Velocore Review: Pioneering Platform On zkSync With Ve Model(3,3)

The ve(3,3) model has emerged as a game changer in the creation of DeFi initiatives. Nevertheless, performance and security constraints hampered the model’s evolution. This resulted in the creation of Velocore, a DeFi platform based on zkSync and based on Solidly’s ve(3,3) model with considerable enhancements. Let’s find out details about this project with Coincu through this Velocore Review article.

What is Velocore?

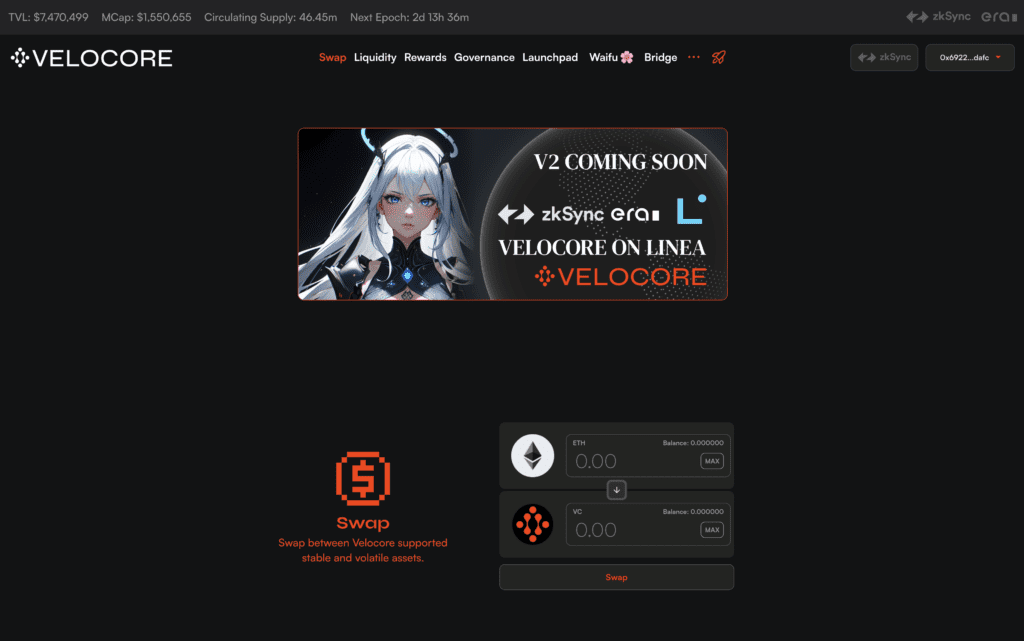

At its core, Velocore serves as an Automated Market Maker (AMM) DEX, which facilitates seamless and trustless token swaps for users. However, what sets Velocore apart is its implementation of the ve(3,3) fork mechanism, originally pioneered by Solidly. This mechanism brings significant improvements to the AMM model, enhancing overall efficiency and security.

The ve(3,3) fork model forms the backbone of Velocore’s AMM DEX. This fork mechanism, inherited from Solidly, is a robust framework that leverages three different types of tokens to manage liquidity pools efficiently. Velocore has managed to overcome the limitations that were encountered by its predecessor, Solidly, by optimally applying the ve(3,3) model. This optimization ensures a seamless and frictionless experience for users, promoting higher transaction speeds and reducing gas fees.

One of Velocore’s standout features is the innovative Protocol Owned Liquidity (POL) mechanism. POL allows Velocore to optimize profits from liquidity and enhance capital efficiency within its ecosystem. This unique approach aims to provide users with a more rewarding experience while promoting sustainability and stability within the platform. By directly involving the protocol in liquidity provision, Velocore aims to minimize impermanent loss and attract more liquidity providers to its platform.

How does it work?

