Binance Defies China’s Ban, Facilitating $90 Billion in Trades: Report

Key Points:

- Binance enables $90 billion in banned crypto trades in China.

- China emerges as Binance’s top market, accounting for 20% of global volume.

- Regulatory concerns surround Binance’s secretive operations in the country.

In a surprising turn of events, Binance, the world’s largest cryptocurrency exchange, has reportedly facilitated cryptocurrency-related asset trades worth a staggering $90 billion in China over a single month.

The Wall Street Journal revealed this information, citing internal figures and accounts from both current and former employees of the exchange. Notably, cryptocurrency trading has been illegal in China since 2021, making this revelation all the more astonishing.

According to the report, the transactions in China accounted for a significant 20% of Binance’s global trading volume, excluding trades made by a select group of large-scale traders. However, the exact month in which these transactions took place was not specified in the report.

Binance has deep roots in China, where it was founded in 2017. The exchange represented mainland China until regulatory restrictions forced it to relocate its operations. Despite this move, China has remained the largest market for the exchange, followed by South Korea, Turkey, Vietnam, and the British Virgin Islands, as per documents examined by the Wall Street Journal.

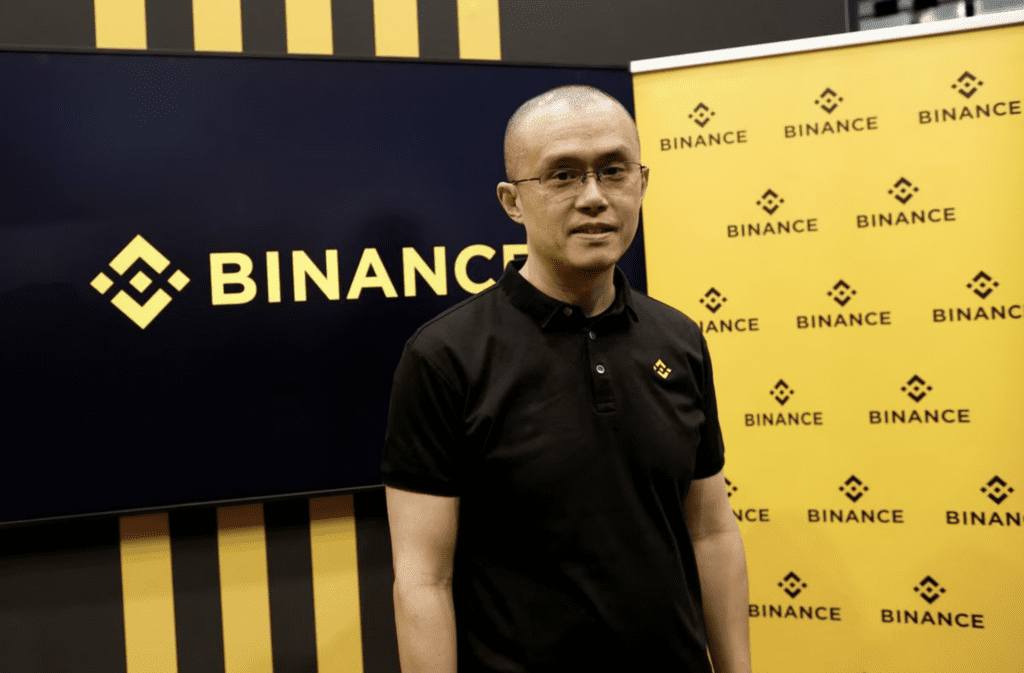

The exchange’s activities in China have not gone unnoticed by regulators, both in the United States and China. The Commodity Futures Trading Commission (CFTC) sued Binance, alleging it operated an “illegal” exchange and had a deceptive compliance program. Meanwhile, the Securities and Exchange Commission (SEC) sued the exchange and its CEO, Changpeng Zhao, accusing them of inflating trading volumes, diverting customer funds, misleading investors, and failing to restrict U.S. customers from using the platform.

Furthermore, Binance is under investigation by the U.S. Justice Department over potential money laundering and sanctions violations. During a Senate Banking Committee hearing in December, U.S. Senator Bill Hagerty expressed concerns that the exchange might be controlled by the Chinese government, though the exchange denied any legal entities or ties in China.

The Journal’s data highlights that China’s market accounted for $80.6 billion in futures trading and $9.4 billion in spot trading for Binance. South Korea, on the other hand, provided $56.9 billion in futures volume and $1.39 billion in spot volume. Interestingly, despite the ban on cryptocurrencies within China, Binance’s teams actively collaborate with Chinese law enforcement to identify potential criminal activity. Additionally, the exchange boasts approximately 900,000 active users within the country.

Chinese traders have been evading geographical restrictions through a combination of a Virtual Private Network (VPN) and digital residency programs like Palau’s RNS.ID. Binance also operates an active peer-to-peer crypto market that allows trading in Chinese yuan-denominated pairs, with fiat onramps through Alipay and WeChat pay.

Maintaining a presence in China has become crucial for Binance, especially amid the ongoing regulatory scrutiny and concerns raised about its future. While the exchange claims its website is blocked in China and inaccessible to China-based users, internal documents suggest otherwise, outlining methods to bypass the ban and redirect users to different websites with Chinese domains before ultimately leading them to Binance’s global platform.

Despite the obstacles, Binance continues to thrive and process more cryptocurrency transactions globally than most of its competitors combined. The revelations of its activities in China provide a glimpse into the exchange’s ability to operate discreetly in unwelcome territories, sparking concerns among regulators and investors alike.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.