In the fast-evolving world of finance (DeFi), Raft Finance, a pioneering project in the LSDfi (Liquid Staking Derivatives Finance) sector, has attracted attention for its unique operational mechanisms. Focused on the cutting edge of DeFi innovation, Raft Finance presents a remarkable opportunity that aligns perfectly with the current industry trend. Let’s find out details about this project with Coincu through this Raft Review article.

As interest in the LSDfi sector grows, investors and enthusiasts are closely monitoring the development potential and community support for this attractive project. This is a remarkable project and follows the current trend. Does the project have enough development potential and receive great investment from the community?

What is Raft?

Raft Finance is a decentralized borrowing and lending protocol on the Ethereum network, providing users with the means to optimize capital efficiency while ensuring asset stability.

The core concept behind Raft Finance lies in its unique approach to lending stablecoin R. Users can achieve this by staking stETH or wstETH, two innovative tokens that play a vital role in the borrowing and lending process. By staking these tokens, users gain access to stablecoin R, receiving a loan amount equivalent to the value of their staked assets. This groundbreaking mechanism empowers users to make the most of their holdings and enhance profits through efficient lending and borrowing.

At its heart, Raft Finance aims to establish a decentralized financial ecosystem on the Ethereum network, enabling users to effectively manage and optimize their capital in a secure and stable environment. By harnessing the power of DeFi, Raft Finance presents a solution to enhance capital efficiency for its growing user base. Now, the Raft Review article will explore the highlights of the project.

Highlights

What sets R apart from its predecessors, SAI (Single Collateral Dai) and LUSD, is its innovative approach to stability, enhanced capital efficiency, and flexible fee structures, making it the preferred choice for borrowing against LSD collateral.

At the heart of R’s stability lies a unique combination of two mechanisms: the Hard Peg and the Soft Peg. Together, these mechanisms ensure that the value of R always remains fixed to the US dollar, offering a stable price between $1 and $1.20.

Hard Peg: The Arbitrage Mechanism

The Hard Peg is the foundation upon which R maintains its stable price within the designated range. This mechanism is governed by two key features: Redemption and Over-Collateralization.

The Redemption feature allows users to exchange R tokens for wstETH (wrapped stETH) at a value equivalent to 1 USD. Notably, when R tokens are redeemed, they are subsequently burned, effectively reducing the circulating supply and contributing to an increase in the price of R. This ensures that even if the price of R falls below the $1 mark, users have the opportunity to redeem their tokens and help stabilize the value.

On the other hand, Over-Collateralization empowers users to mortgage their wstETH in order to mint R tokens. This process enables users to create R tokens at a fixed price of 1 USD, providing an opportunity for profit-making through price differences. By allowing an increase in the supply, the protocol also counterbalances situations where the price of R might surge beyond the $1.20 threshold, thereby aiding in stabilizing the coin’s value.

Soft Peg: Unleashing Capital Efficiency

Complementing the Hard Peg, the Soft Peg mechanism optimizes capital utilization for users by leveraging price fluctuations of R tokens. This approach grants users the freedom to employ strategic tactics to predict and capitalize on the future price movements of R.

During instances where the price of R experiences fluctuations, the protocol incentivizes borrowers to hold onto their positions instead of immediately returning them. This encouragement to hold positions is driven by the understanding that other users may seize the opportunity for profit-making during these price swings.

In conclusion, R has emerged as a game-changer in the realm of stablecoins, harnessing the power of Liquid Staking Tokens (LSDs) like stETH and rETH to ensure capital efficiency on the Ethereum network. Its robust combination of the Hard Peg and Soft Peg mechanisms guarantees that the value of R remains steadfastly anchored to the US dollar while also promoting efficient and instant liquidation. As the cryptocurrency market continues to evolve, R stands at the forefront, providing users with a reliable and innovative stablecoin solution that paves the way for a more secure and prosperous future in the decentralized financial landscape.

Products

Raft primarily offers borrowing and lending products on Ethereum.

The core features of Raft’s revolutionary protocol are designed to cater to the financial needs of its users:

- Borrowing Stablecoin R: Through the process of staking stETH or wstETH, users gain access to borrowing stablecoin R. This enables them to secure a loan amount equivalent to the value they have staked, providing a seamless and efficient borrowing experience.