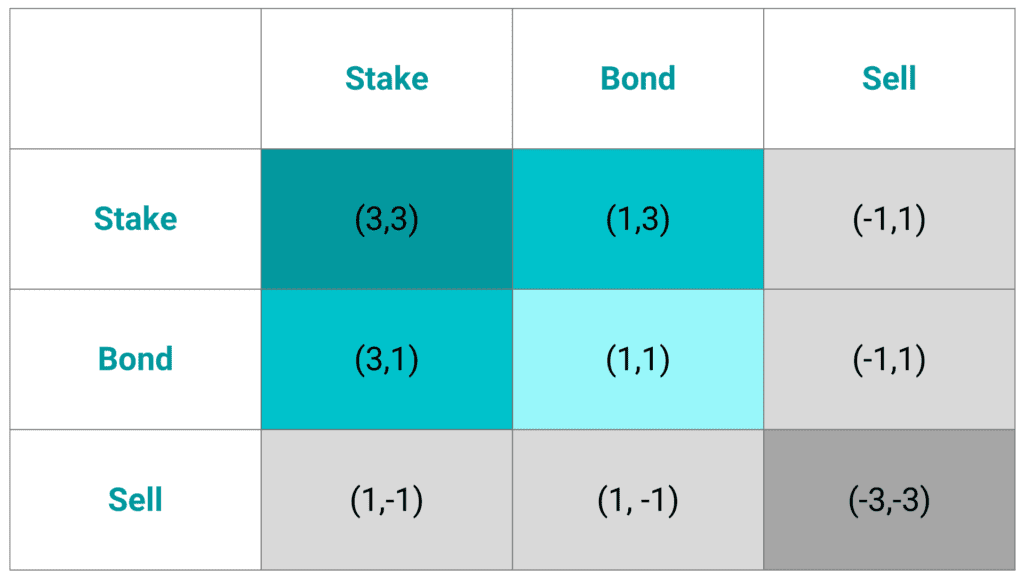

Velocore’s novel ve(3,3) model incorporates two characteristic features aimed at bolstering voting rights and rewards. With inspiration from existing mechanisms such as the “Ve” voting deposit by Curve Finance and the (3,3) approach pioneered by the Olumpus DAO project, Velocore’s ve(3,3) introduces a unique blend of asset locking, incentivized behaviors, and attractive token rewards.

The Ve mechanism, short for “Voting Deposit,” functions by enabling users to lock their assets for specific periods, entitling them to increased voting rights and rewards. As the lock period extends, the voting rights and rewards correspondingly grow, fostering a sense of commitment among participants. However, this approach comes with its challenges, primarily linked to lower liquidity, a concern Velocore acknowledges and seeks to address.

The second characteristic of the ve(3,3) model – (3,3) – encompasses three fundamental components: Staking, Rebasing, and Bonding. Borrowing inspiration from the innovative Olumpus DAO project, this aspect encourages behaviors directly aligned with the protocol’s prosperity – providing liquidity and holding long-term tokens.

Under the ve(3,3) mechanism, liquidity providers stand to receive VC tokens as incentives for their contributions to the network’s liquidity pool. Meanwhile, holders of the veVC tokens gain access to a range of benefits, including transaction fees, rebase rewards, and governance rights.

Velocore also employs the Protocol Owned Liquidity mechanism in conjunction with Reactor Fusion, a loan protocol on the zkSync Era system, to improve the protocol’s liquidity efficiency.

Velocore V2 has announced its mission to transform into an open liquidity platform accessible to all liquidity provider (LP) participants. A major highlight of this development is the elimination of whitelisting requirements, opening the doors for LP providers to freely create gauges and add bribes, fostering a dynamic and inclusive ecosystem.

Unlike traditional platforms that impose stringent whitelisting procedures, Velocore V2 embraces openness and flexibility. LP providers within the Velocore V2 network can now construct pools comprised of various tokens and set their desired fees. As soon as a pool is established, a corresponding gauge is automatically generated, ushering in new possibilities for liquidity optimization.

The introduction of bribes adds an intriguing dimension to Velocore V2’s liquidity market. With virtually anyone having the ability to bribe the gauges, the platform becomes a vibrant space where real-time interactions drive liquidity dynamics.

What sets Velocore V2 further apart is the level of control bestowed upon bribers. They now have the autonomy to choose between the exponential or linear release of their offered bribes, tailor-fitting their strategies to maximize effectiveness. Now, the Velocore Review article will explore the project’s products.

Products

AMM DEX

Velocore allows you to trade 17 different kinds of tokens with little slippage.

