Hyperchains & Hyperbridges: Lead The New Way To Seamless Asset Exchange

Key Points:

- ZK Stack’s Hyperchains offer ownership and customization for L2/L3 blockchains, enabling seamless asset exchange.

- Hyperbridges facilitate cross-chain communication and liquidity for user assets in ZK Credo’s ecosystem.

- Challenges include Hyperbridges’ complexity, limited native token use cases, and the need for a user-friendly interface for mass adoption.

ZK Stack is a highly customizable, diverse, open-source framework that makes it easy for developers to build a Layer 2 or Layer 3 based on Zero-knowledge (ZK) technology. The advantage of ZK Stack lies in the fact that they are technically quite clear when announcing both Hyperchains and Hyperbridges as cross-chain bridges similar to Cross-Consensus Message format (XCM) or Inter Blockchain Communication (IBC). Let’s find out in detail about two important factors of ZK Stack with Coincu.

What are Hyperchains?

ZK Stack introduced its cutting-edge Hyperchains, boasting two key features that promise to redefine the industry: sovereignty and seamless connectivity. The Hyperchains offer complete ownership and unparalleled customization for creators, ushering in a new era of decentralized applications and asset exchange.

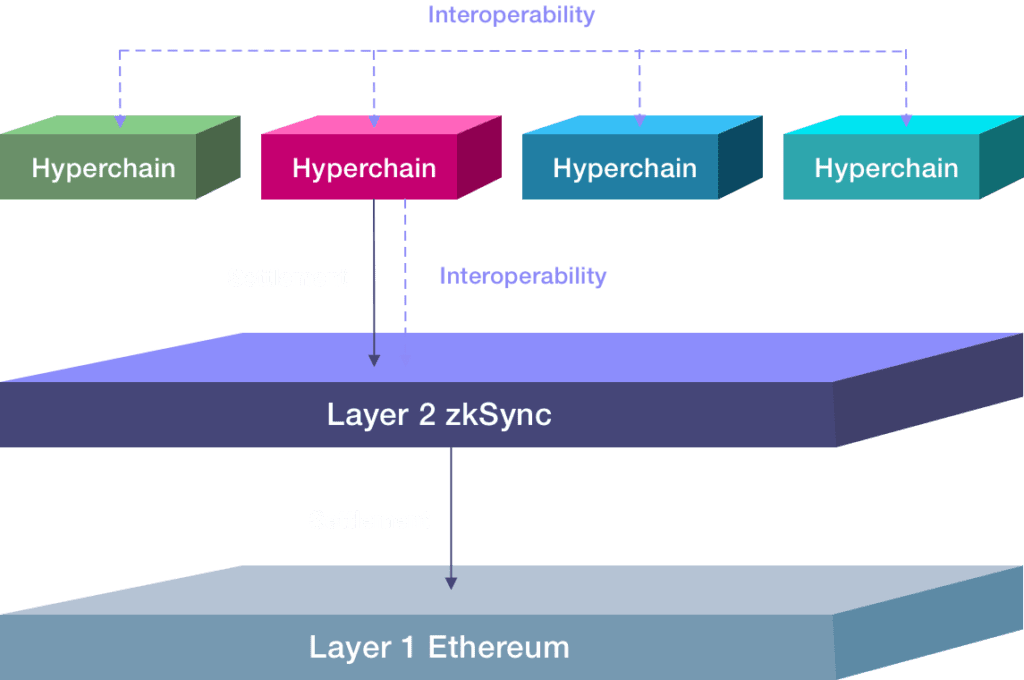

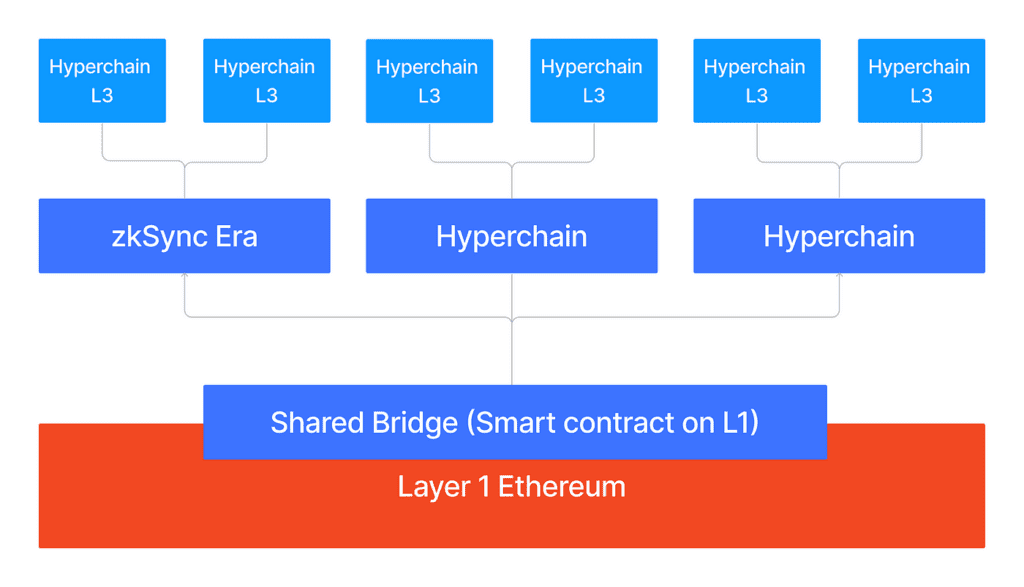

At its core, the ZK Stack’s Hyperchains are L2 or L3 blockchains built atop the platform. Depending on their origins, they are classified as either Layer 2, similar to zkSync Era, if constructed on Ethereum, or Layer 3 if directly built on zkSync Era.

