Mummy Finance, a SuperDEX, has implemented cutting-edge technology to provide traders with a great experience and reshaped the concept of trading on Fantom Opera. In this Mummy Finance Review, let’s find out through the article below.

What is Mummy Finance?

Mummy Finance is a perpetual DEX and swap offering a wide range of trading options and high liquidity for a wide range of blue-chip crypto assets. The platform represents a new type of decentralized exchange due to the constant innovation driven by its developers.

Mummy Finance aims to be the solution for all traders who want to control their capital and enjoy the best trading experience on Fantom Opera, with unique advantages.

With low swap fees and zero price-affected transactions, it has attracted more than 6,000 user base and facilitated trading volume in excess of $375 million, resulting in a total fee of $700,000 and more than $15 million in TVL. This impressive performance makes Mummy Finance a major player in the derivatives sector.

Why should users choose Mummy Finance for trading?

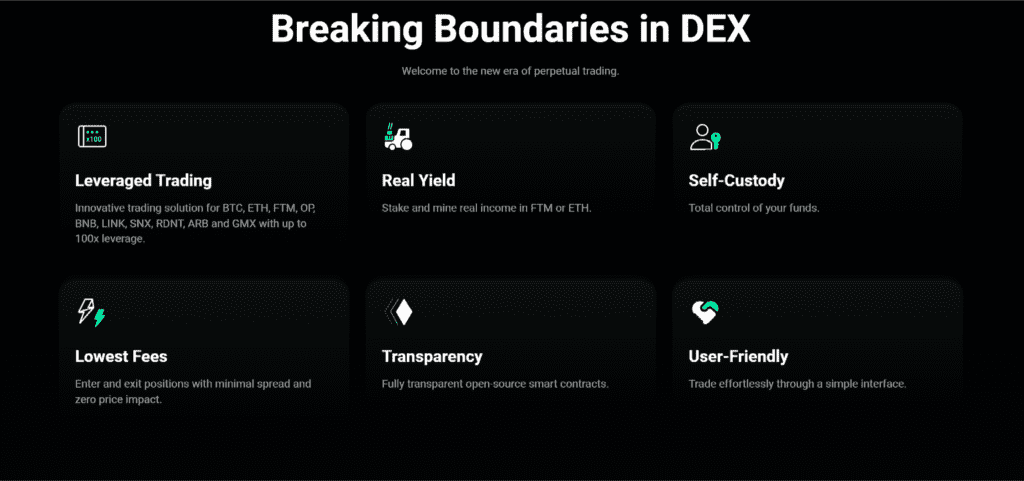

Mummy Finance, like other next-generation decentralized exchanges, offers a wide range of standard and advanced trading features but with the added advantages of anonymity, security, and self-management. Accessing the platform is as easy as connecting your web3 wallet, providing a seamless trading experience for new and experienced traders. Platform provides:

- User-friendly UI/UX for ease of use, with expert mode for experienced traders

- No slippage or unusual liquidations in the perpetual trade, thanks to the price determination provided by Chainlink Oracles

- Fast transaction and low cost

- Expanding trading options, including aggregating and forex, allows Fantom users to access all their favorite options without leaving the network.

What Makes Mummy Finance Stand Out?

In addition to Mummy taking advantage of Fantom Opera to provide the most standard and advanced features for trading, like CEX, with a much higher level of anonymity, security, and self-governance with transaction speed Fast and low cost, the protocol also has a number of important improvements to make it more competitive with well-known CEXs and DEXs:

Multi-asset pool — trading solution without impacting price: For every X amount of assets deposited into the pool, an equivalent dollar amount of index tokens, named $MLP, is minted. The liquidity provider can withdraw at any time by burning $MLP in exchange for any assets in the pool. This is why Mummy Finance review can be used for high volume swaps without affecting the price.

Blockchain technology and oracle pricing: To set prices for each asset, the platform aggregates Chainlink Price Feeds from major DEXs and CEXs. This pricing mechanism is of great benefit to leveraged traders as it reduces the risk of liquidation from temporary wicks.

