Why Is Arbitrum Having Certain Dominance Against Optimism?

In recent times, the market for Layer 2 solutions has witnessed remarkable growth, offering a promising path to scalability for blockchain platforms. However, this expansion has also triggered a surge in competition within the industry. One notable contender that has emerged is Arbitrum, which is poised to challenge and potentially outperform other Layer 2 solutions, such as Optimism. Let’s find out with Coincu the outstanding advantages that Arbitrum brings compared to Optimism.

Overview

Ethereum is one of the leading platforms for smart contract execution. However, as its popularity surged, so did the challenges of scalability and high transaction costs. To address these issues, a groundbreaking Layer 2 scaling solution called Arbitrum stepped in, revolutionizing the Ethereum ecosystem.

Arbitrum serves as a beacon of hope for Ethereum enthusiasts seeking faster smart contract transactions and decreased transaction expenses. By functioning as a Layer 2 solution, it effectively handles blockchain transaction processing and batching, alleviating congestion and cost burdens from the Ethereum main network.

The key driving force behind the success lies in its ability to power swift, smart contract transactions without compromising on security and decentralization. By implementing advanced algorithms and a robust consensus mechanism, it achieves remarkable efficiency while maintaining the utmost trust and reliability.

Optimism is also a pre-existing solution. In 2019, Ethereum developers founded Optimism, an innovative Layer 2 (L2) blockchain that leverages optimistic rollups to process transactions in batches, unlocking a realm of cheap and nearly instantaneous transactions for users.

Optimism aims to revolutionize the way transactions are handled on the Ethereum blockchain. The key to its success lies in its implementation of optimistic rollups, a scaling technique that aggregates multiple transactions into a single batch, reducing congestion and gas fees significantly.

One of the main advantages of Optimism is the accessibility it offers to users. With transactions becoming cheap and nearly instantaneous, users can experience a seamless and efficient blockchain experience. The high-speed nature of transactions opens up new possibilities for various use cases, especially in the realm of decentralized applications (dApps) and decentralized finance (DeFi).

Arbitrum’s superiority against Optimism

Market share

While Ethereum has taken the native scaling route with a comprehensive roadmap following its shift to proof-of-stake after the Merge, layer-2 chains like Arbitrum and Optimism have stepped in to alleviate the network’s workload.

Arbitrum and Optimism employ optimistic rollups, a similar technical approach, to bundle hundreds of transactions into a single block, thus easing the traffic on the Ethereum mainnet and enabling faster and cheaper transactions on the secondary layer.

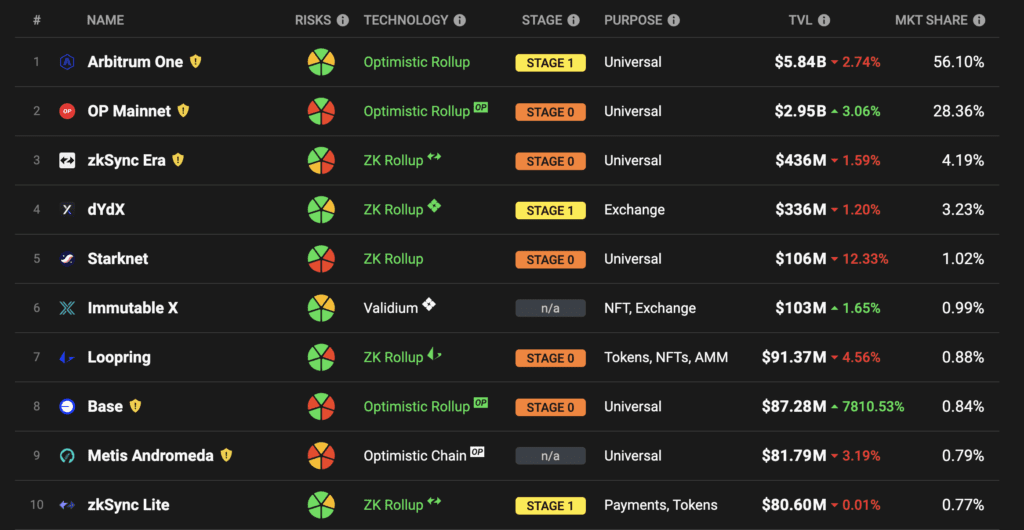

As per recent data from DefiLlama, Arbitrum has gained a significant lead over Optimism in Total Value Locked (TVL), boasting more than double the value locked. With a market share of 56.1% and a staggering total value locked of over $5.84 billion, Arbitrum currently stands at the forefront of layer-2 usage, according to L2 Beat, a platform tracking layer-2 projects.

Nansen, a blockchain analytics platform, predicts that Arbitrum will continue to lead the wave of Ethereum scalability solutions in the foreseeable future as developers increasingly turn to build on its platform.