- Lending and Profit: Raft protocol extends the opportunity for users to lend the borrowed R stablecoin, which they obtained through staking stETH or wstETH. By actively participating in the lending process, users can increase their overall returns on assets.

- Efficient Asset Management: A standout advantage of the Raft protocol in its ability to assist users in managing and optimizing their capital effectively. By engaging in borrowing and lending using stETH or wstETH, individuals can unlock the full potential of their assets, leading to enhanced financial growth and stability.

- Asset Stability: One of the paramount concerns for users engaged in trading and borrowing is asset stability. Raft addresses this by users allows to stake stETH or wstETH to borrow stablecoin R, thus safeguarding the stability of their assets throughout these processes.

In essence, Raft’s decentralized lending and borrowing protocol on the Ethereum network stands as a pivotal step forward in the realm of blockchain-based finance. By granting users the ability to borrow stablecoin R through staking stETH or wstETH, the platform offers a powerful and secure means of optimizing capital efficiency and enabling asset stability in an ever-evolving digital landscape.

The R token economy has introduced a groundbreaking borrowing and repayment system, revolutionizing the way users interact with the token. This system requires users to create a position by depositing their LSD with a collateral rate of at least 120% for every R token borrowed. The minimum amount of R borrowed has been set at 3,000 tokens (~3,000 USD), ensuring a stable and secure borrowing process.

Borrowing

To borrow R tokens, users must deposit their LSD as collateral, maintaining a collateral rate of at least 120%. This mechanism acts as a safety net for the lending process and protects both borrowers and lenders.

Returning

There are three distinct methods for repaying the borrowed R tokens:

- Loan Repayment: Borrowers can repay the previous loan along with accrued interest to retrieve their collateral LSD token. This method encourages responsible borrowing and timely repayment.

- Redemption: Holders of R tokens can participate in the market and acquire another borrower’s collateral LSD. This allows for greater flexibility in the ecosystem, as tokens can change hands while maintaining stability.

- Liquidation: In case of default, a Liquidator pays off the borrower’s debt with R tokens at the Minimum Mortgage Rate (MCR) and receives the collateral LSD token along with the Liquidation Bonus from the previous borrower. This process helps maintain the liquidity and health of the overall economy.

Furthermore, to ensure the stability of the R token economy, the number of R tokens used in these repayment methods will be burned.

Flash Mint

The introduction of Flash Mint has empowered users with a powerful tool that allows them to mint R tokens up to 10% of the total R supply without making any initial payments. However, there is a 0.5% Fast Mint Rate applicable, which needs to be repaid in the same transaction. Initially, the rate has been capped at 0.5%, but market efficiency can push it up to 5%.

Oracle

The R token economy boasts a sophisticated Oracle system designed to be adaptable and maintainable in a multi-signature configuration. This setup enables participants with multisig capabilities to make necessary updates, ensuring the system remains robust and reliable even as market dynamics change.

Features

Raft has seven features: Position, Redeem, Mint, Leverage, Liquidators, Frontend Operators, and Governance Forum.

Position

Raft enables users to borrow R tokens by opening a new position, with each wallet address representing one position. To borrow R tokens, users must stake stETH or wstETH with a minimum collateral rate of 120%. The borrowing process entails certain requirements, including a minimum loan amount of 3,000 Rs. Additionally, users are subject to a borrowing fee paid in R tokens, calculated based on the borrowed amount and rate, which is influenced by the frequency of redeeming the R token.

Redeem

The Redeem feature facilitates the exchange of R tokens for wstETH, with a conversion rate of 1:1 to USD. The feature involves two primary roles: Redeemers and Redemption Providers (RPs). Redeemers seek to convert R tokens into wstETH, while RPs offer wstETH to facilitate redemptions. Raft incorporates a spread mechanism, varying from 0.25% to 100%, to mitigate risks for Redeemers. Additionally, Redeemers are subject to a Redeem Fee, calculated based on the Redeem value and rate, with RPs earning a fee based on a percentage of the total fee.

Mint

Raft allows users to mint up to 10% of the total supply of R tokens. Minting requires users to pay back R tokens in the same transaction, accompanied by a mint fee of 0.5%. Initially fixed at 0.5%, the mint fee is subject to adjustment based on the effective utilization of R tokens.

Leverage

The Leverage feature empowers users to enhance their capital ratio for each trade, enabling higher profits from smaller investments through custom margin ratios. However, users should exercise caution, as leverage amplifies the risk of losses, especially during periods of intense market fluctuations. To maintain stability, Raft sets the maximum leverage at 6%.