The ZK Stack’s architecture facilitates trustless interoperability through a network of Hyperbridges, ensuring fast and cost-effective asset exchange across Hyperchains. The entire chain of trust can be completed within minutes, with the exchange process equivalent to a single transaction.

The Data Availability features of Hyperchains are diverse, catering to different blockchain requirements:

- zkRollup: Designed for DeFi-oriented blockchains with high security and decentralization needs. Data is sent from L3 to L2 and ultimately to L1, ensuring robustness.

- zkRollup (Inputs Only): An enhanced mode where additional transaction information is placed on Layer 1, boosting security beyond regular zkRollup.

- zkRollup (Self-hosted): Users are required to store all their data, aiming to drive blockchain mass adoption.

- zkPorter: Ideal for NFT, gaming, and social blockchains with scalability as a priority. Most data is stored off-chain and only hashed back to L1, resulting in nearly zero transaction fees. However, there is a risk of collusion among validators.

- Validium: A combination mode merging zkRollup and zkPorter, offering flexibility based on security, decentralization, and scalability priorities.

- Hyperchains are also highly customizable in terms of Tokenomics, Data Availability, Sequencers, and more. They enjoy the autonomy to switch between L2 and L3, offering unparalleled flexibility.

Developers are empowered to create their own Data Availability solutions, further enhancing the ecosystem’s versatility and innovation. Moreover, the Hyperchains are not just limited to addressing scalability challenges; they also offer Execution options:

- Centralized Sequencer: Leveraging a centralized sequencer, the network prioritizes scalability with rapid transaction validation, taking approximately 0.01 seconds.

- Decentralized Sequencer: Hyperchains can opt for various consensus algorithms like Tendermint or HotStuff by decentralizing the transaction arrangement process.

- Priority Queue: Forgoing a sequencer altogether, this option enables transactions to be directly validated at L2 or even L1.

What are Hyperbridges?

Hyperbridges are designed as a sophisticated system of smart contracts that play a pivotal role in verifying Merkle proofs from transactions occurring on various Hyperchains. This breakthrough development ensures seamless communication and interoperability between different chains, fostering a more unified and liquid ecosystem for user assets.

One of the key advantages of Hyperbridges lies in their ability to lock user assets in smart contracts on L1, the base layer of the ZK Credo ecosystem. This approach offers users a sense of security and decentralization, particularly in contrast to Ethereum-based solutions. By leaving the original assets at L1, users can rest assured that their holdings are safeguarded and well-protected within the ecosystem.

Moreover, Hyperbridges bring an essential speed improvement to the ZK Credo network. While many optimistic rollup solutions often suffer from the issue of slow withdrawals on L1, the zkRollup integrated within Hyperbridges offers a remarkable resolution time, typically concluding within minutes. This time variance depends on the specific Hyperchains involved, showcasing Matter Labs’ dedication to optimizing user experience and transaction efficiency.

Advantages and disadvantages of Hyperchains & Hyperbridges

Advantages

Unlike conventional scalability solutions, Hyperchains present a unique approach by enabling multiple chains with varying degrees of decentralization and throughput to coexist simultaneously. This multi-chain setup allows each Hyperchain to execute different consensus rules, catering to diverse and specific use cases as per the requirements of users.

The key advantage of this architecture is the freedom it grants users to transact through a Hyperchain that aligns perfectly with their needs. For instance, a user engaged in a significant purchase, such as buying a vehicle or a home, may prioritize security and opt for a Hyperchain with robust security measures, even if it means lower processing speeds.

On the other hand, a user involved in a smaller transaction, may prioritize swifter processing speeds and opt for a Hyperchain that prioritizes speed at the expense of some security features.

The modularity of Hyperchains stands as a significant benefit for ZK Stack users. These Hyperchains act as plug-ins that users can optionally integrate into their transactions. This means users have the liberty to choose whether to leverage a Hyperchain or not, depending on their individual requirements and risk preferences at the time of making a transaction.

Disadvantages

Despite the numerous outstanding features, it is essential to acknowledge that the technology also carries certain drawbacks that warrant careful consideration:

- Complexity and Potential Risk in Hyperbridges Model: One of the significant concerns surrounding ZK Credo is the complexity of the Hyperbridges model, which could introduce potential risks. Similar to Polkadot’s Cross-Chain Message Passing (XCMP) protocol, which faced exploits upon its initial launch, the intricate nature of Hyperbridges may expose it to unforeseen vulnerabilities. Ensuring rigorous security measures and thorough testing becomes crucial to mitigate such risks.

- Limited Use Cases for zkSync’s Native Token: The option for Hyperchains to choose their native token as a transaction fee might lead to limited use cases for zkSync’s Native Token. This situation could mirror the challenges faced by Cosmos, where a plethora of native tokens hindered broader adoption. Striking a balance between token utility and seamless integration within the ecosystem becomes vital for zkSync’s growth.

- Network Spam and Potential Security Risks: Setting transaction fees too low may result in network spam, leading to network congestion. Moreover, relying on solutions that minimize Call Data down to L1 may inadvertently create potential security risks. The need for establishing appropriate fee structures and robust security mechanisms is imperative to maintain the network’s stability and safety.

- Complicated User Experience: The user experience on ZK Credo may prove to be relatively complex, potentially hindering mass adoption. Without a streamlined solution to simplify UI/UX, Matter Labs may encounter challenges in attracting a broader user base. Enhancing user-friendliness, intuitive interfaces, and comprehensive tutorials can play a significant role in overcoming this dilemma and promoting wider adoption.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.