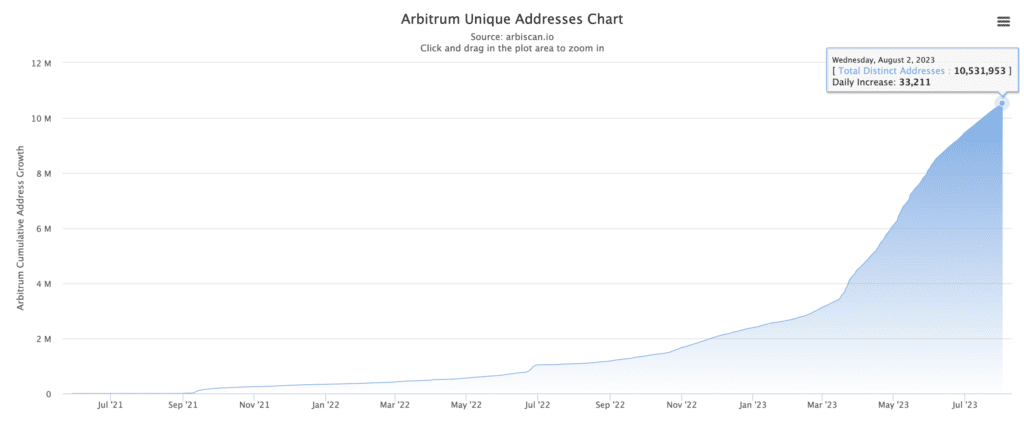

Currently, it boasts an impressive user base, with 10,531,953 unique addresses on its platform, indicating a growing community of users embracing its advantages.

Mode of operation

According to a report by Nansen, optimistic rollups like Arbitrum, Boba Network, and Optimism show promise in enhancing Ethereum’s scalability. However, their early-stage development brings forth certain challenges. For instance, long withdrawal times, lasting up to seven days due to potential fraud disputes, remain a concern. Moreover, interoperability issues and fragmented liquidity among different rollups add complexity to the ecosystem.

Let’s delve into the key differences between Optimism and Arbitrum:

- Architecture: Optimism utilizes an optimistic rollup architecture, while Arbitrum operates on a sidechain architecture. This fundamental distinction impacts their approaches to scalability and security.

- Transaction Speeds: Both Optimism and Arbitrum aim to increase transaction speeds on Ethereum. Optimism claims to achieve up to 20,000 transactions per second (TPS), while Arbitrum boasts an impressive 40,000 TPS. This significantly outpaces Ethereum’s base layer, which can only handle 15 to 30 TPS. Additionally, its lower transaction fees further enhance its appeal to users seeking cost-effective options.

- Token Compatibility: Both solutions are compatible with Ethereum tokens. However, Optimism offers full compatibility with Ethereum’s EVM, while Arbitrum employs its own EVM with minor differences from Ethereum’s EVM.

- Security Measures: Both Optimism and Arbitrum prioritize security, but they adopt different approaches. Optimism relies on fraud proofs to ensure transaction security, while Arbitrum combines fraud proofs with optimistic verification mechanisms.

In terms of adoption, Arbitrum gained an early advantage over Optimism, with several DeFi projects embracing the technology. Its lower transaction costs attracted users to shift towards Arbitrum while interacting with Ethereum-based dApps like Aave and Uniswap. This adoption momentum encouraged major centralized exchanges like Binance and Crypto.com to support Arbitrum, further fueling its growth.

Despite these challenges, the Optimism network, which employs the optimistic rollup architecture, has shown impressive growth. The number of unique addresses on the Optimism network continues to rise, suggesting a steady influx of new members. Users may be drawn to the network’s benefits, such as low fees and swift transactions, even without additional incentives like Optimism Quests NFTs. However, a recent dip in gas usage on the network indicates a decrease in overall activity.

Supports NFTs and GameFi

When compared to alternative Layer 1 solutions, both Arbitrum and Optimism have faced limitations in their GameFi performance, attributed primarily to their connection with Ethereum’s other layers, which has kept transaction costs relatively high, above $0.01.

In the realm of NFT marketplaces, Arbitrum has managed to garner significant attention, highlighted by Opensea’s recent support for the chain. Treasure, in particular, stands out as a gaming and NFT ecosystem featuring a native currency called MAGIC, which is backed by the various metaverses within the community’s ecosystem. On the other hand, Optimism has faced difficulties in enticing developers, despite efforts to establish an NFT and Gaming Committee, although its governance-based grant system is still in its early stages.

Comparing the NFT activity on both platforms, Arbitrum takes the lead with 47,537,579 transfers and 32,009.54 ETH in total volume, as reported by NFTscan. In contrast, Optimism has recorded 32,436,402 transfers and 7,952.25 ETH in volume during the same period.

To address some of these limitations and bolster its competitiveness, Arbitrum has introduced “Arbitrum Nova,” a new rollup design featuring an external Data Availability Committee (DAC). This innovative approach has led to further reductions in transaction fees, albeit with some trade-offs in terms of trust. As a result, social and gaming applications can now flourish on the platform. A prominent example of this is the recent migration of Reddit’s Community Points system (known as MOONS) to the Arbitrum Nova infrastructure.

Conclusion

For Optimism, completing the whole transaction on-chain has some benefits, like as increased security, but it also introduces another constraint, such as increased cost. Arbitrum is less expensive for fraud proofs than it is for splitting the cost of blocks.

Arbitrum now has a “timing” aspect, it will win the fight with Optimism if it makes excellent use of this time to produce a powerful impact.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.