Bitcoin HODLers Reach 75% Of Circulating Supply As Glassnode Reports New ATH

Key Points:

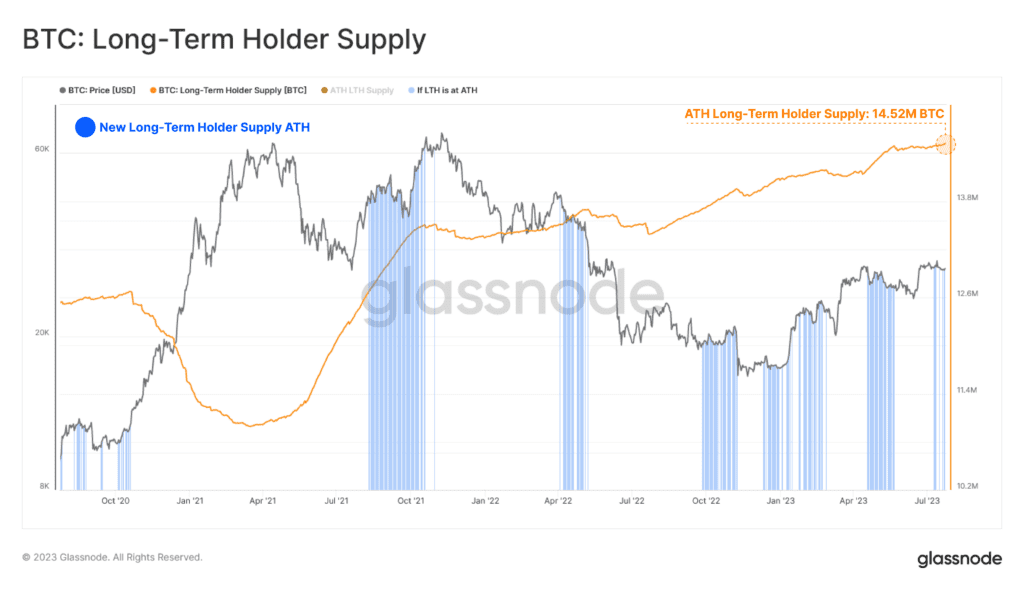

- Glassnode reports an all-time high in long-term holder supply of 14.52M BTC, indicating a preference for HODLing among mature investors.

- Only 0.42% of trading hours have recorded a tighter Bitcoin 30-day price range, suggesting a likelihood of volatile price movement.

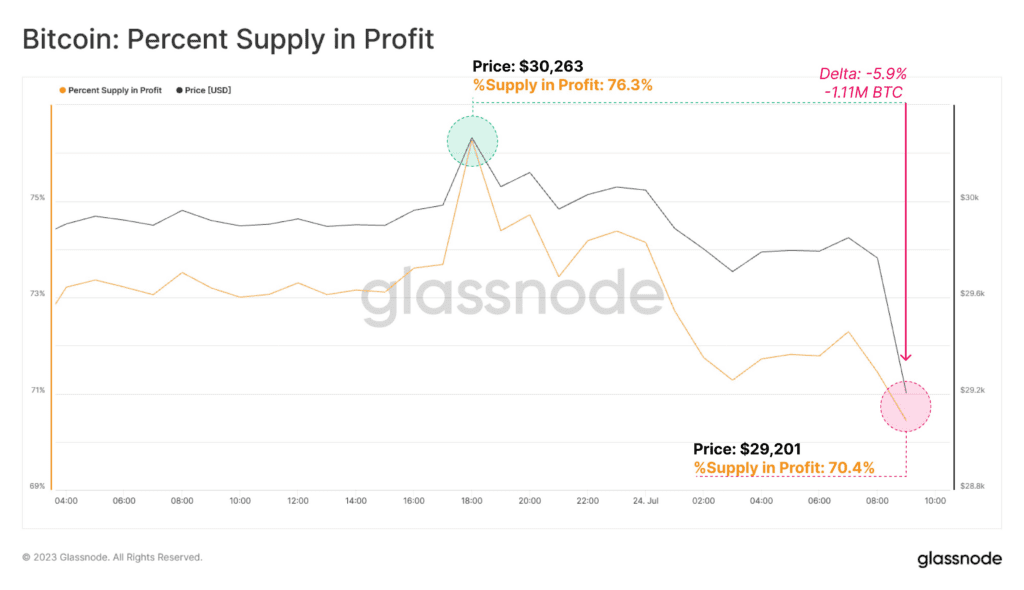

- BTC has significantly dropped to $29K, about 5% over the last 24 hours.