Liquidity

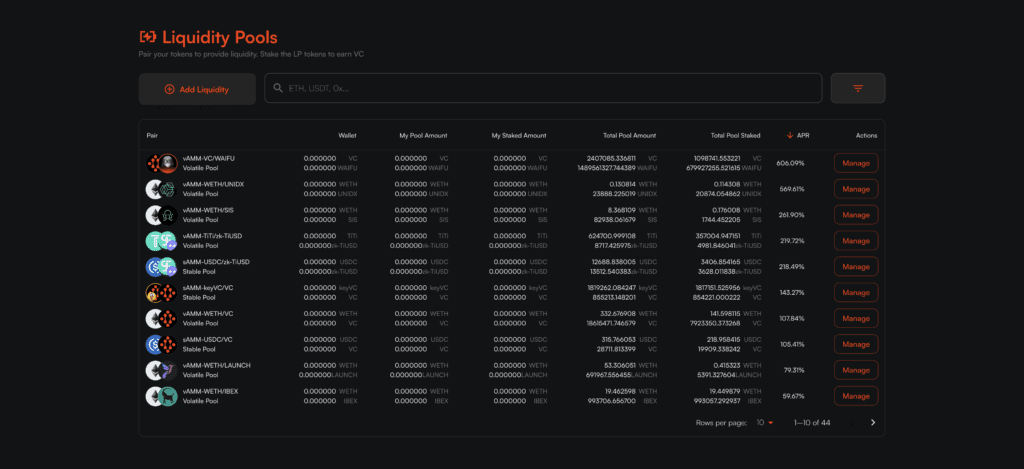

Velocore distinguishes between two primary types of liquidity pools to cater to different asset types and risk preferences.

Stable Pool

The Stable Pool accommodates non-volatile assets, focusing on a combination of two stablecoins: USDC (USD Coin) and BUSD (Binance USD). This pool aims to provide a secure and predictable environment for those seeking minimal exposure to market fluctuations. By adding liquidity to the Stable Pool, users not only contribute to the stability of the platform but also receive VC tokens in proportion to their contribution.

Volatile Pool

For users interested in engaging with more common tokens with potential market volatility, Velocore offers the Volatile Pool. This pool includes assets such as vAMM-VC and WAIFU, providing higher risk but potentially higher rewards. Participants who provide liquidity to the Volatile Pool will receive VC tokens based on their share of the total liquidity provided.

The VC token serves as the core element of Velocore’s ecosystem, enabling users to participate in governance, yield farming, and other DeFi activities within the platform. As the demand for VC tokens increases, liquidity providers can benefit from their holdings, making it a potentially attractive venture for DeFi enthusiasts.

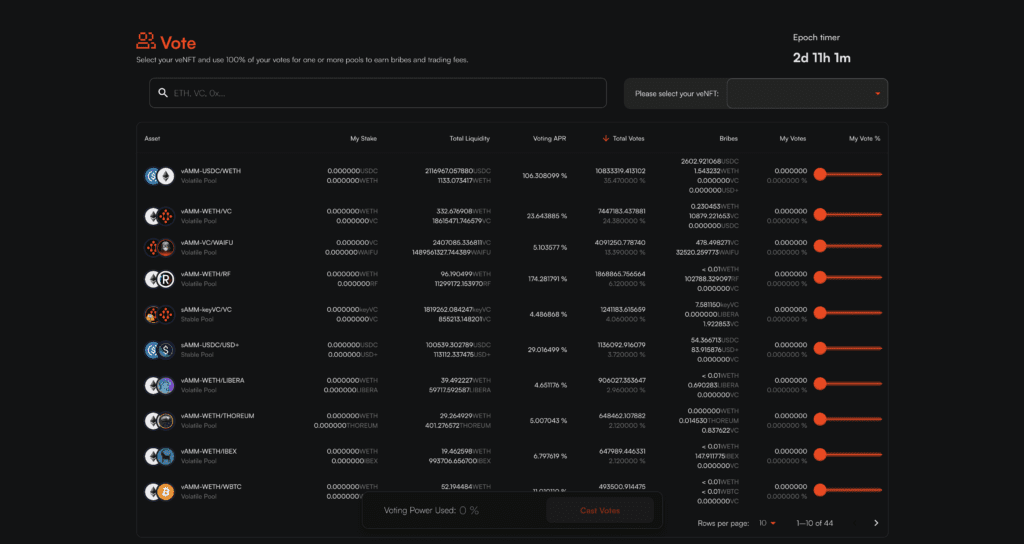

Governance

You must have veNFT to participate in project administration. To get veNFT, you must engage in a VC token lock; the minimum lock period is one week, and the longest is four years; the longer the lock time, the greater the likelihood of obtaining veNFT.