Liquidator

The Liquidator’s role is crucial in ensuring that each R token maintains a value backed by 1 wstETH token, equivalent to 1 USD. In the event that a Minter’s collateral falls below 120%, they face liquidation. Users can participate as Liquidators, settling a Minter’s debt and receiving wstETH equivalent to the liquidated amount. Raft incentivizes users to become Liquidators through liquidation rewards, offering an additional source of income.

Frontend Operators

Raft extends its support to developers through the Frontend Operators feature, offering a toolkit that facilitates seamless integration with user dApps. Additionally, Frontend Operators gain marketing support through promotional campaigns, helping them maximize their potential rewards and contributions to the project.

Governance Forum

To maintain decentralization, Raft provides users with an opportunity to participate in the governance forum, enabling them to actively contribute to the platform’s governance. Users can voice their opinions on key areas such as the appointment of the Liquidity Committee, defining liquidity pools for the R token, treasury fund allocation, and protocol fees, including mint fees.

Team

David Garai (Founder) is the project’s strategic, financial, and operational leader. He has worked as a lawyer in both London and Tokyo.

Raft’s co-founder, Ore Mijovi, is in charge of technological supervision. He formerly worked at the Ethereum Foundation as a lead developer of the Solidity compiler.

Investors & Partners

Investors

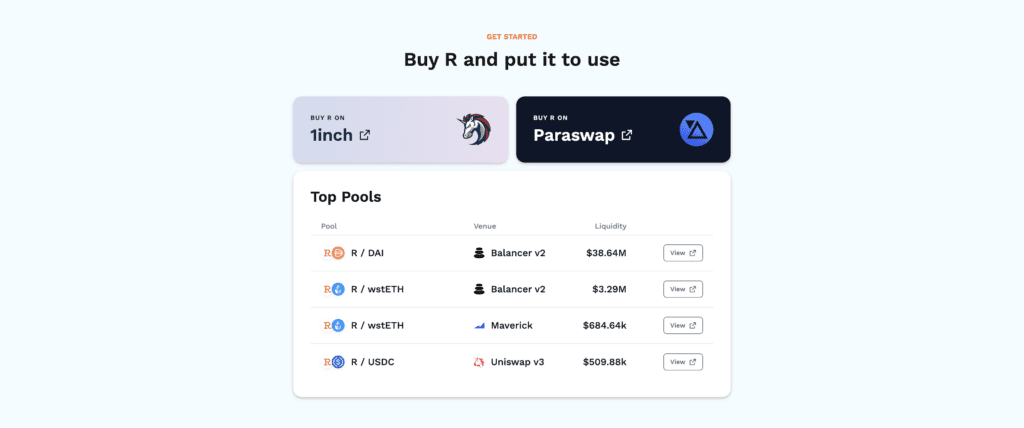

While the precise amount collected by the Raft Finance project is unknown, it is obvious that the initiative has attracted funding from renowned investment firms such as Jump Crypto and Wintermute.

Partners

The project does not disclose many partners, but notable names are Maverick and Uniswap.

Conclusion of Raft Review

In the realm of decentralized finance (DeFi), the LSDfi sector has seen remarkable innovations, with Raft Finance emerging as a notable player alongside its leading counterpart, Lybra Finance. While both projects operate within the LSDfi landscape, they boast distinctive features that set them apart.

One of the striking contrasts lies in their loan mechanisms. Lybra Finance stands out for its interest-free loans, offering users an attractive borrowing proposition. On the other hand, Raft Finance has opted for a conservative yet practical approach, attaching a modest 5% interest rate to its loans. This distinction signifies a choice between flexible borrowing in Lybra and a slightly costlier but stable borrowing model in Raft.

The project’s emphasis on creating trust around its stablecoin could be seen as a daring move, but it also reveals the team’s confidence in the stability and value proposition of their offering. This “trust-building” strategy will likely unfold over time, allowing the community to assess its effectiveness and risk implications.

At present, the Raft Finance project remains relatively enigmatic, with limited information available for analysis. As the community gains first-hand experience with the platform, a clearer picture will emerge, enabling us to make informed judgments about its position and potential within the LSDfi segment. Hopefully, the Raft Review article has helped you understand more about the project.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.