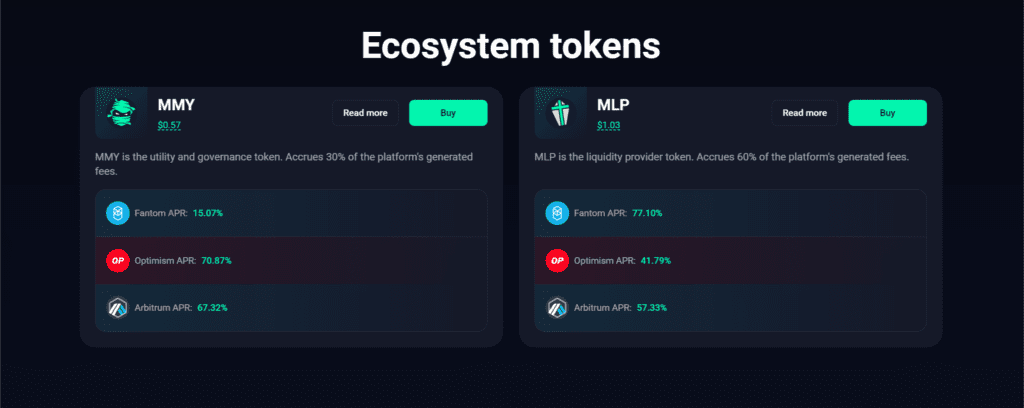

Fair and transparent rewards: 90% of the fees collected by the platform will be distributed to $MMY and $MLP bettors, while the rest is used for redemption and additional liquidity/burn.

Mummy Finance Review: Products

Perpetual trading

Mummy also offers trades with the opportunity to multiply your assets with up to x100 leverage. Mummy allows traders to open leveraged positions through a simple swap interface similar to traditional trading platforms. In addition, Mummy is self-regulating and untrusted, allowing anyone to trade cryptocurrencies directly from their wallets.

The Mummy dual exchange model supports both spot swaps and leveraged trading of perpetual swaps. This improvement enables efficient use of capital as the MLP team has a high utilization of assets, ensuring that user deposits generate additional profits and never sit idly by.

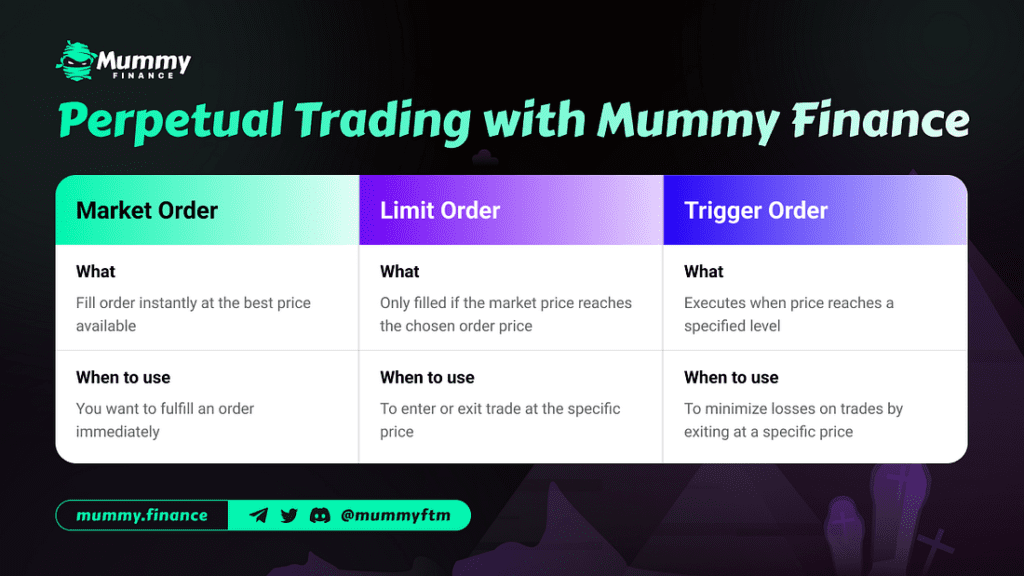

Mummy Finance review offers three types of orders, just like CEX, to fulfill all your perpetual trading needs on Fantom Opera:

- Market order: A market order is an order to buy or sell a cryptocurrency at the best price available in the market. A market order usually guarantees execution but does not guarantee a specific price. Market orders are optimal when the main goal is to execute trades instantly.

- Limit Order: A limit order is an order to buy or sell cryptocurrencies with a limit on the maximum price paid or the minimum price received (“limit price”). If the order is filled, it will only be at the specified limit price or better. However, there is no guarantee of performance (depends on market price)

- Trigger order: A trigger order is a preset order that the user places in advance with the order price and contract amount (like a limit order), which will only be triggered under specific conditions (trigger price/ activated). Once the latest trading price has reached the “trigger”, the pre-order will be executed.