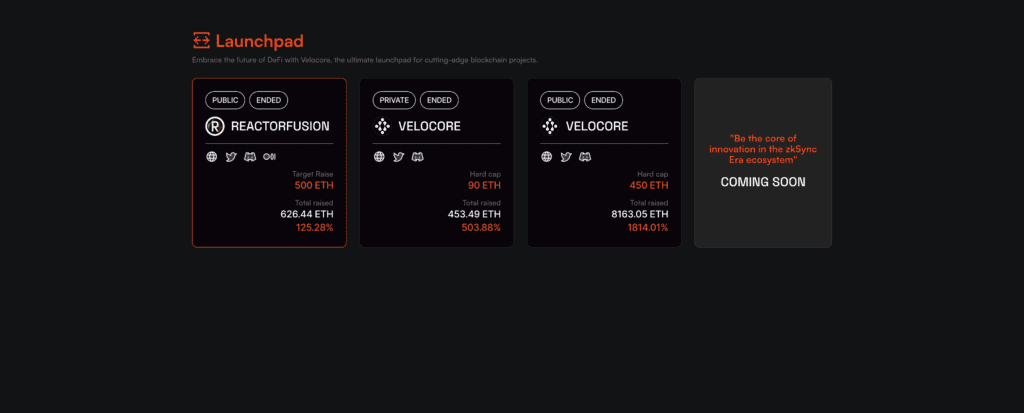

Launchpad

Velocore projects are supported by Launchpad. Participants in the Launchpad will utilize ETH to participate. The first project to launch on Velocore is Reactorfusion.

VC token

Key Metrics

- Token name: Velocore token

- Ticker: VC

- Blockchain: zkSync Era

- Token contract: 0x85d84c774cf8e9ff85342684b0e795df72a24908

- Token Type: Utility

- Token Supply: 60,000,000 VC

- Token Circulating: 36,770,000 VC

NFT veVC is Velocore’s governance token.

Token Allocation

- Private Sale: 7.25%

- Public Sale: 32.75%

- Lockup – Team: 15%

- Lockup – LP: 15%

- Lockup – Ecosystem Fund: 22.5%

- Ecosystem Fund: 7.5%

Use Cases

The VC token presently serves only as a liquidity provider (LP) incentive.

Release Schedule

- Private: April 3-4, 2023, with a hardcap of 4,350,000 VC tokens.

- Public sale: April 4-5, 2023, with hardcap of 19,650,000 VC tokens.

Roadmap

The roadmap includes an array of groundbreaking products and features designed to enhance user experience, foster community engagement, and incentivize token holders. Here are the key highlights:

AMM Engine – Minimizing Gas Fees and Slippage

The first milestone in Velocore’s roadmap is the implementation of an Automated Market Maker (AMM) engine. By leveraging advanced algorithms, this engine aims to minimize gas fees and significantly reduce slippage. Velocore’s AMM engine will support various liquidity pools, including 80/20 pools and 3-stable-pools, ensuring a seamless trading experience for users.

Voting System and Introduction of veVC Token

As a strong proponent of decentralized governance, Velocore is set to introduce a comprehensive voting system. This system will empower community members to participate in decision-making processes, fostering a sense of ownership and transparency. Additionally, the platform will unveil the veVC token, which will be integrated into the voting mechanism to incentivize active participation.

User-Friendly UI Revamp

Velocore places a premium on user experience, and as part of its roadmap, the platform is gearing up for a major user interface (UI) revamp. The redesigned UI will provide a seamless and friendly experience for both seasoned DeFi enthusiasts and newcomers alike, making it easier for users to navigate and interact with the platform’s offerings.

Overflow Launchpad with Farming Incentives

In a bid to reward veVC token holders and promote community engagement, Velocore is introducing the Overflow Launchpad. This innovative feature will enable users to participate in farming activities, earning rewards in proportion to their token holdings.

Token Airdrop for Early LP Users

Velocore’s commitment to rewarding early adopters is exemplified by the Token Airdrop initiative. Users who actively engage in Liquidity Providing (LP) early for farming will have the chance to receive VC tokens during the Proof-of-Airdrop (POAP) event. The Airdrop distribution will be proportionate across different tiers of users, ensuring a fair and inclusive distribution process.

Introducing Memecoin – VCGS

Building on the excitement surrounding the burgeoning meme token trend, Velocore is set to introduce its very own Meme token called VCGS. This move aims to capture the attention of the crypto community and further diversify the platform’s offerings.

Account Abstraction Wallet

To enhance security and streamline user interactions, Velocore is actively developing an Account Abstraction Wallet. This feature will provide users with a secure and efficient way to manage their assets and engage with the platform’s ecosystem.

Investors & Partners

Velocore has recently increased its collaboration with other projects: Ave.ai, LSDxfinance, and @CelerNetwork are a few examples. In addition, information about the project’s investors is not disclosed.

Conclusion of Velocore Review

Velocore has proudly positioned itself as the first v(3,3) decentralized exchange (DEX) project built on zkSync, a cutting-edge layer-2 scaling solution. What sets Velocore apart from its counterparts is not only its innovative technology but also its distinct approach to funding.

Unlike many other projects that boast the backing of prominent investors, Velocore has shunned traditional funding routes. Instead, it has successfully conducted both its private sale and public sale rounds solely through crowdfunding efforts. By relying on the collective support of the community, it aims to create a truly decentralized and inclusive financial ecosystem. Hopefully the Velocore Review article has helped you understand more about the project.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.