KuCoin Bolsters Security With Asset Reserve Certificate Update!

Key Points:

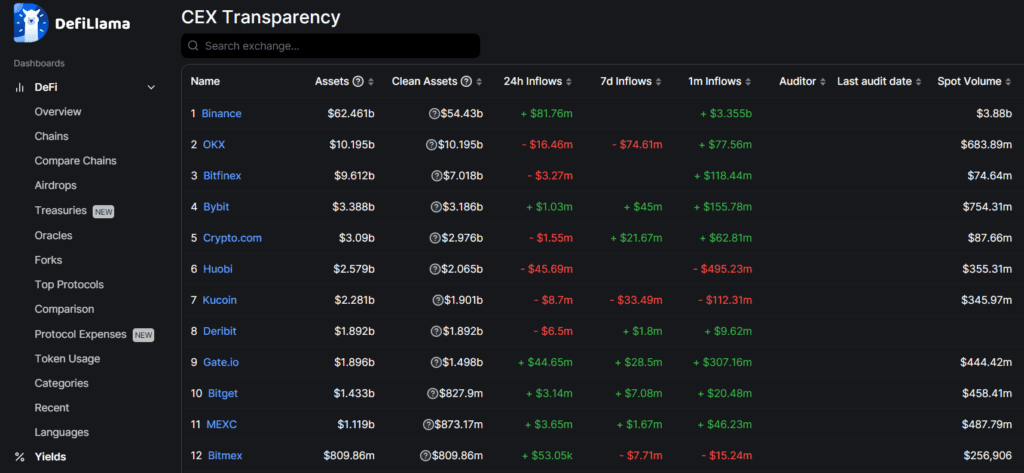

- KuCoin enhances asset reserve certificate for greater transparency and investor confidence.

- As of August 1, KuCoin holds over 19,000 BTC, 157,000 ETH, 920 million USDT, and 96 million USDC.

- Despite a ~US$130 million decrease from the previous month, KuCoin maintains a robust asset reserve.

KuCoin has updated its asset reserve certificate.

As of August 1, the exchange held more than 19,000 BTC, 157,000 ETH, 920 million USDT, and 96 million USDC. Despite a decrease of approximately US$130 million from the previous month, KC’s commitment to maintaining a robust asset reserve remains unwavering.

With the dynamic nature of the crypto market, ensuring the security and solvency of exchanges has become a top priority for investors. In response to this demand, KC has taken the proactive step of updating its asset reserve certificate to provide greater transparency and accountability.

The latest asset reserve certificate reveals the impressive holdings of KuCoin, including more than 19,000 BTC and 157,000 ETH, making it one of the substantial cryptocurrency reserves among exchanges. Additionally, the exchange maintains significant holdings of stablecoins, with 920 million USDT and 96 million USDC in reserve.

While the overall holdings represent a commendable reserve, it’s important to note that there has been a decrease of approximately US$130 million from the previous month. Such fluctuations are not uncommon in the volatile crypto market, and KC’s ability to maintain a robust reserve despite these changes underscores its commitment to managing risk and ensuring the financial stability of the exchange.

The updated asset reserve certificate is a proactive measure by KuCoin to reassure its users and the broader crypto community about its financial standing. By disclosing its holdings, KuCoin provides investors with essential information to make informed decisions and reinforces trust in the platform.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.