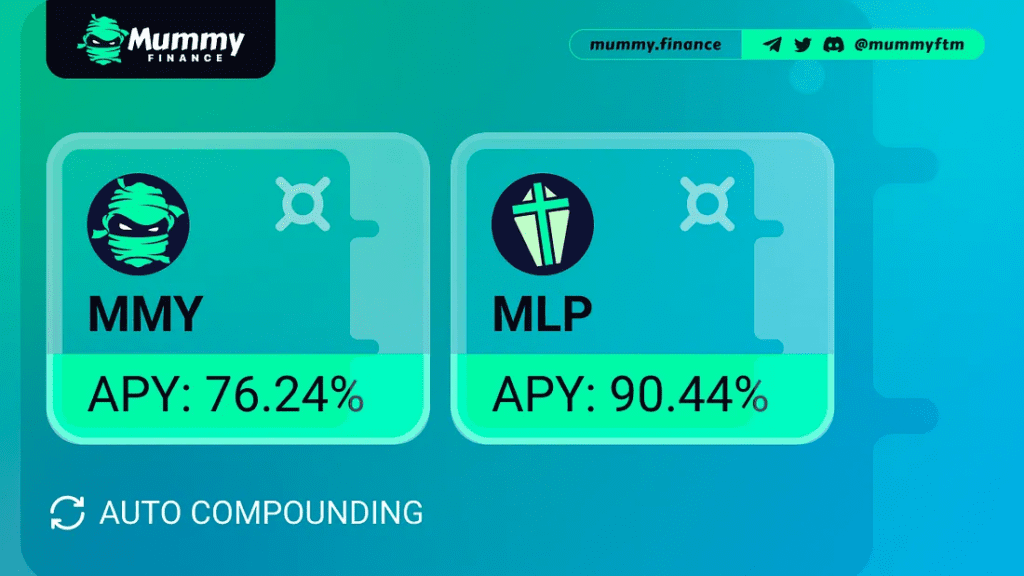

Mummy Vault

Similar to vaults, Mummy Vault will provide a specific set of strategies for productive farming. It leverages automation to continuously invest and reinvest deposits, achieving high compound interest through the platform’s 2-token staking, MMY, and MLP.

For MMY vault

- The Mummy team will bet MMY sent from uses to earn FTM, esMMY and MP.

- esMMY will be staked separately and MPs are staked to increase APR for extra fees.

- All FTM rewards are used to redeem MMY and then staking to get more rewards.

For the MLP vault

- The Mummy Team will stake the MLP sent from users to earn FTM and esMMY.

- esMMY will be staked separately, and MPs are staked to increase APR for extra fees.

- All FTM rewards are used to mint more MLP and then staking to get more rewards.

From there, the Mummy Vault helps stabilize the price of MMY and provides owners with more investment options with their MMY. For holders, MLP provides liquidity to leveraged traders and profits when leveraged traders lose.

Mummy Club NFT

Mummy Club is a collection of 5,000 NFTs (non-fungible tokens) that exist on Fantom, made up of more than 130 hand-drawn characteristics. The collection has been created for the Mummy Finance decentralized perpetual exchange community hence the Mummy logo.

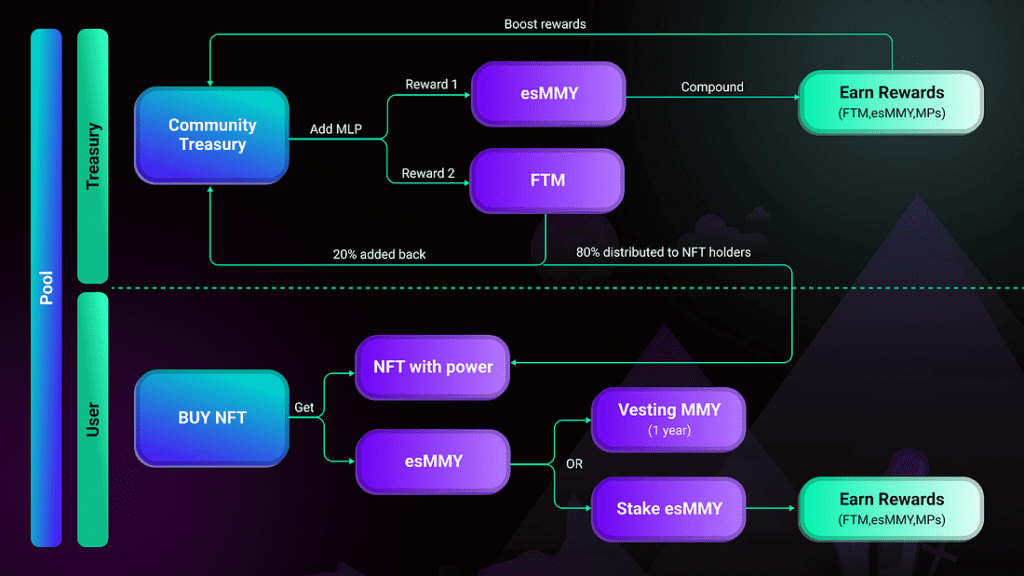

Unlike other Art NFT Collections, Mummy Club is a utility collection of NFTs created for the community to provide more liquidity to Mummy Finance and earn rewards based on the strength of the NFT. Users buy NFT to receive esMMY, from which they can vest MMY for 1 year or stake esMMY to receive FTM.

