent chain within Starknet’s developer stack, effectively positioning it as a Layer 2 appchain.

The choice of Starknet as the platform for Paradex comes as no surprise, given its capacity for scalability, control, and customization. Nafaa Hendaoui, Head of Product at Paradex, expressed enthusiasm for Starknet’s private instance, Appchain, which provides a robust solution to accommodate Paradex’s ambitious vision.

One of Paradex’s primary aims is to address the trust deficit that has emerged in the realm of centralized finance, with FTX’s multi-billion-dollar collapse due to a liquidity crisis caused by management decisions serving as a poignant example. By integrating the transparency and trustlessness of DeFi, Paradex endeavors to furnish users with a secure and reliable trading platform.

Beyond enhancing trust, the platform seeks to tackle the challenges posed by fragmentation within legacy CeFi risk engines. Such fragmentation adversely affects capital efficiency and liquidity levels, prompting Paradex to devise an all-encompassing solution.

Paradigm, with its wealth of experience in catering to both institutional crypto derivatives traders and the DeFi sector, is confidently venturing into the Layer 2 domain with the introduction of Paradex. By leveraging Starknet’s capabilities, the platform aims to offer an unparalleled trading experience, fostering greater adoption of DeFi within the institutional sphere.

As Paradex takes flight, the industry eagerly anticipates how this hybrid derivatives exchange will shape the future of decentralized finance and redefine the landscape of crypto trading.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.