USDC Witnesses $1.6 Billion Decrease in Circulation in 30 Days, USDT Sees 0.8% Increase

Key Points:

- Significant changes in stablecoin circulation: USDC down, USDT up.

USDC sees 5.6% drop in circulation, while USDT grows by 0.8%.

- Fluctuations may indicate market shifts, USDT’s sustained growth reflects stablecoin demand.

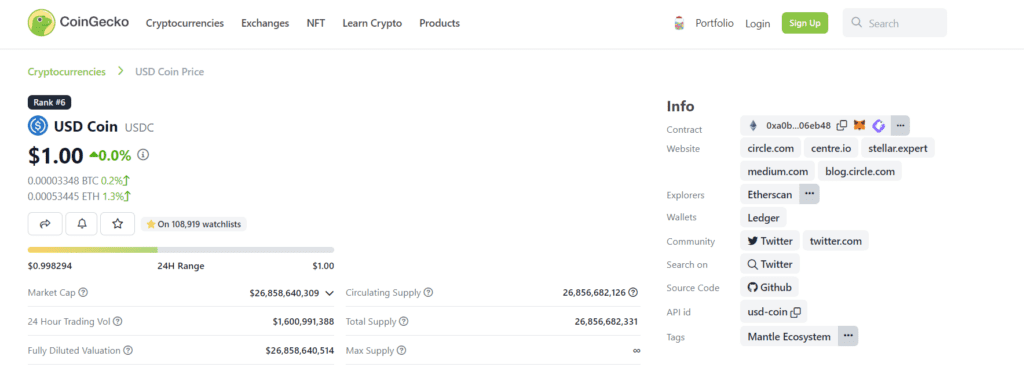

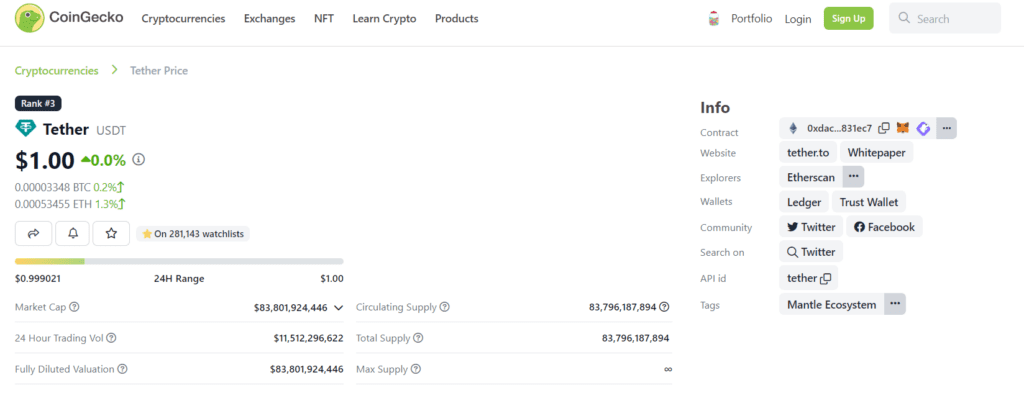

Data from Coingecko reveals significant changes in the circulation of stablecoins in the past 30 days, with USDC experiencing a notable decline while USDT sees a slight increase in circulation.

The USDC (USD Coin) has seen a decrease of $1.6 billion in circulation over the past month, representing a substantial 5.6% drop. As of July 23, the total circulation of USDC stands at $26.867 billion.

On the other hand, TUSD (TrueUSD) has also experienced a decrease in circulation, with a decline of $332 million, accounting for a significant 10.5% reduction.

In contrast, USDT (Tether) has witnessed an increase in circulation, with a rise of $660 million, marking a modest 0.8% growth. The total circulation of USDT stands at a substantial $83.818 billion.

Stablecoins have become an essential part of the cryptocurrency ecosystem, providing stability and pegging their value to fiat currencies like the US Dollar. These digital assets offer traders and investors a means to mitigate the high volatility often associated with other cryptocurrencies.

The recent fluctuations in the circulation of stablecoins may be influenced by various factors, including market demand, user preferences, and regulatory developments.

The decrease in USDC circulation could be attributed to investors moving funds to other assets or platforms as market conditions evolve. As stablecoins aim to maintain a 1:1 peg with the US Dollar, the decrease may indicate a shift in investor sentiment or market dynamics.

On the other hand, the increase in USDT circulation suggests sustained demand for this widely used stablecoin. USDT’s status as one of the most established and widely accepted stablecoins in the market likely contributes to its continued growth.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.