As shown in the diagram above, Mummy Club owners receive 80% of the Club’s FTM fees, while the remaining 20% is immediately added to the Treasury. Other rewards (in esMMY) are also accumulated in the Treasury. This profit is continuously compounded into an additional token for the team and, thus, can generate even higher returns in the future. These profits are deposited into a distribution contract that Mummy Club holders can take advantage of.

Mummy Finance Review: Tokenomics

MMY token

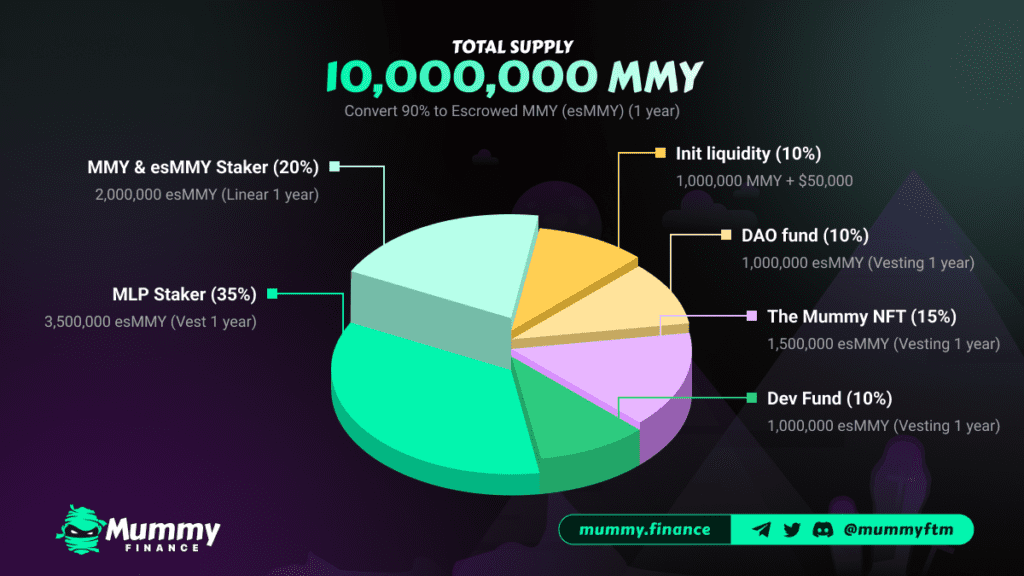

MMY is Mummy’s native and governance token, incentivizing users to stay long, with many rewards accumulating quickly. The max supply of MMY is 10,000,000.

Token Allocation:

- Initial liquidity (10%): 1,000,000 MMY

- The remaining 90% MMY will be converted to Escrowed MMY (esMMY) in 1 year:

- DAO fund (10%): 1,000,000 esMMY (Vesting in 1 year)

- The MUMMY NFT (15%): 1,500,000 esMMY (Vesting in 1 year)

- Dev Fund (10%): 1,000,000 esMMY (Vesting in 1 year)

- MLP Staker (35%): 3,500,000 esMMY (Vesting in 1 year)

- MMY & esMMY Staker (20%): 2,000,000 esMMY (Linear 1 year)

Token utilities:

- Vote for project management.

- Revenue Sharing: MMY and esMMY token holders can stake to receive 30% transaction fee. The remaining fee consists of 60% of the transaction fee belonging to MLP staker, 5% to the team and 5% to buy back and add liquidity for the MMY – FTM pair on the DEX Equalizer.

- MMY and esMMY have a staking mechanism using Multiplier Points, which benefits long-term investors.

MLP token

The MLP includes an index of assets used on the platform for swaps and leverage. Users can mint MLP by adding any index asset to the liquidity pool (LP) while MLP is burned every time user removes any index asset from LP. After minting MLP, it will automatically be staked to earn esMMY, multiplier and FTM rewards.

Holders of the MLP token earn Escrowed MMY rewards and 60% of platform fees distributed in FTM. Note that the fees distributed are based on the number after deducting referral rewards and the network costs of keepers, keeper costs are usually around 1% of the total fees.

