US SEC Charges Quantstamp $2.5M With Unregistered Securities ICO In 2017

Key Points:

- The US SEC charged Quantstamp with unregistered crypto-security ICOs in 2017.

- Quantstamp has raised over $28 million by selling QSP tokens to approximately 5,000 investors.

- The platform agreed to settle the allegations for $2.5 million without admitting or denying the SEC’s findings.

According to Blockworks, the US Securities and Exchange Commission (SEC) accused Quantstamp of conducting an unregistered initial coin offering (ICO) of crypto-security in 2017.

According to regulatory filings, Quantstamp has raised over $28 million by selling QSP tokens to about 5,000 investors. The filing adds that the company plans to use the proceeds from the ICO to develop a protocol on the ethereum blockchain that will provide automated security audits for smart contracts.

The company allegedly made QSP buyers expect the value of the tokens to increase with the success of the company’s business. In a press release last week, the SEC said it had taken steps to make the tokens tradable on third-party digital asset exchanges after the ICO.

Quantstamp claimed that the unregistered sales of QSP were exempt, but “failed to qualify for any exemption to registration,” the SEC said in a news release last week.

Quantstamp agreed to settle the charges without admitting or denying the SEC’s findings, paying nearly $2.5 million in judgment, interest, and a $1 million civil penalty. The company’s automated smart contract security audit platform, built in June 2019, is no longer operational.

The settlement comes about a week after a US district judge ruled after a nearly three-year span on SEC allegations that Ripple’s XRP token sale was a service unregistered security.

Quantstamp is the first Smart Contract security audit protocol. Specifically, they solve security problems by creating a scalable and cost-effective system that allows audits of all Smart Contracts on the Ethereum platform. It attracted a lot of attention from the community after the ICO announced QSP at the end of 2017 and went on Binance afterward.

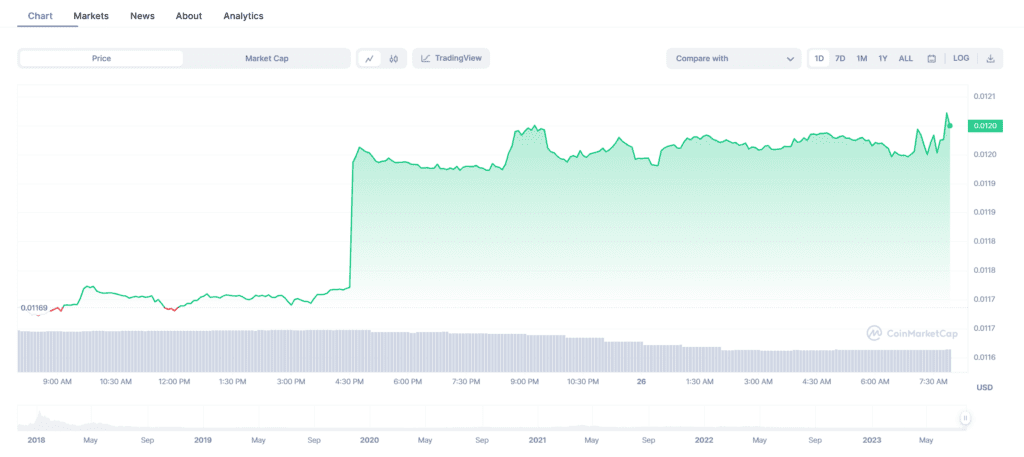

Contrary to the sharp decline of tokens when caught in legal trouble with the SEC, QSP is even up 3% in the past 24 hours and is currently trading at $0.012.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.