Liquid Staking Solution – Groundbreaking Generation Method In PoS

Key Points:

- Liquid staking is an innovative solution that addresses the limitations of traditional cryptocurrency staking, providing users with enhanced liquidity and flexibility.

- Users receive liquid staking tokens (LST) when staking their cryptocurrencies, allowing them to trade, lend, or use their staked assets as collateral while still earning staking rewards.

- The method democratizes the staking process and aligns with the principles of DeFi, offering users a user-centric approach to growing their assets in the dynamic decentralized finance ecosystem.

With the increasing popularity of cryptocurrency staking as a means of earning rewards and among networks, concerns surrounding illiquidity, complexity, and centralization have arisen among investors. However, a groundbreaking alternative known as “Liquid Staking” has emerged as an innovative solution to address these limitations.

Cryptocurrency staking involves locking up funds to support blockchain networks and validate transactions, thereby earning rewards in return. Traditional staking methods like self-staking and exchange staking have their drawbacks, including the inability to access locked assets for a specific period, complexity in managing staking operations, and concerns about centralized custody of staked assets.

In contrast, liquid staking introduces a novel approach that seeks to sidestep these risks. By tokenizing staked assets, users can maintain liquidity while participating in staking activities. This newfound liquidity allows investors to trade, lend, or use their staked assets as collateral, providing flexibility that was previously unavailable in conventional staking models. Let’s learn about this staking method with Coincu.

What is liquid staking?

At its core, liquid staking is a software-based innovation that facilitates direct staking on proof of stake (PoS) networks. When users stake their cryptocurrencies, they receive a liquid staking token (LST) that is programmatically minted by the protocol. This LST serves as evidence of ownership for the staked tokens and any associated network rewards.

The primary advantage of liquid staking lies in its ability to address the liquidity constraints imposed by traditional staking methods. Unlike the latter, which require users to endure bonding and unbonding periods lasting several days to weeks, liquid staking empowers token holders with enhanced liquidity and capital efficiency. The LSTs they receive can be transferred, stored, traded, or utilized in various DeFi applications without compromising their staking rewards.

One of the pioneering platforms in the liquid staking landscape is Lido. This platform enables users to stake any amount of Ethereum and receive stETH (a tokenized representation of their staked funds) in return. The stETH can be utilized for lending, used as collateral, or traded in other DeFi activities, all while the user continues to earn daily staking rewards. Additionally, Lido’s approach enables users to unstake at any time through stETH-ETH liquidity pools.

In the context of liquid staking, the process is akin to depositing ETH into a third-party application, which then deposits the user’s ETH into the Ethereum deposit contract through their own validators. In exchange, the app mints a representative ETH token (e.g., stETH) for the user. This representative token grants users the flexibility to transfer their ETH while still earning Ethereum staking rewards.

However, it is crucial to acknowledge that liquid staking comes with its own set of risks. While it offers increased liquidity, it also exposes users to potential security vulnerabilities or network-related issues. As with any financial venture, cautious research and risk assessment are vital when considering participation in liquid staking activities.

The year 2022 witnessed significant adoption of liquid staking, riding on the wave of DeFi opportunities. As more crypto enthusiasts explore innovative ways to earn rewards and optimize their assets, liquid staking is anticipated to play a prominent role in shaping the future of staking and contributing to the continuous growth of the DeFi ecosystem.

How does it work?

While bearing some resemblance to traditional staking options, the execution methods of liquid staking stand apart as a distinct and game-changing approach.

Liquid staking protocols represent a new generation of opportunities that enable users to stake any desired amount of an asset and easily withdraw them without impacting their initial deposit. This process involves depositing assets into specialized platforms, where users are then issued tokenized versions of their staked crypto assets. These derivative tokens carry an equivalent value and operate on a one-to-one basis with the original asset, albeit usually distinguished with a unique emblem.

For instance, if a user decides to stake 1 ETH into one of the liquid staking services, they would receive one stETH, with the “st” signifying staked ETH.

One of the key benefits of liquid staking is the fluidity it offers to users. The newly issued tokens can be freely transferred, traded, stored elsewhere, or even used for transactions without interfering with the initial deposit. This enhanced accessibility sets liquid staking apart from conventional staking methods. Additionally, users can earn staking rewards on their initial deposits while simultaneously generating more funds from their derivative tokens, creating a win-win situation.

Should a user choose to withdraw their initial deposit, they must return an equivalent deposit value to regain access to their funds. It is worth noting that certain liquid staking protocols may charge fees for the use of their platforms, though the fee structures can vary.

In contrast to conventional staking, where locked-up assets remain inaccessible for a set period, liquid staking empowers users to grow their crypto holdings while retaining the flexibility to capitalize on other investment opportunities or navigate volatile market conditions.

Liquid staking operates through a process of users delegating their crypto assets to a validator node on a delegated Proof-of-Stake (DPoS) network by pooling tokens in a staking pool via a third-party liquid staking service provider or native projects within the network. In return for locking their tokens in the network, users are issued derivative tokens representing their underlying assets, granting them access to liquid funds while their crypto remains staked. Liquid staking protocols typically utilize two primary mechanisms: rebasable and exchange rate-based tokens.