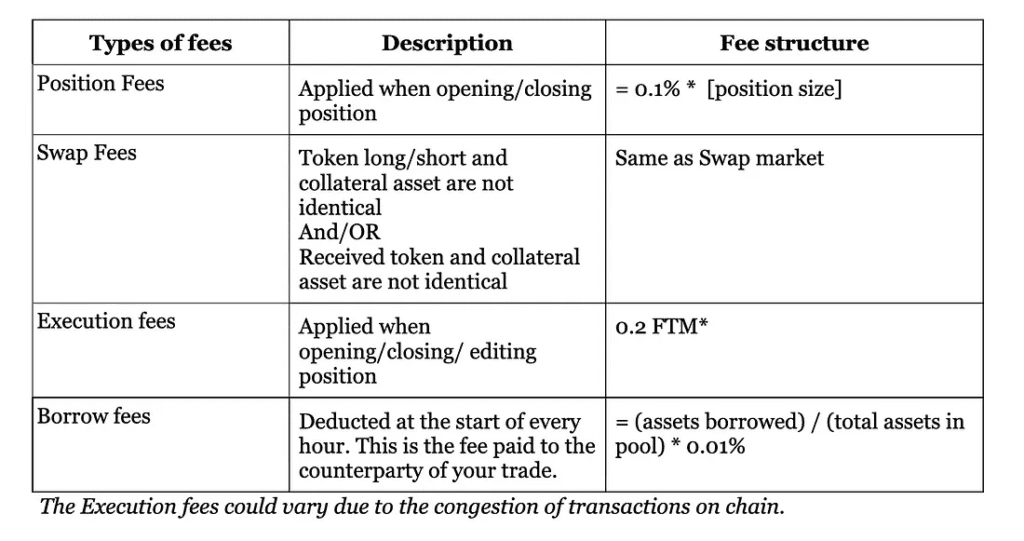

Mummy Finance Review: Fee

Trading

Staking

- 0% deposit fee

- Withdrawal fee 0.1%

- Performance fee 4% (APY shown represents performance fee deducted only from the profit generated)

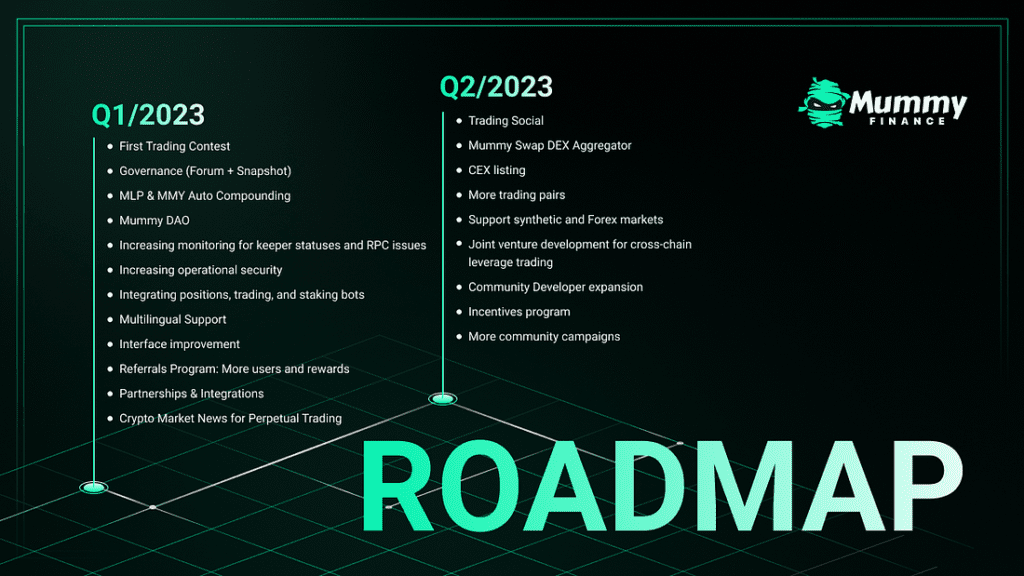

Mummy Finance Review: Roadmap

Conclusion

Mummy Finance review is a derivative and swap exchange on Fantom, forked from GMX’s model with a different Tokenomic model design. The platform is now highly regarded by users entering and exiting positions with minimal spreads and zero price impact making it possible for them to receive optimal prices without incurring additional costs. Simple, user-friendly swap interface. In particular, Chainlink price feeds from major DEXs and CEXs, and this pricing mechanism is of great benefit to leveraged traders as it reduces the risk of liquidation.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.