Key Points:

- Leading venture capital firm Sequoia Capital drastically cuts its crypto fund from $585 million to $200 million.

- The cuts come amid a downturn in the crypto industry to focus on other opportunities.

- Sequoia had previously invested $150 million in FTX, but the company collapsed in November.

Amid a cryptocurrency recession, the inflow of money dropped sharply. The latest name in downsizing crypto investments is Sequoia Capital.

According to the Wall Street Journal, citing people familiar with the matter, venture capital giant Sequoia Capital has slashed the size of its crypto fund by more than 65% to $200 million from $585 million. It also cut the size of an ecosystem fund that invests in other venture funds from $900 million to $450 million.

The downsizing of the fund announced to the company’s limited partners in March of this year, comes amid a widespread downturn in private technology companies and a liquidity crunch for one company’s limited number of partners.

Future crypto funds will be used to support startups, not large companies that are facing challenges under current conditions. As per previous news, Sequoia Capital has reorganized its venture capital team and fired two crypto investors. Last year, the company recorded zero investment in the crypto exchange FTX.

The demise of FTX serves as a wake-up call for the sector, and Sequoia will now roll out its shrinking fund into early-stage companies. The company says it can still invest in cryptocurrencies through its other funds.

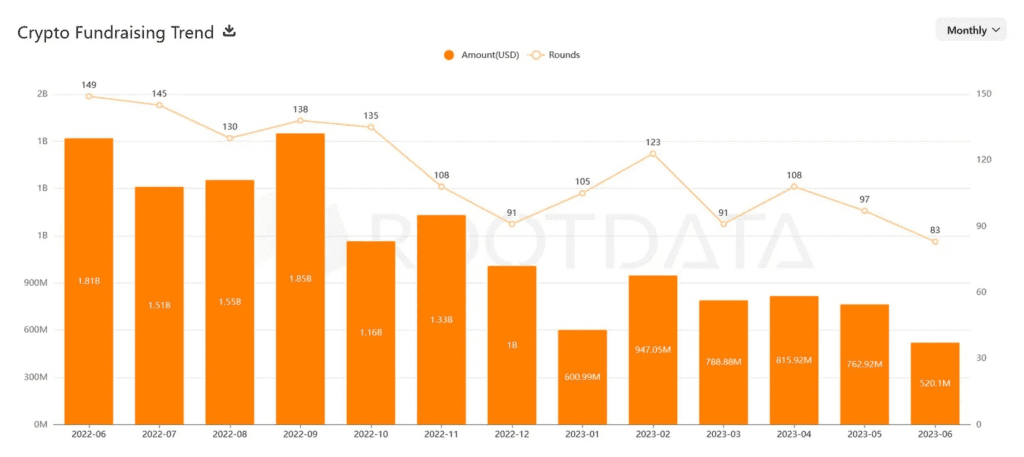

Venture capital investments in cryptocurrency companies have plummeted over 70% over the past 365 days, according to information published by RootData, a crypto data provider. During June 2022, the digital asset space received $1.81 billion in 149 rounds, whereas this year, only 83 projects registered $520 million – the lowest funded month to date.

While it’s true that it will be difficult to raise startup capital in 2023, that doesn’t mean the well has completely dried up – that’s especially true in the crypto space. Last week, crypto startups raised over $200 million in venture capital, led by a $54 million raise for metaverse startup Futureverse and a $40 million Series A round for RISC Zero.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.