Glassnode reported a new all-time high of 14.52M BTC in long-term holder supply, suggesting HODLing is preferred. Tighter 30-day price range, the potential for volatile movement, and a recent price drop of -1.11M BTC to $29K. Bitcoin block 800,000 just mined.

Recently, Glassnode, an on-chain analysis platform, reported that the Bitcoin Long-Term Holder Supply has reached a new all-time high of 14.52 million BTC, which is equivalent to 75% of the circulating supply. This suggests that the preferred market dynamic amongst mature investors is HODLing.

In addition, only 484 out of 114,055 trading hours (0.42%) have recorded a tighter Bitcoin 30-day price range. This suggests that the likelihood of severe volatile price movement is enhanced.

The recent BTC spot price movement from $30,263 to $29,201 has sent -1.11 million BTC (-5.9%) into an underwater position. This places the current percent supply in profit at 70.4% (13.45 million BTC). At the time of writing, Bitcoin has witnessed a significant drop to $29K, about 5% over the last 24 hours.

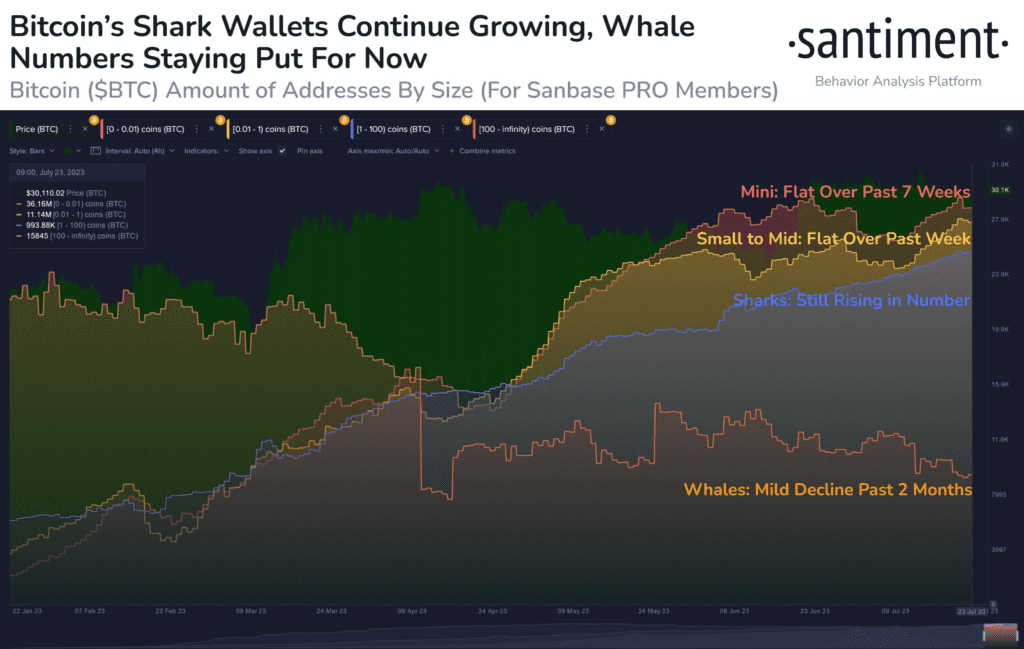

According to Santiment, Bitcoin has rebounded above $30k last weekend, and it’s recommended to keep an eye on the number of large addresses as summer progresses. If the 100+ $BTC wallet line begins rising again, another breakout greatly increases in probability.

Previously, Checkmate, Lead On-chain Analyst of Glassnode, reported that Bitcoin block 800,000 has just been mined! A quick thread on some Bitcoin network stats up until this point: a total of 19.437 million BTC have been minted, and 268.7k BTC in fees paid out to miners.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.