Key Points:

- Ukrainian National Bank demands financial statements from local crypto companies.

- Kuna exchange leaves the Ukrainian market due to NBU’s actions, facing significant volume reduction.

- IRS collaborates with Ukraine to tackle crypto-related sanctions evasion.

According to a Cointelegraph report, the government of Ukraine has recently approached the country’s cryptocurrency industry with a new request for financial information.

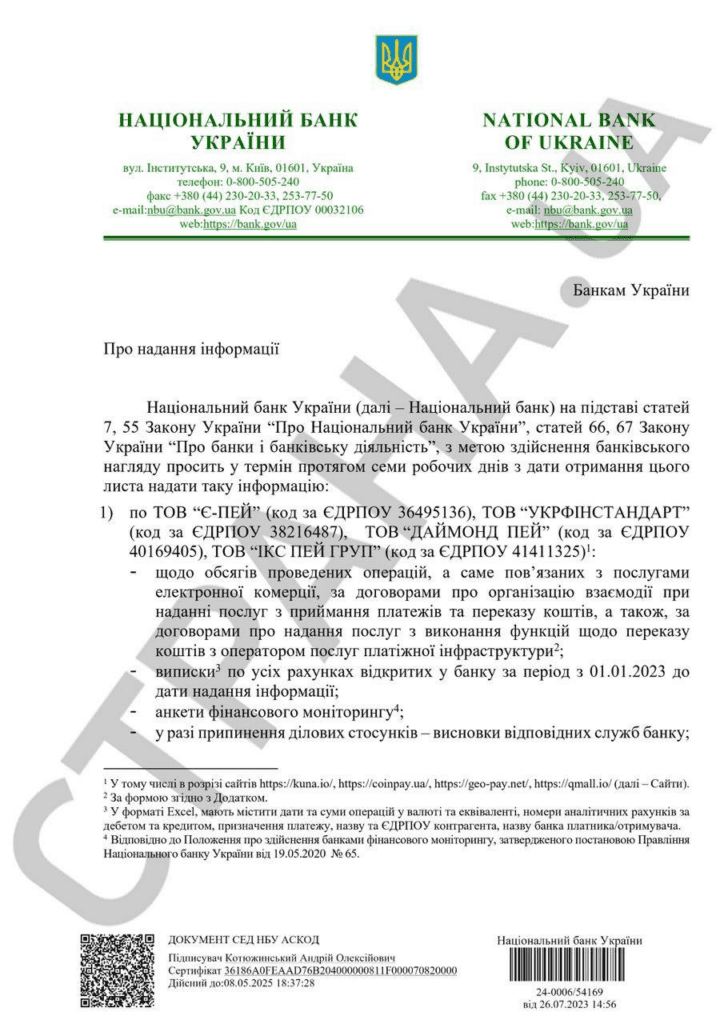

The National Bank of Ukraine (NBU) has specifically targeted four local crypto companies – Kuna, CoinPay, GEO Pay, and Qmall – demanding their financial statements for the first two quarters of 2023. The NBU set a tight deadline, requiring cryptocurrency businesses to submit their financials within just seven days.

The revelation of this request came to light through Michael Chobanyan, the founder and CEO of Kuna exchange, who shared the news on July 3. He referred to a document distributed by the Ukrainian Telegram news channel, Politics of the Country, which contained the NBU’s demands.

In addition to financial statements, the NBU also seeks data on the operating volumes of these crypto companies, along with detailed information regarding the receipt and transfer of funds. Furthermore, Ukrainian cryptocurrency firms are required to provide statements for all accounts dating back to the beginning of 2023.

Chobanyan confirmed the NBU’s action through his own Telegram channel, expressing uncertainty about the reasons behind the latest move. He noted that such information had never been requested in Ukraine before, even before the launch of Kuna back in 2015. Chobanyan speculated that the government’s intentions were apparent, referring to a series of recent searches and raids on exchanges across the country triggered by the actions of the NBU, the Ministry of Internal Affairs, and the Security Service of Ukraine.

The repercussions of the NBU’s actions have been significant for the Kuna exchange. In March 2023, Kuna made the decision to leave its business-to-customer market in Ukraine due to what Chobanyan described as “predatory actions” by the NBU.

He expressed concern that such measures were undermining the potential of his country in the crypto and Web3 space. As a result of these regulatory challenges, Kuna’s exchange volumes have plummeted by 90% in recent months. Previously, the company also faced a substantial drop in volumes when it exited the Russian market after February 24, 2022.

While the reasons behind the NBU’s stringent actions remain unclear, they have undoubtedly sparked debates within the Ukrainian crypto community and raised concerns about the future of the industry in the country.

Meanwhile, on a separate note, the Internal Revenue Service (IRS) criminal investigative division is ramping up its efforts to pursue sanctions evaders, collaborating with Chainalysis, a blockchain analytics company, and Ukrainian investigators. Approximately 50 Ukrainian law enforcement officers recently attended a virtual training session to bolster their engagement in combating crypto-related crimes.

In April, Ukrainian officials attempted to implement particular MiCA regulations in order to legalize crypto assets in the nation. They predict Ukraine will be one of the first countries to implement new EU regulations into domestic law.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.