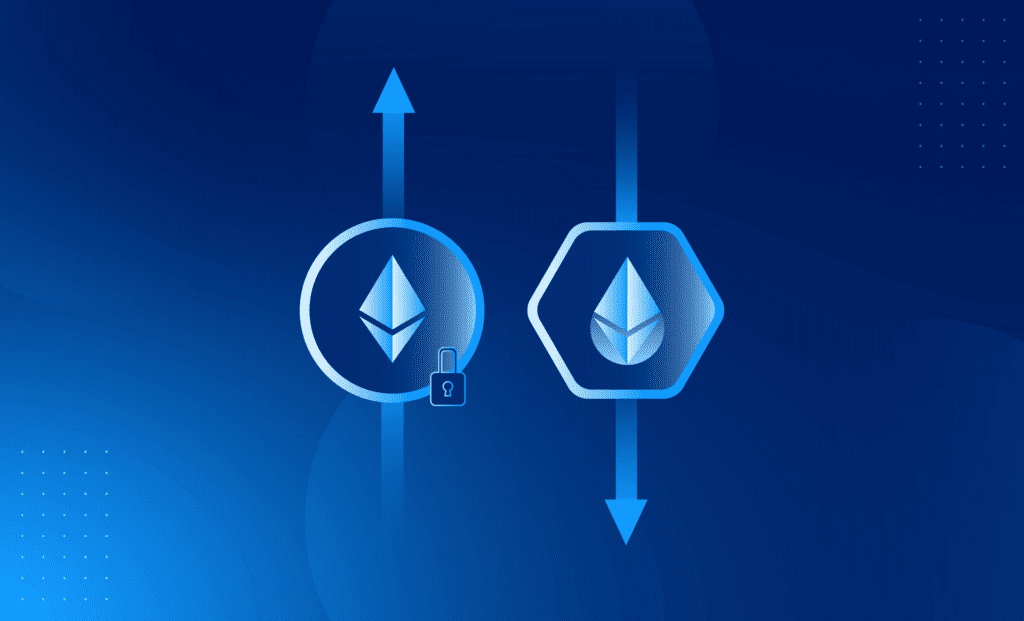

Rebasable Liquid Staking Derivatives

Under the rebasable LSD model, the value of the underlying asset and the derivative token remains consistently pegged at a 1:1 ratio. The balance of the derivative token is recalculated daily through updates from an oracle, reporting changes in the balance of the underlying token. For example, staking 1 Ether (ETH) on platforms like Lido would yield users 1 stETH, and upon withdrawal, users can redeem their ETH by burning stETH at the same 1:1 ratio established during minting.

Exchange Rate-Based Liquid Staking Derivatives

Exchange rate-based LSDs differ by experiencing fluctuations in value over time to reflect accrued rewards and fees while maintaining an unaltered balance. This results in a constant change in the exchange rate between the LSD and its underlying asset, usually updated on a 24-hour basis, depending on the specific protocol. For instance, staking 1 ETH on Rocket Pool would grant users 1 rETH, with the rETH/ETH exchange rate updated daily based on rewards earned by Rocket Pool’s Beacon Chain node operators, leading to an increase in the value of rETH over time.

Advantages and Disadvantages

Advantages

- Mobility: Liquid staking offers the flexibility to withdraw tokenized assets, allowing users to move their funds and react to market changes swiftly. This prevents users from being locked into long-term staking commitments during volatile market conditions, reducing the risk of potential losses.

- Multiple Income Streams: Liquid staking enables users to leverage their staked assets as collateral for crypto-backed loans, creating additional income streams. By depositing these loans into higher-yield accounts, users can optimize their returns and take advantage of various DeFi opportunities.

- Barrier-Free Entry: The concept of liquid staking aims to address the barriers associated with traditional staking, such as illiquidity, immobility, and inaccessibility. By converting locked capital into liquid assets through Receipt Tokens, users gain immediate access to liquidity, fostering a more accessible and inclusive staking ecosystem.

- Composability of Yield Strategies: Liquid staking tokens can be utilized as collateral on centralized or decentralized platforms, allowing stakers to earn interest on top of their staking rewards. This opens up a wide array of yield strategies in the DeFi space, enhancing the overall profitability of staked assets.

- Enhanced Technical Features: Unlike traditional staking, which delegates funds to a single validator, liquid staking offers more technical sophistication. Users can interact with smart contracts to manage their staked assets, granting them greater control and diversification options.

Disadvantages

- Depegging Risk: One significant risk of liquid staking lies in the possibility of tokenized assets depegging from the original staked tokens. If the tokenized version’s value deviates significantly from the underlying asset, users may experience losses when trading or redeeming their assets.

- Loss of Access to Deposited Funds: Users face the risk of losing access to their deposited funds if they lose their tokenized assets in a trade. Retrieving the original deposit then requires making an equivalent deposit, which could be problematic for users facing financial constraints.

- Smart Contract Vulnerabilities: Liquid staking relies on smart contracts to manage the tokenization process. While smart contracts are efficient, they are not immune to bugs or vulnerabilities. If a smart contract is exploited, it could lead to the loss of users’ funds, with no recourse for recovery.

Conclusion

Liquid staking eliminates the risks and complexities of self-staking while democratizing the staking process, catering to holders of all ETH amounts and promoting decentralization and accessibility within the DeFi ecosystem.

By balancing risk, reward, and convenience, liquid staking opens doors for traders to exchange staked tokens without facing stringent requirements, making it a viable alternative to both self and exchange staking on the Ethereum network. It aligns perfectly with the core values of DeFi, fostering growth and innovation in the space while empowering users to actively participate in the dynamic decentralized finance movement.

In conclusion, liquid staking represents a paradigm shift in the world of staking and DeFi. It empowers users to unlock the potential of their staked assets while participating in securing PoS networks. As the demand for DeFi opportunities continues to surge, liquid staking is poised to become an integral component of the evolving decentralized finance landscape. However, prudent consideration of the risks and benefits associated with liquid staking is essential for users seeking to make the most of this groundbreaking innovation.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.